Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsTax office gears up to phase out abhorred exit tax

As the enforcement draws near of a new policy on the much-decried fiskal, or exit tax for travelers going overseas, the tax office says it will do its utmost to spare travelers any inconvenience

Change text size

Gift Premium Articles

to Anyone

As the enforcement draws near of a new policy on the much-decried fiskal, or exit tax for travelers going overseas, the tax office says it will do its utmost to spare travelers any inconvenience.

On Tuesday, Darmin Nasution, the Finance Ministry’s director general of taxation, said his office had set up all the necessary systems at international ports and airports to support the new “free exit tax” policy.

Besides performing real-time simulations, the directorate has also prepared directions and pamphlets to guide travelers looking to benefit from the exit tax exemption.

“There will be directions for each group wishing to get exit tax exemption, so they won’t get confused,” Darmin said.

All of the country’s international gateways will feature a line for each of the three types of tax-exempt travelers — registered taxpayers, those below 21 years of age, and those with supporting documents.

Under the new policy, the exit tax for those aged 21 years and above departing from airports will be raised from Rp 1 million (US$91) to Rp 2.5 million, and for those traveling by sea from Rp 500,000 to Rp 1 million, effective from Jan. 1, 2009, to Dec. 31, 2010.

The tax will apply only to those not in any of the three groups.

The exit tax will be scrapped entirely by 2011.

“After checking in at ports or airports, registered taxpayers will need to validate their tax numbers (NPWP) with the tax office (there), and bring a copy of their NPWP,” Darmin said.

Family members of registered taxpayers seeking exemption from the exit tax will have to provide a copy of the “family card”, he added.

Under the new income tax law, people below 21 years of age are exempt from paying the exit tax. The previous law only exempted children below 12 years of age.

Those seeking to avoid the tax must register for an NPWP at least three days before departing, to allow the tax office sufficient time to prepare the files needed at the gateways.

“We can make the service faster; we’re bringing our master file (to the ports and airports), putting our entry there,” Darmin said.

However, the tax office previously said if the NPWP was rejected by port officials, travelers would have to pay the tax.

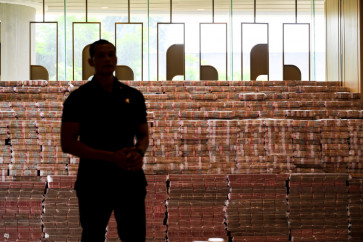

The new exit tax policy is aimed at encouraging middle- to upper-income residents to pay taxes. At present, only 10 million taxpayers out of the country’s total population of 230 million people have been registered by the tax office.

Those exempt from paying exit tax directly:

1. People below 21 years of age

2. Foreigners staying in Indonesia no more than 183 days within the last 12 months

3. Diplomats and people working for the diplomatic corps

4. International organization officials, including families

5. Indonesian citizens with residency permits from a foreign country

6. Haj pilgrims

7. Indonesian citizens working abroad

8. People departing Indonesia by land

9. NPWP holders and their dependents

Those exempt from paying exit tax, with supporting documents:

1. Foreign students in Indonesia

2. Foreigners involved in research in science and culture, cooperation in technology, religious and humanitarian missions

3. Foreigners working in Batam, Bintan and Karimun and liable to pay income tax as per Article 21 or Article 26.

4. Disabled and ill people seeking medical treatment abroad paid for by social organizations

5. Members of art, culture and sport missions who represent Indonesia abroad

6. Students in a student-exchange program

7. Indonesian citizens working abroad with approval from the Manpower and Transmigration Ministry