Emergency curbs reverse recovery

Consumer confidence falls back into pessimistic territory, retail sales take hit

Change Size

A

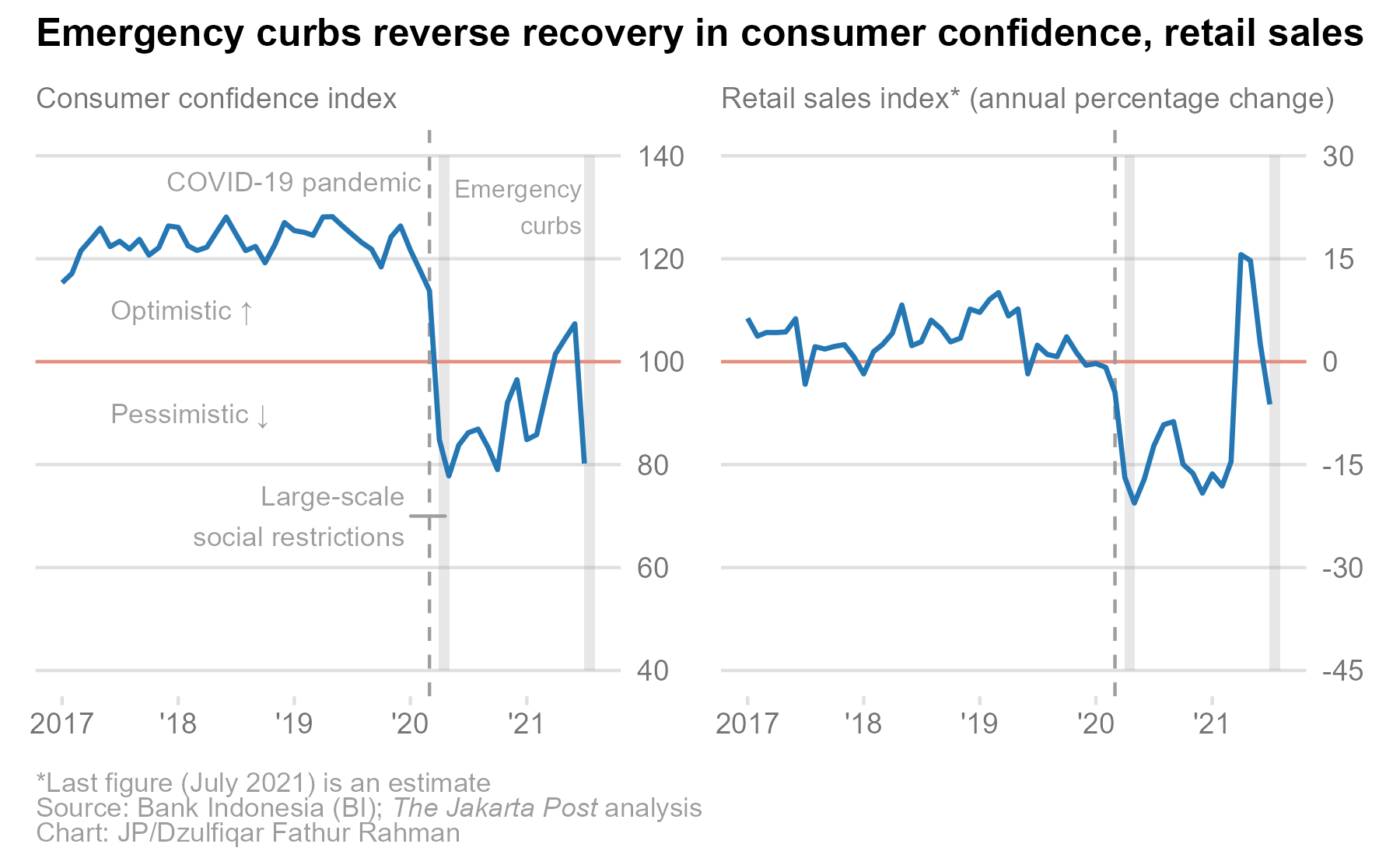

three-month recovery in consumer confidence and retail sales came to an abrupt end as shops and offices were closed and travel was severely restricted in an effort to rein in soaring COVID-19 infections and deaths last month.

Bank Indonesia (BI) reported last week that its consumer confidence index dropped to 80.2 in July, well below the threshold of 100 and hence marking a return to pessimistic territory, reversing a recovery in consumer confidence that had begun in April.

Meanwhile, the retail sales index was estimated to have contracted by 6.23 percent in July from a year earlier, BI reported on Tuesday. The contraction occurred across all categories, except vehicle fuels.

The fall in consumer confidence had been expected given the emergency curbs imposed by the government, said Faisal Rachman, an economist at state-owned Bank Mandiri, the country’s largest lender. With more consumers turning pessimistic, household spending and overall economic growth are expected to slow.

“Household spending is still likely to register growth in the third quarter of 2021 on a year-on-year [yoy] basis but be lower than in the second quarter,” Faisal told The Jakarta Post in a phone interview, explaining that this was due to the base effect.

Faisal estimated that household spending would grow 1 percent yoy this quarter and that GDP overall would be up 3.5 percent yoy, supported by government expenditure, investment and net exports.

Indonesia’s GDP grew by 7.07 percent yoy in the April-to-June period, largely thanks to the base effect and seasonal factors, Statistics Indonesia (BPS) reported last week. Inflation remained muted despite the unusually high growth.

While consumer confidence fell to a level nearly as low as during the large-scale social restrictions last year, the impact of the emergency curbs on retail sales was somewhat less severe.

