Indonesia to collect 90% of tax revenue target: CITA executive

Change text size

Gift Premium Articles

to Anyone

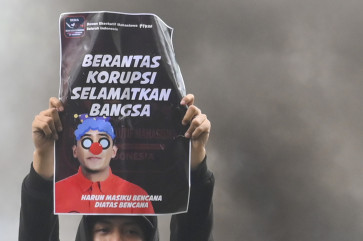

Directorate General of Taxation building in Jakarta (tempo.co/Dasril Roszandi)

Directorate General of Taxation building in Jakarta (tempo.co/Dasril Roszandi)

C

enter for Indonesia Taxation Analysis (CITA) executive director Yustinus Prastowo has estimated that, by the end of this year, the Directorate General of Taxation will collect 90 percent of the tax revenue target of Rp 28 quadrillion (US$89.85 billion).

The government has collected 77 percent of the target as of November.

“I think in December, about 13 percent of this year’s tax revenue target will be realized. So, in total, 90 percent of the tax revenue [target] would be met,” said Yustinus as quoted by kontan.co.id on Monday.

He said an increase in government spending and increase in value added tax as a result of common household spending would result in an overall increase in tax revenue collection in December.

The implementation of Financial Minister Regulation No. 165 on the tax pardon, which required taxpayers to immediately report their undeclared assets, would also contribute to the increase, he said.

Meanwhile, the Directorate General of Taxation's tax revenue and compliance director, Yon Arsal, expressed optimism that the target would be reached because of positive growth across businesses.

He said that value added tax revenue for imported goods grew by 20 percent, while domestic value added tax revenue grew by 14 percent.

"All showed positive signs," he said.

Last year, from January to November, 71.2 percent of the targeted figure was met, he added. (bbn)