Local fintech Flip raises $48m in foreign VC-led funding round

The Indonesian start-up has secured US$48 million in its latest funding round to secure its domestic lead, with plans to expand its services and workforce.

Change text size

Gift Premium Articles

to Anyone

A

local start-up focusing on interbank transfers has secured US$48 million in series B funding in the latest sign of the country’s booming fintech industry.

The funding round for PT Fliptech Lentera Inspirasi Pertiwi, the company behind the app Flip, was coled by venture capital heavyweights Sequoia Capital India, Insight Partners and Insignia Ventures Partners.

In a joint press release issued on Dec. 8, Flip said it planned to use the new funds to accelerate business expansion, invest in technology and expand its domestic workforce with a focus on engineering and product teams.

The move marks the first investment in Indonesia for Insight Partners, a global private equity and venture capital firm based in New York.

“We are [excited] to welcome a leading global venture capital and private equity firm, Insight Partners, which has proven successes in the financial technology landscape, globally. We believe this partnership will help us in pursuing growth and realizing our vision to build the fairest financial products,” said Flip cofounder and CEO Rafi Putra Arriyan.

Fintech funding in Southeast Asia soared to $3.5 billion in the first nine months of this year, more than three times the investment logged for the full year in 2020, according to the 2021 edition of FinTech in ASEAN published by Singapore’s United Overseas Bank (UOB), accounting firm PricewaterhouseCoopers (PwC) and the Singapore Fintech Association (SFA).

Read also: Investment apps all the rage in Indonesia

Singapore and Indonesia continue to lead the region in fintech funding, respectively absorbing 44 percent ($1.4 billion) and 26 percent ($904 million) of total funding in Southeast Asia.

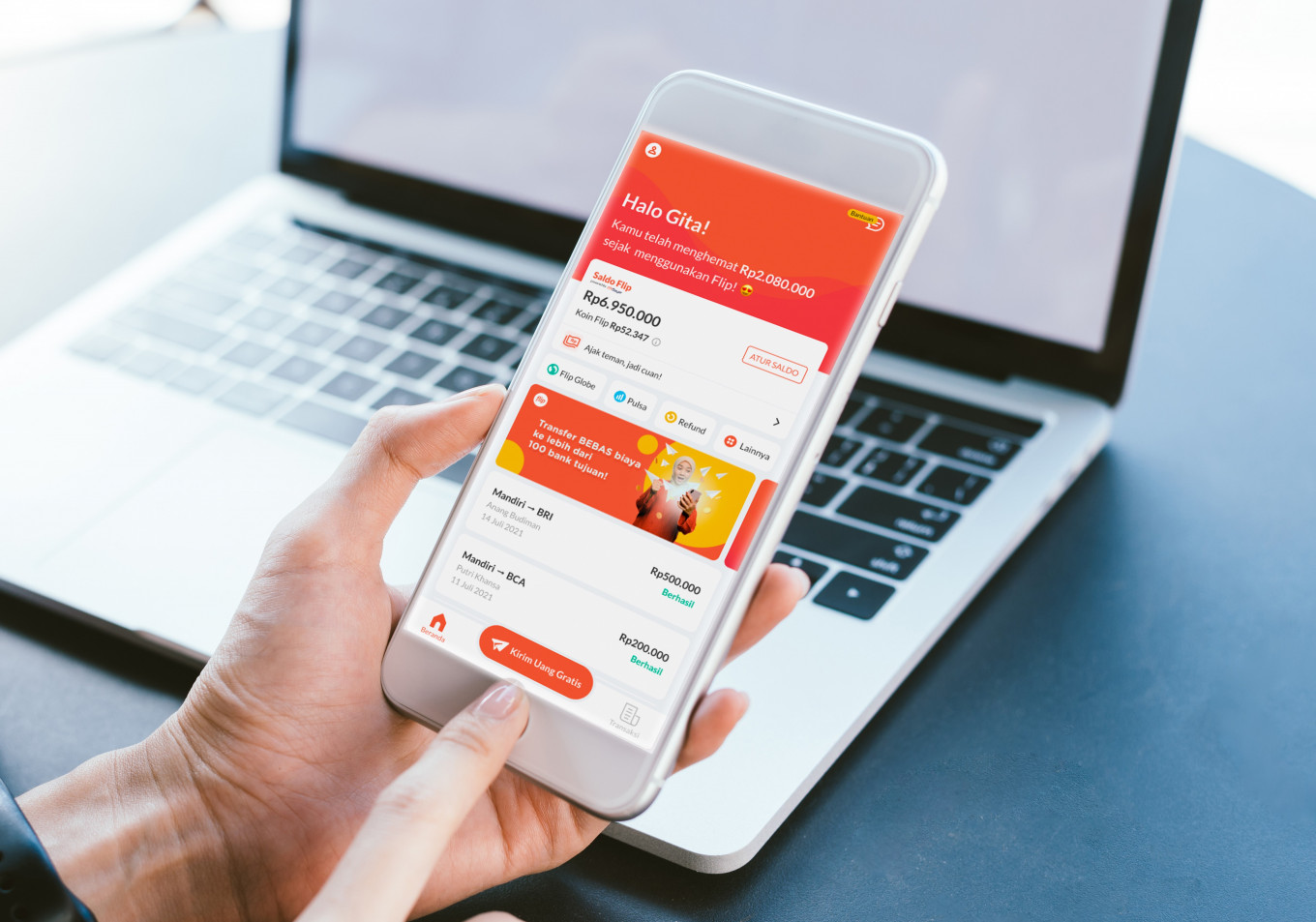

Flip promises to help individuals and businesses execute money transfers at low cost “from anywhere to anyone”. The company’s most prominent products include online peer-to-peer (P2P) payment services offering interbank transfers to more than 100 domestic banks, international remittances, e-wallet services and business solutions.

The company says it serves more than 7 million users and small and medium enterprises (SMEs) for a variety of financial transactions, including payroll management, customer refunds, invoice and supplier payments and international transfers.

“Sequoia Capital India believes that Flip is the most exciting consumer fintech company in Indonesia. The firm is thrilled to be leading the third consecutive [funding] round, testament of its high conviction in the company," Sequoia India vice president Aakash Kapoor said in the joint press release.

“Flip is disrupting the existing interbank transfer market and has established itself as a clear leader in the category, with its superior product that allows for seamless payment movement between bank partners,” said Insight Partners managing director Deven Parekh.

Meanwhile, Insignia Ventures Partners principal Samir Chaibi praised Flip as “the dominant player in its space with millions of Indonesians trusting the platform for their day-to-day financial needs”.

Flip was founded in 2015 by Rafi Putra Arriyan, Luqman Sungkar and Ginanjar Ibnu Solikhin, who started building the start-up while studying at the University of Indonesia. The company now employs more than 250 people.