Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsMarket swoon raises stakes for US-China trade talks next week

Mid-level negotiations between representatives of China and the US is set to begin in Beijing on Monday.

Change text size

Gift Premium Articles

to Anyone

T

he US and China head into trade talks next week with a shared set of worries -- about wobbly markets and a slowdown in economic growth -- that could sharpen their desire to cut a deal.

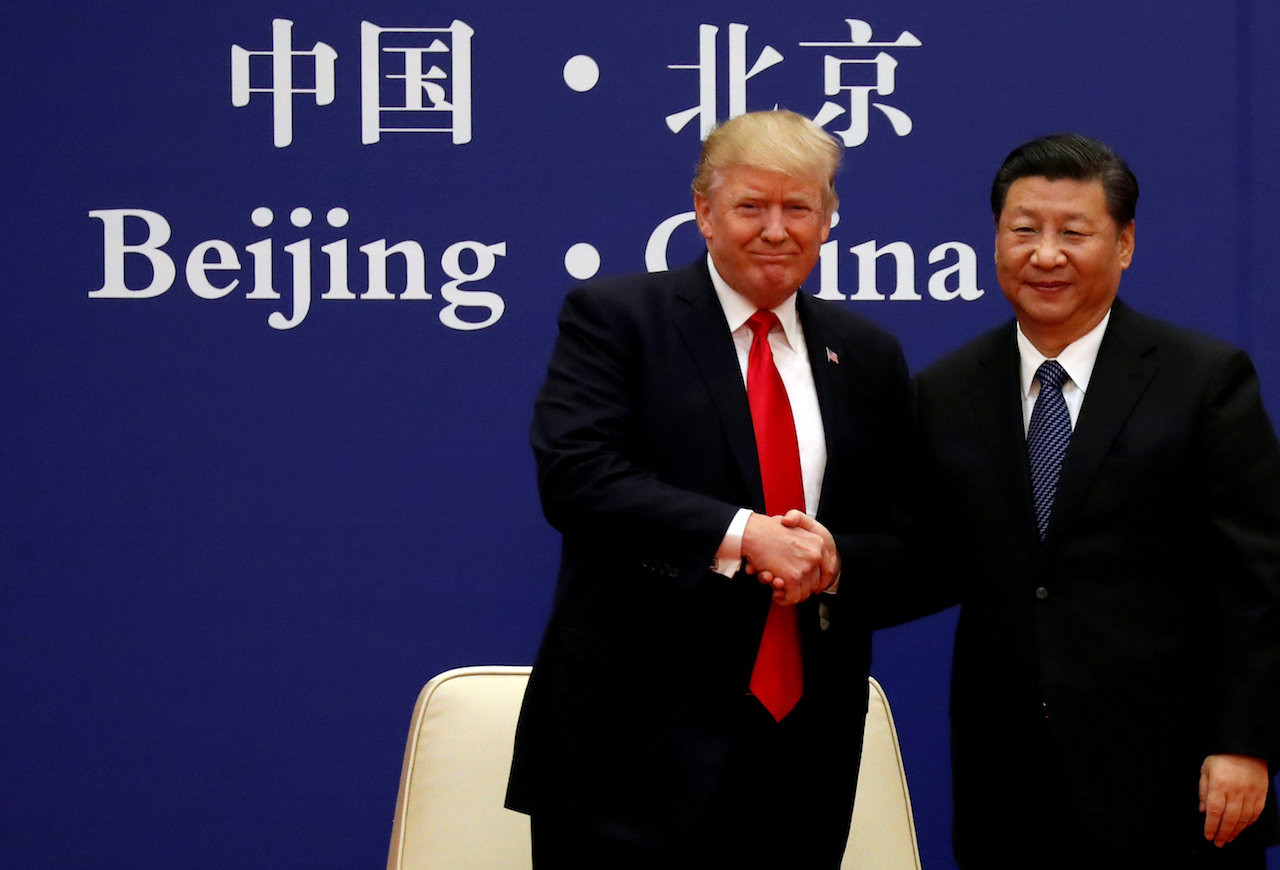

Deputy US Trade Representative Jeffrey Gerrish will lead a delegation to meet Chinese counterparts Monday and Tuesday, China’s commerce ministry said in a statement. It will be the first formal meeting since presidents Donald Trump and Xi Jinping agreed a 90-day tariff-truce in Argentina last month.

In both countries, the trade war has soured the economic outlook and shaken financial markets.

Gloom on the US side lifted somewhat on Friday, as better-than expected job gains for December spurred a stocks rebound. Still, manufacturing gauges are weakening as tariffs start to bite -- and that’s happening in China too.

“Market confidence and growth in 2019 is hanging by a thread,” said Wang Huiyao, an adviser to China’s State Council. “The trade negotiators are shouldering big hopes for a truce.”

China’s central bank moved to inject money into the world’s second-biggest economy on Friday, cutting the amount of cash reserves lenders must hold by 1 percentage point.

Earlier in the week, a key measure signaled a contraction in Chinese manufacturing — delivering another blow to investors after a turbulent 2018. The Shanghai Composite Index slid to a four-year low. Ripples spread into US equity markets too. Apple Inc. plunged the most since 2013 after flagging slower iPhone sales, especially in China.

Next week’s negotiations will address issues including intellectual property, agriculture and industrial purchases, two people familiar with the preparations said. Preliminary discussions have been “a little more optimistic than usual,” White House economic adviser Larry Kudlow told Bloomberg TV Friday.

USTR Robert Lighthizer is expected to meet with Chinese Vice Premier Liu He later this month, one of the people said.

“Given the market sensitivities, both sides will likely want to convey a sense of progress,” said Michael Hirson, Asia director at Eurasia Group and a former US Treasury Department official. “An important indicator of real progress will be whether they announce a substantive round of negotiations soon at a more senior level.”

The Trump administration, which has touted exuberant US markets as a sign of its success through most of its first two years, has sought to put a positive spin on the recent slump. White House economic adviser Kevin Hassett told reporters that lower sales for US companies in China indicates economic pain that “puts a lot of pressure on China to make a deal.”

But other administration officials concede that falling stock prices may have weakened their hand, even as they grow frustrated that Trump’s trade policy is getting the blame. One person familiar with White House discussions said the market moves were being used by advocates of a China deal to press their case with the president.

Which side Trump will eventually come down remains unclear, the person said. Hawks in the administration continue to make the case that the long-term threat posed by China to the US economy makes the fight worth having, and that any meaningful deal could take years to negotiate.

Trump reported “big progress” in trade negotiations after a phone call with Xi last week. Beijing announced another round of tariff cuts starting Jan. 1, as it seeks to lower costs for domestic consumers.

Still, the gap remains wide. China says it’s ready to buy more American goods. But it’s resisting US demands for tougher action on technology transfers, and less state support for strategic industries like robotics and computer chips.

A realistic deal would include big Chinese purchases of US food and energy, more market access for American banks and automakers, and Chinese action on intellectual property, according to David Dollar, a former US Treasury attache in Beijing and now a senior fellow at the Brookings Institution in Washington.

The market slide and the Apple shock “hammer home the message that a trade war will be damaging to the US economy,” he said. “And that it is in the administration’s interest to reach a practical compromise.”