Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsExplainer: The progress and challenges of sustainable financing in Indonesia

Building sustainable financing is not a new idea within the country’s financial system. There have been numerous notable milestones over the years, as this report will explore.

Change text size

Gift Premium Articles

to Anyone

T

he World Bank approved in late March a US$300 million loan for Indonesia to assist Indonesia’s reform agenda by among other methods promoting sustainable financing practices in a bid to strengthen the resilience of the financial sector against economic shocks.

Building sustainable financing is not a new idea within the country’s financial system. There have been numerous notable milestones over the years, as this report will explore.

However, as the country has gradually progressed to establishing a sustainable financial system, there has been an ongoing debate whether financing green projects or investing in companies that uphold the environmental, social and governance (ESG) criteria will bring good returns. To that end, economists have raised concerns about whether there is an appetite for sustainable investment products in the market.

While the country is still laying down the building blocks, it is important to see what sustainable financing has to offer so that investors will not miss out on its potential benefits while issuers can plan ahead to cater to the growing market.

What is sustainable financing?

Sustainable financing largely refers to any form of financial service that takes into account the ESG criteria to achieve the broader goal of sustainable development.

According to the Financial Services Authority (OJK) Roadmap for Sustainable Finance in Indonesia 2015-2019, sustainable financing includes efforts in the financial services industry to mitigate the impact of climate change, to shift toward a competitive low-carbon economy, to promote environmentally friendly investments, as well as to support the 4P development principles as outlined in the National Medium-Term Development Plan (RPJM), which consist of pro-growth, pro-jobs, pro-poor and pro-environment.

The pursuit of sustainable financing to date

Sustainable financing has been pursued for years. In December 2014, the OJK published a Roadmap for Sustainable Financing in Indonesia, which lays out much of the agenda’s development framework. Three years later, it issued the OJK Regulation (POJK) No. 60/POJK.04/2017 which set out the standard for green bonds issuance in the country. Last year, it appointed eight banks to start channeling loans based on the principle of sustainable financing.

Other stakeholders have also taken part in the agenda. The Finance Ministry issued a green Islamic bond (sukuk) in February 2018 and put Indonesia on the map by becoming the first Asian country to do so. The bond raised $1.25 billion and was used to fund several environmentally friendly projects. The ministry issued another one in February 2019 worth around US$2 billion.

In the local green bond market, state-owned infrastructure financing company PT Sarana Multi Infrastruktur became the first issuer of a corporate green bond in Indonesia, which was issued on July 9, 2018. The company was committed to utilizing 100 percent of the proceeds for green projects, such as the LRT and mini-hydropower plants, meanwhile, POJK No. 60 only required 70 percent of proceeds from green bond sales to be used to finance green projects.

All these efforts are in accordance with Indonesia’s 2005-2025 National Long-Term Development Plan (RPJPN), which states that one of its eight missions is the realization of “a greener and sustainable Indonesia” as it recognizes that “the long term sustainability of development will face the challenges of climate change and global warming which affect activities and livelihood”.

Reported better returns, better resilience

“Sustainability is good business,” a 2020 report written by The Economist Intelligence Unit (EIU) on financing sustainability says.

Of the 161 investors and 154 issuers across the Asia Pacific that the study surveyed, 68 percent of investors and 63 percent of issuers said that their sustainable investments and financing performed better than their traditional equivalents.

It is worth mentioning that for over a quarter of investors, sustainable investing failed to bring about the desired returns. Despite this, the report noted that all of the parties interviewed for the study “firmly debunk the notion that there is no financial benefit to sustainable investing”.

In the local bourse, there is already an indicator that shows the correlation of ESG to higher returns, as measured by the Sustainable and Responsible Investment (SRI) -KEHATI Stock Index. It is the only one of its kind on the Indonesia Stock Exchange (IDX) as it focuses on companies that have fulfilled its ESG criteria.

