The risks surrounding Indonesia’s economic stability

Change text size

Gift Premium Articles

to Anyone

G

lobal pressures are still very high in 2022. The world economy still has to face several risk factors from now on due to global inflationary pressures, the continuing war between Russia and Ukraine, geopolitical tensions in several countries and aggressive worldwide monetary policy tightening.

Global inflationary pressures continue to increase in line with high commodity prices due to continued supply chain disruptions followed by widespread protectionist policies, particularly related to food policies. Various countries, notably the United States, have responded to rising inflation with more aggressive monetary policy tightening measures, thereby restraining the economic recovery and increasing the risk of stagflation.

US inflation has remained at a high level for the past few months, followed by a 225-basis-point hike in its benchmark interest rate so far this year, from January to July, heading to its upper limit of 2.5 percent.

Until the end of the year, the US Federal Reserve will also continue to raise the Fed Funds Rate to between 3.5 percent and 4.5 percent due to the view that inflation is still high, above the 2 percent target.

With the various risks remaining high, there is a growing possibility that the global economy will slow down this year. Economic growth in multiple countries, such as the US, European Union, Japan and China, is estimated to be lower than the previous projection.

The World Bank and IMF revised their forecasts for global growth in 2022 down to 2.9 percent (from 4.1 percent) and 3.2 percent (from 3.6 percent), respectively.

The increasing uncertainty in global financial markets has resulted in more significant foreign capital outflows, particularly portfolio investment, and resulted in the weakening of currencies of developing countries against the US dollar, including Indonesia’s.

The Dollar Index continues to show strengthening against the majority of global currencies. The Dollar Index experienced its highest increase in 20 years and reached 110 on Tuesday.

The index has risen in line with the Fed's policy of being more “hawkish” to reduce inflation. The strengthening of the Dollar Index reflects the fact that the US dollar is still strengthening compared to other major world currencies such as the euro, the British pound sterling and the Japanese yen.

Domestic inflationary pressures also increased, mainly due to high global food and energy commodity prices. The government increasing fuel prices on Saturday will cause inflation to rise higher going forward.

Various policy measures will be taken to anticipate the impacts of high inflation. From within the country, one of the ways to control domestic inflation is through fiscal instruments because domestic inflation has begun to creep up.

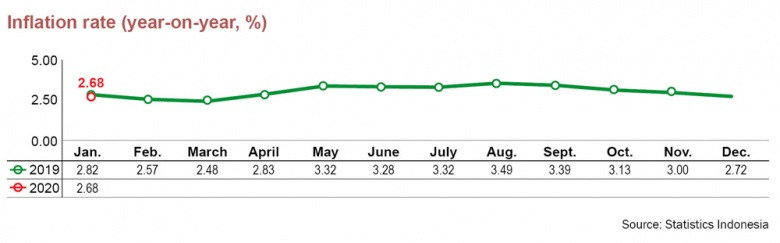

Inflation in August 2022 was recorded at 4.69 percent. Core inflation has also increased to above 3 percent, and inflation expectations are estimated to be at risk of increasing due to rising prices for fuel and volatile foods, as well as increasing inflationary pressure from the demand side.

These developments are predicted to push inflation higher in 2022 and 2023 and put it at risk of exceeding the upper target limit of 3±1 percent. To control inflation and protect purchasing power through fiscal instruments, several policy measures have been taken, such as providing incentives and direct cash assistance for food.

The synergy between the government and Bank Indonesia continues to rein in the inflationary pressure. BI will strengthen coordination with the central government as well as the regional administrations to maintain price stability and the policy mix response to maintain stability and economic recovery.

To maintain stability in the financial market, BI will strengthen monetary operations by increasing the money market's interest rate structure in accordance with the BI 7-Day Reverse Repo Rate (BI7DRRR). In August 2022, BI raised the BI7DRRR by 25 basis points to 3.75 percent to mitigate the increase in inflation and core inflation.

BI will also carry out a twist operation by buying and selling government bonds (SBN) in the secondary market to strengthen the stability of the rupiah exchange rate. This policy is expected to increase the attractiveness of returns on short tenor SBN portfolio investments and lower the long tenor SBN yields.

In the time of high inflation ahead, we must remain vigilant. The projected higher inflation in 2022 will be driven by increasing demand and the recovery of the domestic economy, as well as the impact of the increased fuel prices.

With the rise in fuel prices, inflation at the end of the year could be higher than our initial estimate of 4.6 percent. Following the BI7DRRR hike in August, Bank Mandiri’s economic research team predicts that the benchmark interest rate of BI has room to increase further in line with rising inflation and external pressures, especially the increasingly hawkish policy of the Fed.

Hence, despite the recently high market volatility, there is a potential for the rupiah to strengthen toward the end of the year, in line with the higher interest rate. The rupiah has the potential to return to the range of between Rp 14,700 and Rp 14,800 against the greenback by the end of 2022, supported by the return of capital inflows.

Yet, despite financial market potential in the future, external risks are currently very high and vulnerable to capital flight reversals. Nonetheless we are confident that the Indonesian economy will still be able to grow at around 5 percent in 2022.

This optimism is supported by better export performance and the government improving the investment climate as structural reforms accelerate, business activities recover and the COVID-19 pandemic continues to be well managed and under control.

*****

The writer is a senior quantitative analyst at Bank Mandiri.