Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBanks reluctant to go full throttle despite shrinking loans at risk

Indonesian lenders remain cautious in managing their balance sheets, as external factors could significantly rattle the banking system.

Change text size

Gift Premium Articles

to Anyone

T

he share of loans at risk (LAR) in major local banks, including loans restructured in response to pandemic-induced financial problems, contributed to the economic downtrend in the second quarter of this year.

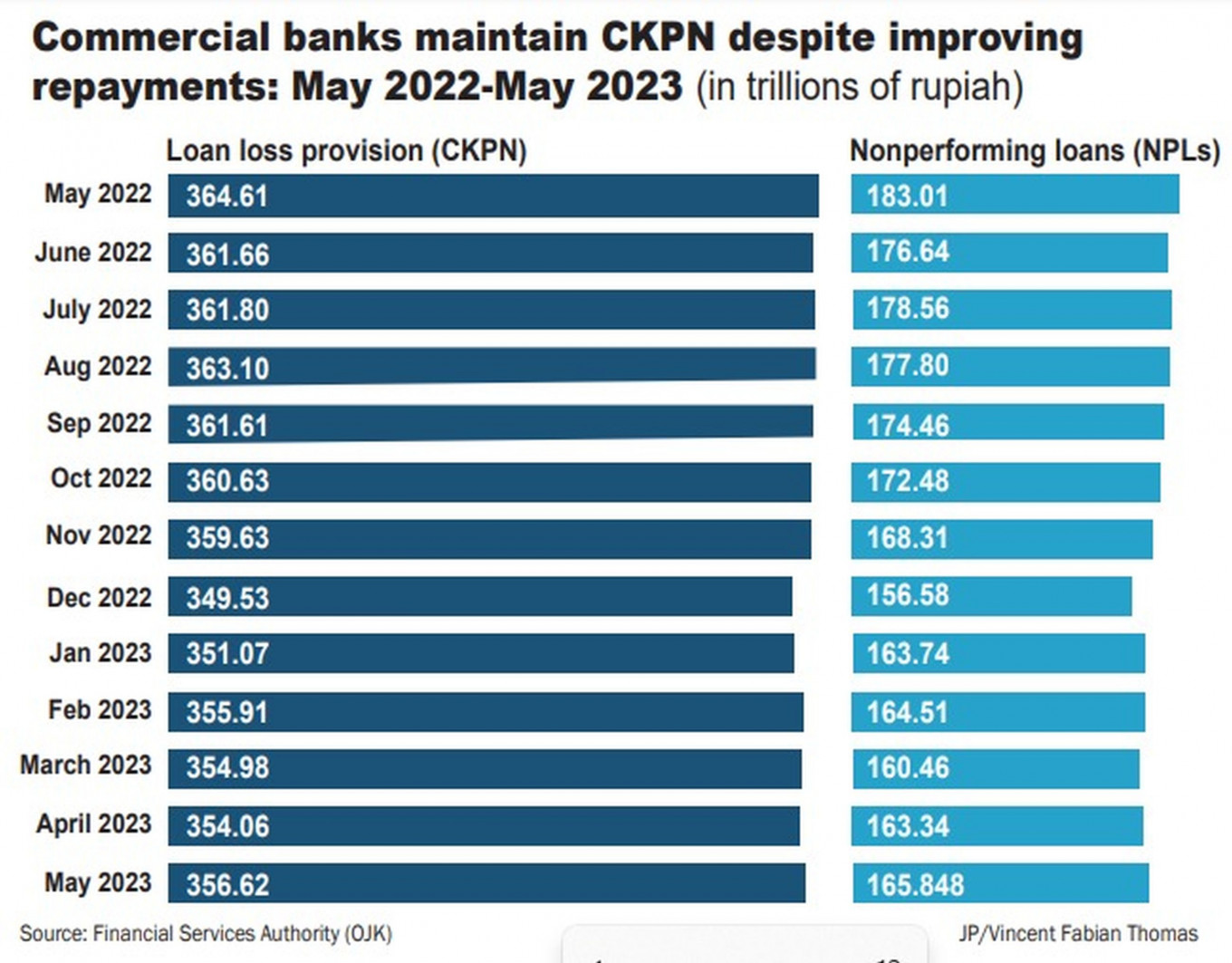

However, lenders keep the thick buffers they introduced in 2020 to tackle bad loans, pushing their LAR coverage ratio higher.

Analysts say Indonesian banks tend to be relatively cautious in managing their balance sheets, as the pandemic showed that external factors could significantly rattle the worldwide banking system.

