Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSustaining Indonesia's growth amid global uncertainty

Change text size

Gift Premium Articles

to Anyone

I

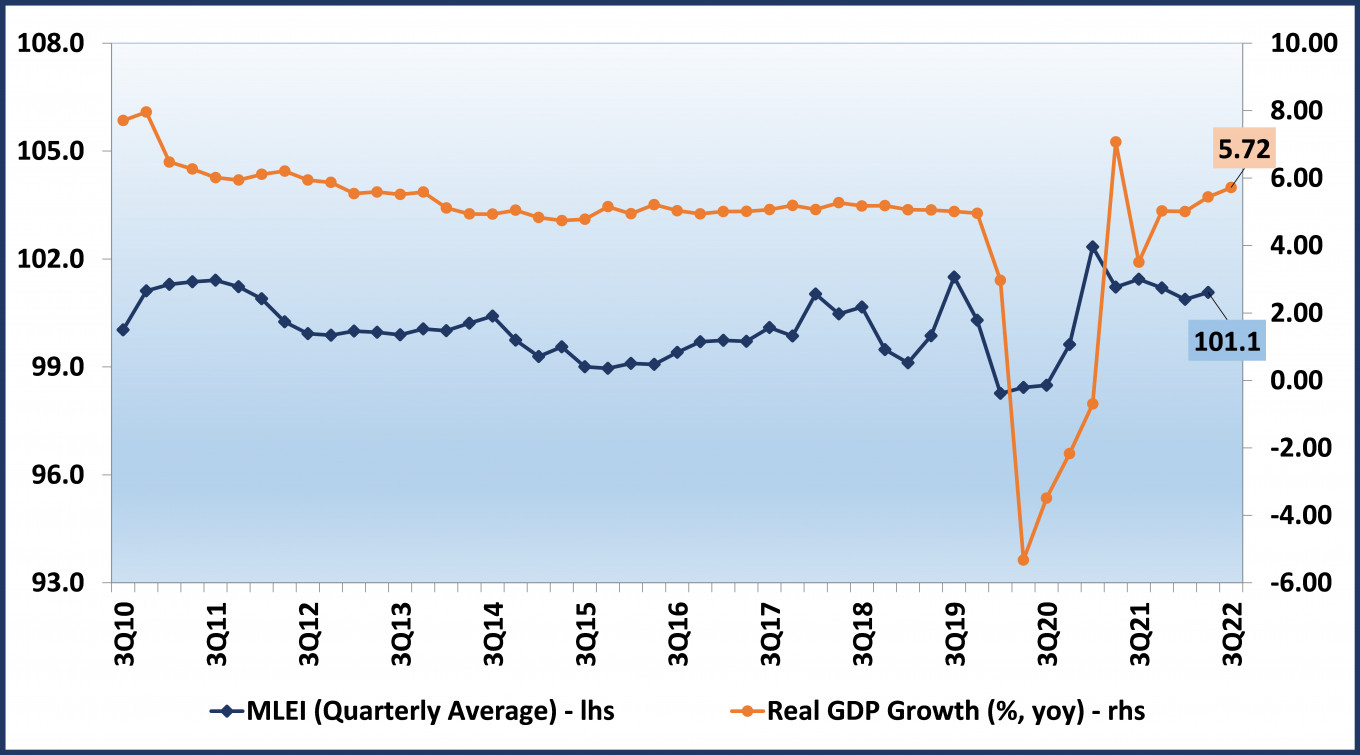

ndonesia's economy remains solid amid higher global uncertainty. It grew by 5.72 percent in third quarter of the year compared to the same period last year, exceeding the growth in the second quarter of 5.44 percent. This growth is mainly supported by export performance and household consumption.

Government spending, on the other hand, contracted. The government can increase spending in the fourth quarter by ensuring sufficient revenue to finance expenditures until the end of the year. With regard to sources of growth, the manufacturing industry was the most significant contributor to the economy in the third quarter, with a share of 17.88 percent.

By sector, the transportation and warehousing sector had the highest growth of 25.81 percent, followed by the accommodation and food and beverage sector, which grew by 17.83 percent compared to the third quarter of 2021.

