Time for fintech to shine

Since the rise of fintech, Indonesia’s financial inclusion rate has dramatically increased to levels unseen in history, reaching 76.1 percent in 2019, according to an OJK survey, from less than 50 percent in 2017.

Change Size

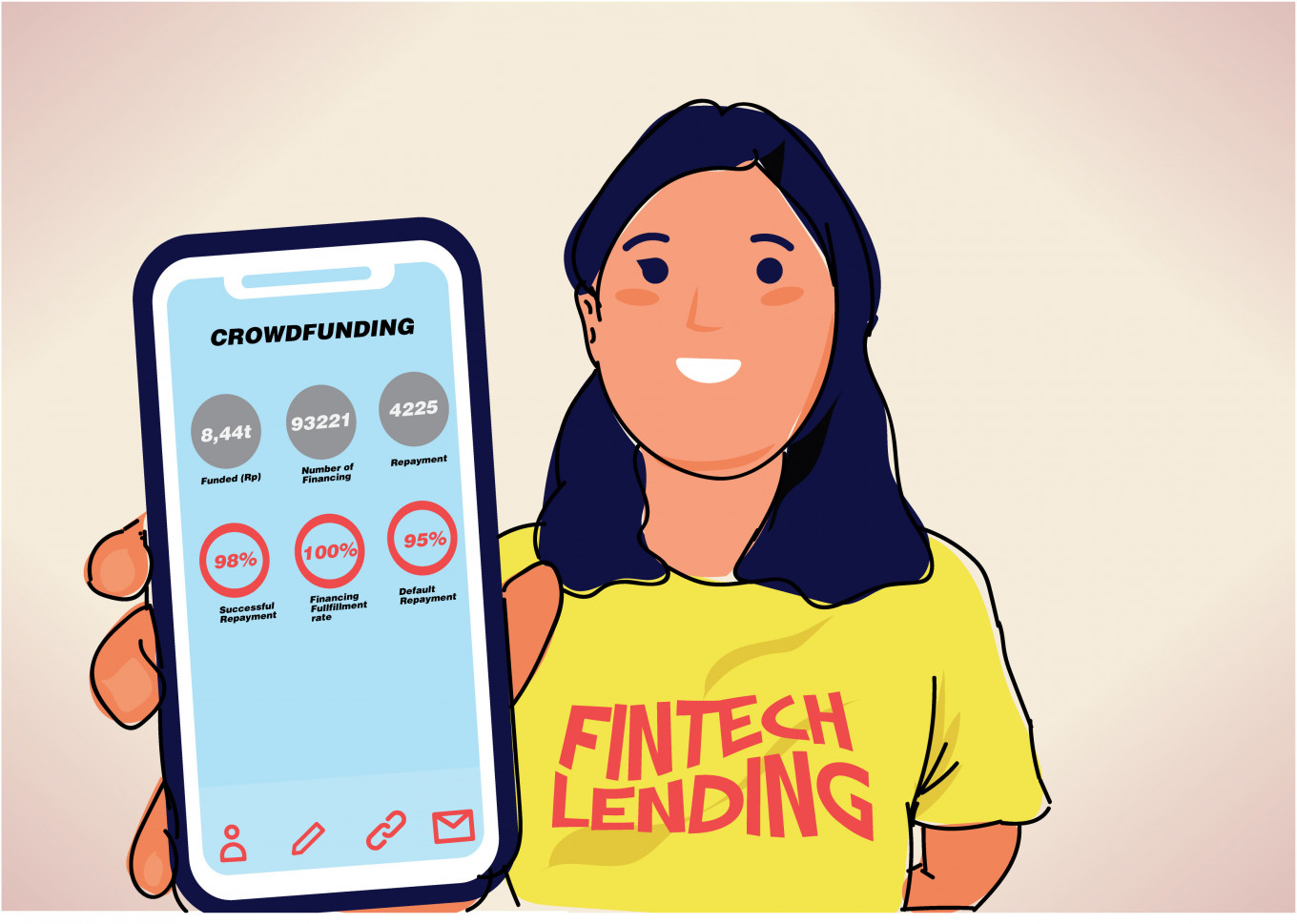

Illustration of fintech lending. (JP/Swi Handono)

Illustration of fintech lending. (JP/Swi Handono)

F

intech’s role in public services has undoubtedly been on the rise during the pandemic. From providing digital payment solutions in channeling electricity subsidies and social safety nets for workforces, to becoming an investment platform for government debt securities, fintech firms assist governments and banks with COVID-19 public services.

Fintech has emerged as a crucial part of Indonesia’s economic recovery, as more people turn to digital platforms for financial services. Banks traditionally take the more prudent, risk-averse stance in serving the public, especially as the risk of bad loans is on the rise during the pandemic-induced economic crisis.

But fintech is not immune to the bad loan problem. The proportion of bad loans within Indonesian peer-to-peer lenders neared 8 percent in July, up from 4.22 percent in March and 2.62 percent in March of 2019, according to combined regulator and association data. In comparison, gross nonperforming loans at domestic banks stood at 3.22 percent in August.

The soaring bad loans call for more prudential measures adopted by fintech firms and stern monitoring by regulators while maintaining essential services that adhere to prudential principles and could contribute to Indonesia’s economic recovery.

Regulators Bank Indonesia — which is in charge of fintech payments — and the Financial Services Authority (OJK) — overseeing other sectors, from lending to investment — have pledged support for fintech innovation. Balancing out innovations and growth in the sector while maintaining prudential principles have been the agenda, if not struggle, of the regulators in overseeing the industry.

Even with the existence of a regulatory sandbox to facilitate prudent fintech innovations and a lot of regulations surrounding the fintech sector, the rising threat of illegal fintech is clouding the sector’s achievements. From 2018 to 2020, the OJK has stopped the operations of 2,591 fintech firms and is now freezing license issuances for peer-to-peer fintech lenders until further notice.

The emergence of illegal fintech platforms calls for more broad-based, structural literacy programs to be carried out by regulators and industry players in the country’s fintech scene. The literacy programs need to be carried out across the archipelago for more inclusive and safe fintech operations in Indonesia.

The fintech industry has so far helped boost financial inclusion in Indonesia by serving more people previously untouched by formal financial services. Since the rise of fintech, Indonesia’s financial inclusion rate has dramatically increased to levels unseen in history, reaching 76.1 percent in 2019, according to an OJK survey, from less than 50 percent in 2017.

Fixing the country’s digital connectivity bottlenecks could turn more Indonesians to finance through fintech platforms. Indonesia’s digital competitiveness index ranks 56th this year, below neighbors Singapore (second), Malaysia (26th) and Thailand (39th), according to the Institute for Management Development.

The Jakarta Post hosted a three-day Jakpost Fintech Fest webinar series last week to discuss issues surrounding fintech for a more inclusive and safer industry in Indonesia.

At least three big action times are high on the agenda for regulators, fintech players and the society: boosting connectivity, literacy programs, as well as stern regulations against recklessness in fintech operations and illegal fintech platforms.