Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGovt to start taxing P2P lending, e-wallet services

Taxes will be imposed on gains from P2P lending and on service fees from e-wallets.

Change text size

Gift Premium Articles

to Anyone

I

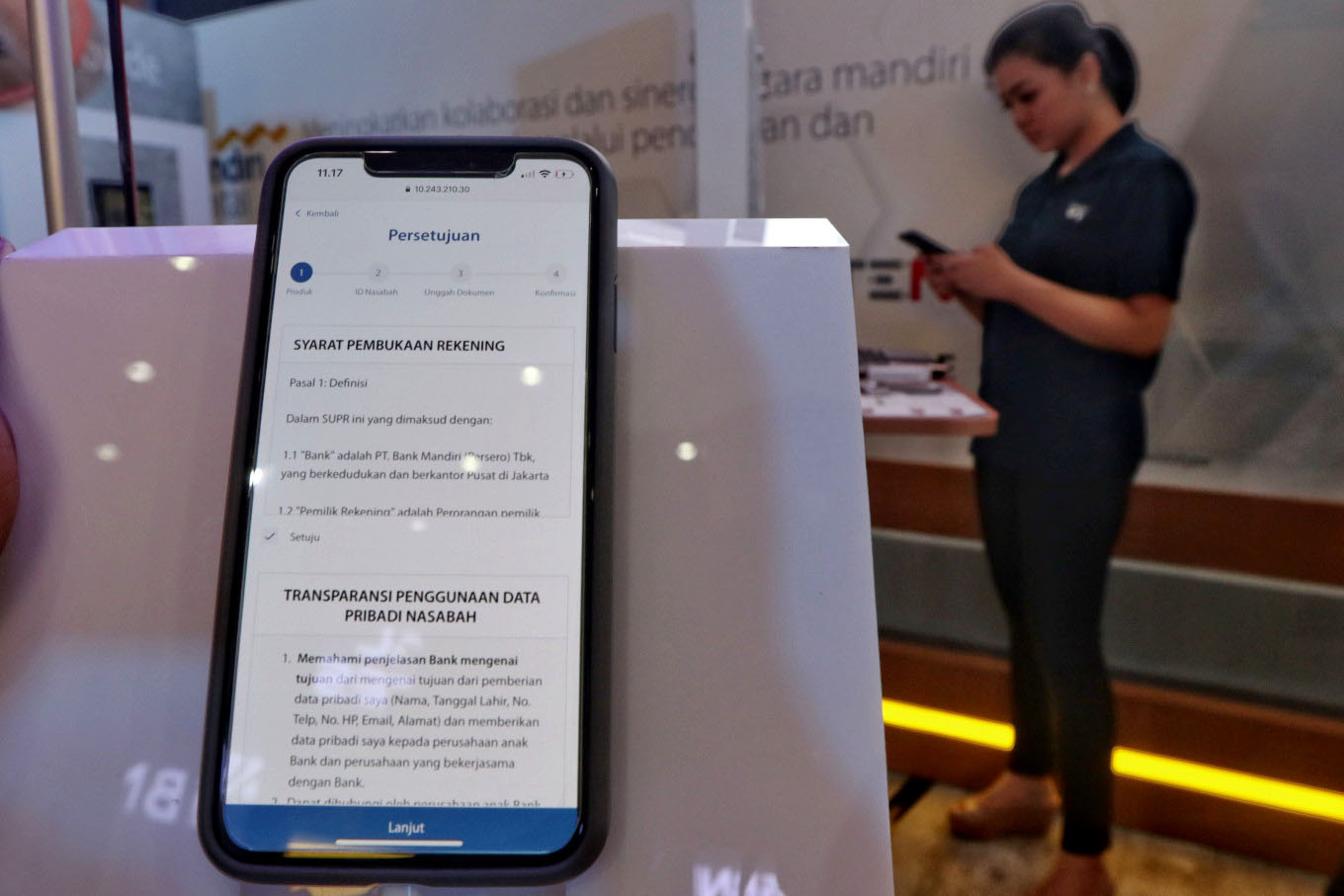

ndonesia is to start imposing taxes on services provided by fintech companies starting May 1 in the hope of leveling the playing field with conventional financial companies.

The tax comprises income tax on interest generated through peer-to-peer (P2P) lending services and value added tax (VAT) for commission, fees and cuts obtained by other fintech services like payment gateways, digital wallets, e-money, settlement on investment and insurance technology (insurtech), among many others.

The tax is stipulated in Finance Ministerial regulation No. 69/2022 on VAT and income tax for fintech companies. The regulation also requires fintech companies to collect the tax from users, and hand it over to the government.

“There is nothing new on taxing services provided by fintech companies. These services used to be subject to VAT, but we decided to rearrange the regulation again,” said Bonarsius "Bonar" Sipayung, head of the VAT, trade, services and other indirect taxes sub-directorate at the Finance Ministry, on Wednesday.

Read also: Indonesia to impose VAT, income tax on crypto from May

The decision to tax fintech services came after the passing of the Harmonized Tax Law last year, which aims to boost state revenue in achieving fiscal consolidation plans, including by reinstating a budget deficit ceiling of 3 percent of gross domestic product (GDP) in 2023.

Two years ago, the government started imposing VAT on certain transactions facilitated by electronic system providers like Google, Facebook and Amazon. It has also introduced taxes on crypto assets.