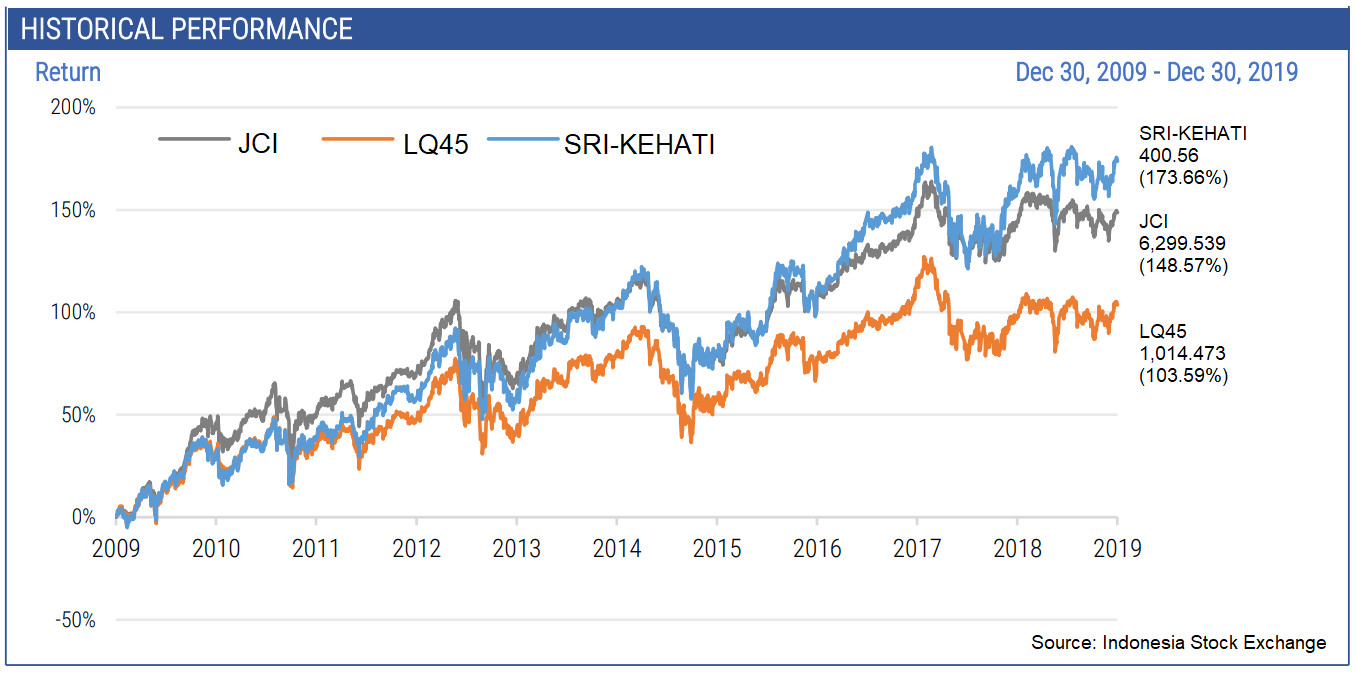

The SRI-KEHATI index tracks the shares of 25 publicly listed companies, among them are agribusiness company PT Astra Agro Lestari, PT Bank Central Asia and food manufacturing giant PT Indofood Sukses Makmur, and according to data provided on the IDX site, the index does better than the IDX main gauge, the Jakarta Composite Index (JCI), and the LQ45 index in terms of returns.

Between Dec. 30, 2009, and Dec. 30, 2019, the SRI-KEHATI index generated a return of 173.66 percent, higher in comparison with the JCI and the LQ45 index, which generated a return of 148.57 percent and 103.59 percent, respectively.

Over the years, the SRI-KEHATI index has also experienced fewer steep falls in comparison with the LQ45. In 2018, for example, when the main gauge’s return fell to a negative 2.5 percent, the LQ45 plunged to a negative 9 percent, meanwhile the SRI-KEHATI only recorded a negative return of 4.3 percent.

Meanwhile, for the year to date, the SRI-KEHATI index fell by 29.65 percent, lower than that of the LQ45 which dropped by 31.64 percent but steeper than that of the JCI, which declined 26.60 percent.

Challenges to weigh up

“In my opinion, the support is not strong enough in Indonesia,” Center of Reform on Economics (CORE) Indonesia research director Piter Abdullah told The Jakarta Post on Thursday when asked about the state of sustainable financing in the country.

He explained that the agenda required cooperation between different authoritative bodies and also a change of behavior within market players.

Institute for Development of Economics and Finance (Indef) executive director Tauhid Ahmad also noted that the growth of sustainable financing in Indonesia was below expectations considering its big potential.

He went on to say that the innovation in sustainable financing was not well-received by the market, including Sarana Multi’s corporate green bond. “It didn’t turn out well, the market didn’t see this as something that is interesting,” he told the Post on Thursday.

Tauhid said that the government was still dominating the development of sustainable financing when ideally it should predominantly be driven by private entities.

The enthusiasm, either from investors to opt for sustainable investment or from issuers to offer such products, is still low as it seems that the general consensus is that sustainable businesses are less profitable than conventional ones.

The returns are there, but not as big as businesses that are not concerned with sustainability,” Artha Sekuritas Indonesia vice president Frederik Rasali said via a messaging service to the Post on Thursday, despite acknowledging that caring for sustainability could mitigate the loss of resources in the long run as climate change risks had already been considered.

The road ahead

As businesses and global economies will have to come to terms with the financial threat and monetary costs that come with the impacts of climate change, a greater push to adopt sustainable financing will be inevitable.

The United Nations Environment Program Inquiry into the design of a sustainable financial system in Indonesia estimates that the country needs around $300 to $530 billion of annual investment that largely will be used for the agriculture, forestry, energy, mining and waste sectors.

Biger Maghribi, a senior analyst at the OJK, wrote in a journal of Asian capital markets that sustainable financing will continue to grow in the future.

“Green bonds are attractive as they create opportunities for investment in environmental change, delivering environmental and financial returns. Therefore, the OJK predicts green bond markets in Indonesia and around the world will continue to grow,” as written in the journal.

Based on the OJK roadmap, between 2020 and 2024, Indonesia will focus on integrated risk management, corporate governance, bank rating and the development of an integrated sustainable financing information system.