Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsEmerging market stocks touch two-week lows on economic uncertainty

Change text size

Gift Premium Articles

to Anyone

M

ost emerging markets had a disappointing start to the week on worries that US tariffs could be more widespread, while signs that a long-awaited Russia-Ukraine ceasefire could be faltering added to the unease.

Over the weekend, Trump said that reciprocal tariffs he is set to announce this week will include all nations, causing uncertainty, as he had previously hinted at flexibility on the policies and investors hoped it could be directed only to countries with the largest trade imbalances with the US.

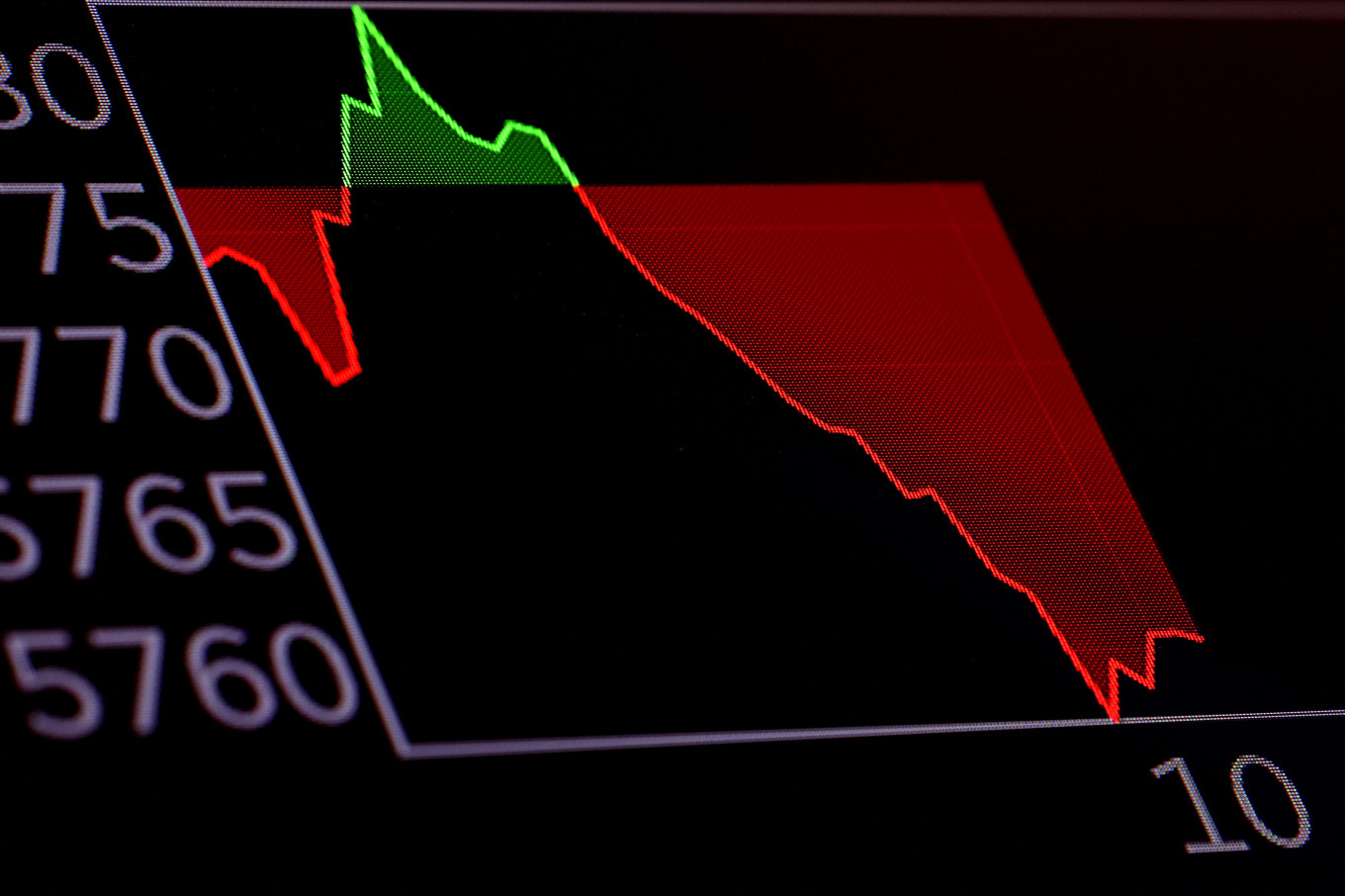

MSCI's emerging markets (EM) stocks gauge lost 1.6 percent and touched a more-than-two-week low on Monday, while an index tracking currencies was flat against the dollar.

Trade-reliant South Korea's KOSPI dropped 3 percent, while Taiwanese stocks lost 4.2 percent, while the Korean won and the Taiwanese dollar were flat, as was Mexico's peso.

Equity indexes in Poland and Hungary shed over 1 percent each. Bourses in Turkey and India were closed on account of a public holiday.

On the other hand, South Africa's rand appreciated 1 percent with gold prices hitting a record high, as markets favored safe-haven assets.

"The core message remains stark: Trump's proposed tariffs threaten to deliver a double blow to EM in 2025 – higher US inflation feeding into already high risk-free rates, combined with potentially severe disruptions to global trade," analysts at Tellimer said in a note.

Despite the day's weak sentiment, the MSCI EM indexes are on track for quarterly gains, signaling a shift from investor interest out of the United States.

Equity benchmarks in Hong Kong have gained over 15 percent in the past three months, while an index tracking central and eastern European stocks has shot up 29 percent – its biggest three-month jump since 2022's fourth quarter.

On the currencies side, Russia's rouble has strengthened 23.6 percent against the dollar on expectations of an imminent end to its conflict with Ukraine. An exchange-traded fund tracking JPMorgan's EM bond index is on track for a quarterly rise of 1.5 percent.

On Monday, signs of slow progress to a long-awaited ceasefire between Russia and Ukraine added to the unease.

The rouble depreciated 0.7 percent as Trump said he would impose secondary tariffs on buyers of Russian oil if he feels Moscow is blocking his efforts to end the war in Ukraine.

Further, the US President said his Ukrainian counterpart wants to back out of a critical minerals deal, sending the country's hard-currency papers and GDP warrants down more than 3.5 cents each on the dollar.

Meanwhile, declines among Chinese stocks were cushioned by data that signaled an expansion in manufacturing activity in the previous month.

China's blue-chip index 0.7 percent and Hong Kong's Hang Seng index declined 1.3 percent.

China's big state-owned banks gained after the lenders unveiled a combined $72 billion recapitalization plan.