Confidence was lowest among consumers with income between Rp 1 million (US$70) and Rp 2 million in July. In contrast, it was consumers earning above Rp 5 million that were the most pessimistic during the large-scale social restrictions last year.

Andry Satrio, an economist at the Institute for Development of Economics and Finance (Indef), said the emergency curbs hit the poor the hardest, as consumers in the lowest income group were the only ones to be pessimistic about income expectations for the next six months.

“The biggest hit was felt among those in poverty or vulnerable to poverty because of these [emergency curbs],” Andry told the Post in a voice message on Wednesday.

The government introduced the emergency curbs in early July as cases and deaths reached a record high. The restrictions were extended until Aug. 16 in Java and Bali, the country’s economic centers. For regions outside those two islands, the government has extended the restrictions until Aug. 23.

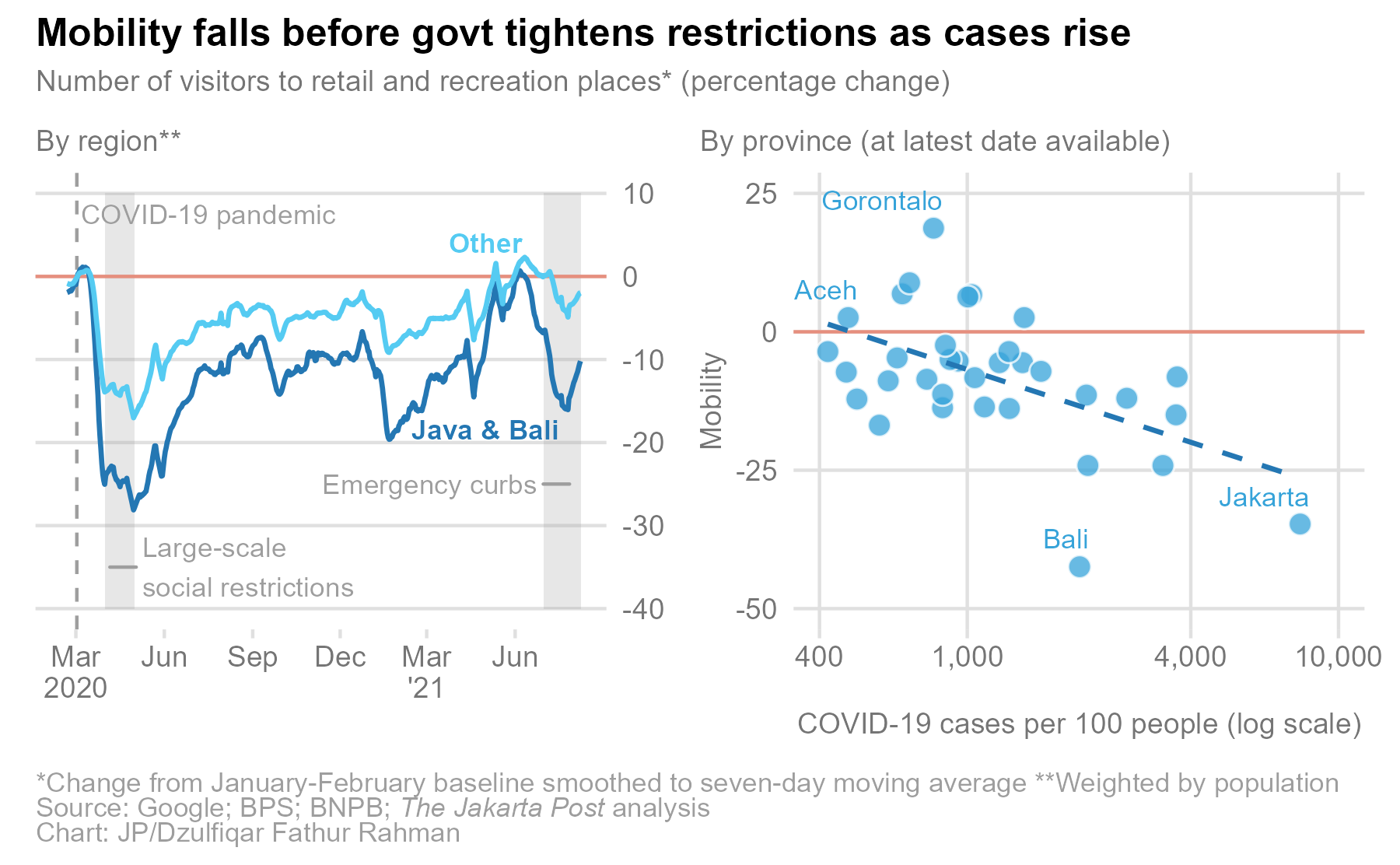

Even before the government imposed the emergency curbs, people had begun to reduce visits to retail and recreational places in June when confirmed COVID-19 cases and deaths began to surge, Google mobility data show.

With daily new confirmed COVID-19 cases showing a sign of dropping in some regions, the government has relaxed restrictions, allowing people who have been vaccinated to visit shopping centers starting this week. Malls can operate at 25 percent of their capacity in the hardest-hit areas, namely Jakarta, Bandung, Surabaya and Semarang.

Visits to places like restaurants and shopping centers have begun to bounce back since late July. On average, however, mobility across Java and Bali remains far below that of other regions. Movement trends tend to be closer to pre-pandemic levels in provinces with fewer cases.

“The consumer confidence index and the retail sales index are quite sensitive to public mobility,” said Faisal. “I expect the [former] to return to the optimistic zone and retail sales to grow again in the fourth quarter.