Indonesia's third-quarter economic performance confirms our Mandiri Leading Economic Index (MLEI), which suggested the economy would grow faster than in the second quarter of this year. The MLEI is a composite index that seeks to predict the movement of GDP in the next quarter. That can be useful as an early warning of trends in the Indonesian economy.

The MLEI's performance so far is quite representative of the direction of GDP movement, and we forecast that Indonesia's economy will grow moderately in the fourth quarter of 2022. In 2022, the average MLEI in the second quarter of 101.1 was higher than the average MLEI in the first quarter of 100.9, so it predicted that the economy would grow more in the third quarter than in the second quarter.

In addition, results from the Bank Indonesia Business Activity Survey show that business activity in the third quarter of 2022 remained strong. Higher growth was reflected by the weighted net balance (WNB) of 13.89 percent in the third quarter of 2022.

The increase in business activity was mainly supported by the performance of the mining and quarrying sector, in line with rising commodity prices and followed by the performance of the financial, real estate, mining industries and company services sectors. In line with more robust business performance, the average production capacity utilization also increased in the third quarter.

Despite the complex challenges of the Indonesian economy, both externally and domestically, Bank Indonesia (BI) and the government are committed to strengthening coordination to maintain macroeconomic stability and promote economic growth. Since the beginning of 2022, the government has taken a policy focus on post-pandemic economic recovery and structural reforms.

The first steps include encouraging vaccination programs and health protocols so that community mobility and business activities will begin to run normally with fewer cases. From the social side, community protection, subsidies and support for the business world also continued to assist small and medium-scale businesses. The government continues to maintain the momentum of structural reforms to increase competitiveness and production capacity through economic transformation.

In line with the government policy, BI strives to maintain financial system stability through monetary policy. BI also strengthened its policy mix response to preserve stability and momentum for economic recovery by strengthening monetary operations and increasing the interest rate structure on the money market.

This policy is in line with the increase in the BI 7-day reverse repo rate (BI7DRRR) benchmark interest rate to reduce overshot inflation expectations. BI also strengthens the stabilization of the rupiah exchange rate by staying in the market as part of efforts to control inflation, mainly imported inflation, through triple interventions and operation twist policies. In addition, international cooperation with central banks and other partner country authorities is encouraged so that exchange rate depreciation is not too deep and United States dollar exposure is not too dominant.

Indonesia's economic prospects will continue to be influenced by the global economy and increasingly tight financial conditions. Fiscal and monetary policies are expected to control inflation and encourage economic growth and exchange rate stability. However, several external risks will still challenge national macroeconomic stability in 2022 and 2023, especially the increasing volatility in global financial markets influenced by the global economic slowdown, inflation and rising interest rates. Several precautions should be taken to minimize the risk.

In financial markets, the volatility of the rupiah exchange rate against the US dollar increased due to expectations of rising inflation/core inflation, and US interest rates. This condition is predicted to continue until 2023, or until inflation starts to slow down.

As of the end of the third quarter of this year, the rupiah had depreciated 6.8 percent to 15,228 against the greenback, when compared to the position at the beginning of the year. The weakening of the rupiah was mainly influenced by capital flight that occurred in line with the continued hawkish policy of the Fed.

We still maintain that the rupiah exchange rate against the US dollar will reach 15,186 by the end of 2022. We also see a potential surplus in the current account of 0.45 percent of GDP supported by improved performance in trade in goods and services.

Investor confidence also increased in line with the strong position of Indonesia's foreign exchange reserves. The position of Indonesia's foreign exchange reserves was recorded at US$130.2 billion as of October 2022 and is still able to strengthen the external sector's resilience and maintain the Indonesian economy's sustainability.

We hope Indonesia's domestic economy can still grow solidly in 2022 and 2023 amid the potential global economic downturn. We estimate that the Indonesian economy will reach 5.17 percent in 2022, supported by strong domestic fundamentals, improved quality of government spending and increased consumption, investment and export performance.

Optimism also came from several global institutions. The latest International Monetary Fund report said the Indonesian economy was still surviving the global uncertainty. The IMF expects the Indonesian economy to grow by 5.3 percent in 2022 and 5 percent in 2023. Meanwhile, global growth is predicted to be only 2.4 percent in 2022 and 1.6 percent in 2023.

*****

The writer is a senior quantitative analyst at Bank Mandiri