NEWS ANALYSIS: Revealing Indonesian Corporate Bond Market potential

Indonesian stocks outperformed those of emerging market countries on the back of good news supporting the economy. Although Indonesian stocks have posted significant year-to-date ( ytd ) growth, the capital market still has the potential to attract more inflow: corporate bonds.

Change Size

A trading floor at the trading floor of Indonesia Stock Exchange (IDX) displays a declined Jakarta Composite Index (JCI). On Feb. 19, the IDX recorded a foreign investors’ net-sell in the banking stocks nearly a half billion rupiah in a day, after the State-Owned Enterprises Ministry official said it would create a deposit interest rate cap for state-owned lender. (thejakartapost.com/Wienda Parwitasari)

A trading floor at the trading floor of Indonesia Stock Exchange (IDX) displays a declined Jakarta Composite Index (JCI). On Feb. 19, the IDX recorded a foreign investors’ net-sell in the banking stocks nearly a half billion rupiah in a day, after the State-Owned Enterprises Ministry official said it would create a deposit interest rate cap for state-owned lender. (thejakartapost.com/Wienda Parwitasari)

I

ndonesian stocks outperformed those of emerging market countries on the back of good news supporting the economy. Although Indonesian stocks have posted significant year-to-date (ytd) growth, the capital market still has the potential to attract more inflow: corporate bonds.

The Jakarta Composite Index (JCI) increased by 18.85 percent ytd, beating the Morgan Stanley Capital International Emerging Market (MSCI EM) return of 11.5 percent. At the same time, bond market performance, like the JCI, was also positive. Indonesia Composite Bond Indexes (INDOBeX – Composite) issued by Indonesia Bond Pricing Agency (IBPA) rose 16.5 percent ytd.

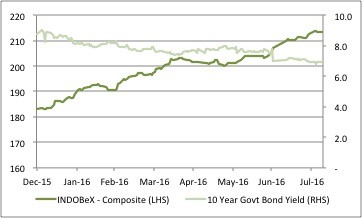

The increase in the bond index was parallel to declining yields. A lower yield is in line with a higher price. The yield on 10-year government bonds -- often used by analysts as a benchmark for the bond market -- shrank by 1.88 basis points to 6.91 percent ytd, indicating an uptrend on average government bond prices.

Indonesia Composite Bond Indexes and 10-year government bond yield %

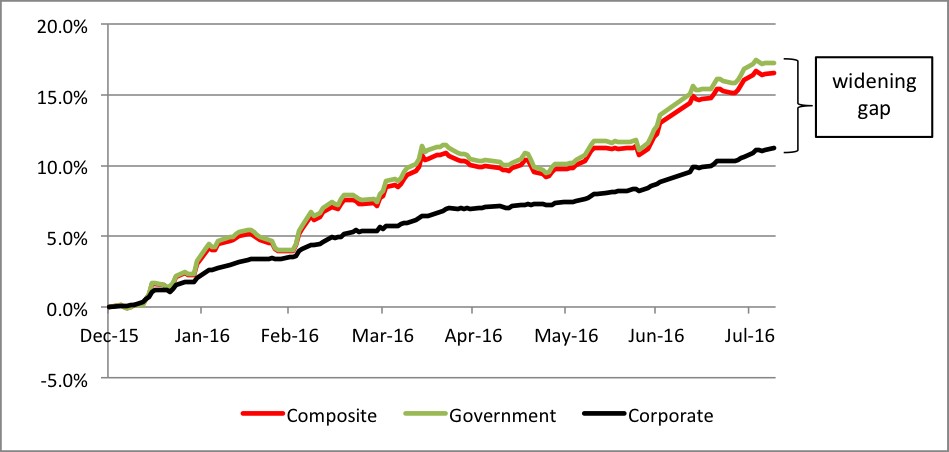

However, the condition of government bonds was the same as that of corporate bonds. Corporate bond prices have gained moderately since the beginning of the year. This has created some disparity between the moves of government bonds and corporate bonds.

As of August, the performance gap between government bonds and corporate bonds has widened. Indonesia Corporate Bond Indexes (INDOBeX Corp), which booked 11.2 percent return, underperformed Indonesia Government Bond Indexes (INDOBeX Govt) with 17.3 percent return. This implies a potential increase for corporate bonds, as government bonds are considered to be relatively expensive.

Indonesia Bond Indexes Comparison

“Corporate bond issuance is likely to increase toward the end of the year as the interest rate is expected to decline, which will boost the bond market,” said Lili Indarli, a research analyst from IBPA. She added that the tax amnesty was expected to be a catalyst for the bond market.

Currently, there are more than 500 corporate debentures listed in the Indonesia bond market. Most received investment grade status from the Indonesia Credit Rating Agency (Pefindo), while around 2 percent have a non-investment grade rating.

Credit quality, in addition to liquidity problems, often restrains investors from investing in corporate bonds. Nevertheless, investors may consider putting their money into corporate bonds issued by state-controlled companies to minimize credit quality risk. (dan)

Source: Bareksa