State-owned lender Bank Negara Indonesia (BNI) saw its number of LAR drop to 16.1 percent of total loans at the end of June, compared to 19.6 percent one year earlier. On the other hand, its LAR coverage ratio increased from 42.3 percent to 47.1 percent.

The firm also increased loan coverage for construction state-owned enterprises (SOEs), which are considered bad loans because the SOEs have trouble repaying their loans. A report from Samuel Sekuritas found that the buffer was hiked to 53.5 percent from 46.6 percent at the end of last year. Sixty percent of the total is earmarked for PT Waskita Karya and another 30 percent for PT Wijaya Karya.

In its report, the local brokerage stated that the buffer BNI spared for those struggling SOEs was sufficient.

Bank Central Asia (BCA), the country's largest private bank in terms of assets, said its LAR ratio had dropped to 8.7 percent at the end of June from 12.3 percent at the same time last year. During that period, its coverage ratio for those risky loans rose from 47.9 percent to 61.6 percent.

Banking industry analyst Doddy Ariefianto from Binus University said that, under normal circumstances, improved economic conditions would decrease the need for banks to make provisions to cover bad loans. However, he opined that local banks currently tend to be conservative and set aside more provisions than required by Financial Services Authority (OJK) rules.

"However, we cannot say that every bank is the same, as they have different market segments that have unique challenges. It also depends on the characteristics and aims of the top management, as they have their own discretions," Doddy told The Jakarta Post on Friday.

Doddy explained that bad loan provisions were still categorized as expenses that could cut into the company's profit. Thus, bank managers needed to perform "acrobatic moves" to maintain a balance between the health of the bank's balance sheet and its performance in front of the shareholders.

"It is not mechanical, [as in] if X, then Y. There are a lot of adjustments in banks' financial books and things differ from one bank to another. There is also a window-dressing element in it," Doddy stated.

Read also: Provisions for impairment losses becomes a banking buffer

M. Amin Nurdin, a senior faculty member at the Indonesian Banking Development Institute (LPPI), said that local banks have become more moderate since the pandemic, and they prefer to keep thick reserves for bad loans as a precaution for bad times.

"They have huge capital, so it's okay to spare some money for buffers. A decision to reduce the provisions would depend on the risk appetite of each bank," Amin told the Post on Friday.

Double-digit conundrum

BCA said its LAR ratio would stay between 8 percent and 9 percent until the end of this year. However, the firm's CEO, Jahja Setiaatmadja, opined that the possibility of those risky loans becoming non-performing loans (NPL) was now greater than before.

"[The COVID-19 loan restructuring program] has been running for more than three years, but those loan repayments are behind schedule. The risks are rising. Thus, it's reasonable for banks to prepare bigger LAR coverage," Jahja said in a press briefing on July 24.

For this reason, three state-owned banks that join BCA on the list of the country’s top banks have yet to push their LAR ratio below 10 percent.

According to Samuel Sekuritas research, BNI anticipates that its LAR ratio will decrease from 16.1 percent to less than 13 percent by the end of the year. According to the bank's financial statement from last year, it succeeded in significantly reducing its risky loans ratio in the fourth quarter.

Bank Rakyat Indonesia (BRI) has a similar projection to BNI. In a statement, the bank said its LAR ratio was expected to exceed 10 percent at the end of this year.

"In June, loans that were restructured because of the pandemic accounted for only Rp 83.2 trillion [US$5.52 billion], or 7.64 percent of our total loans. That means there is a Rp 3 trillion to Rp 5 trillion decline per month. We hope the LAR ratio will be back in single digits by the end of next year or early 2025," the firm's risk management director Agus Sudiarto said.

Bank Mandiri is the closest to pushing its LAR below 10 percent, as it posted a 10.3 percent ratio at the end of June.

Read also: After recent sell-offs, is traditional retail banking dead in Indonesia?

According to LPPI's Amin, conservative forecasts of the major banks resonate with the fact that the country is still in a recovery phase. The banks may have worked hard to improve their internal operations, but they could not control external aspects, such as the federal funds rate, he said.

Amin also explained that the pressure on state-owned banks was quite different from that on private banks like BCA, as they could face a stern warning for a move that would contradict the government's mission.

"The Financial Sector Strengthening (P2SK) Law stipulates that banks can write off bad SME loans. However, there is still a requirement to disburse new loans in that segment. Therefore, banks will think twice when setting their loan growth targets," Amin stated.