Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAsian markets extend gains as China-US talks head into second day

Change text size

Gift Premium Articles

to Anyone

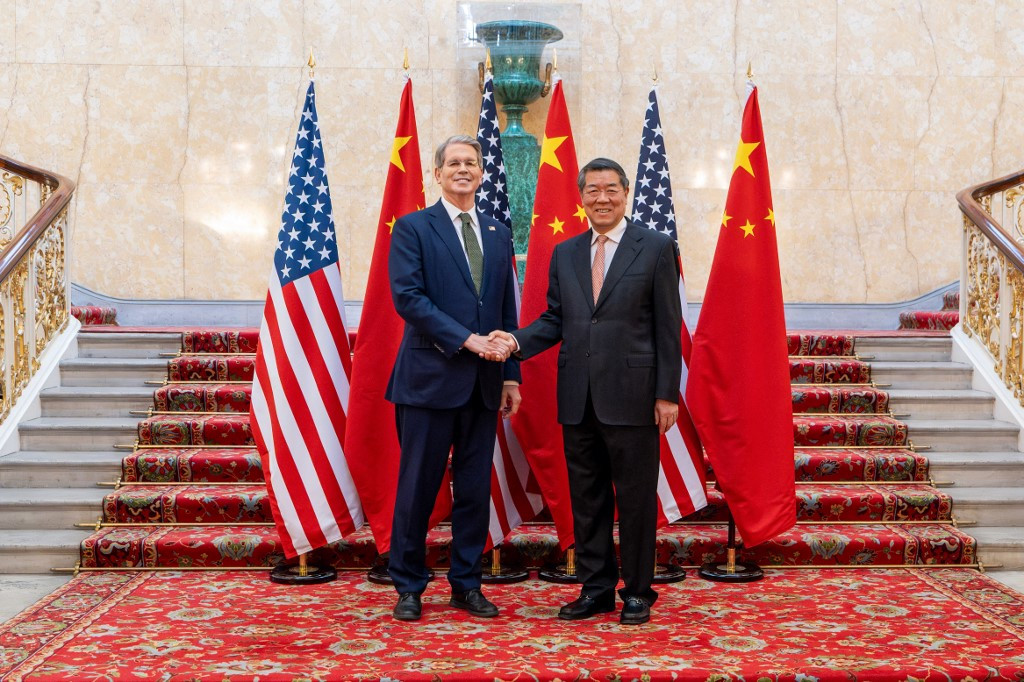

US Secretary of Treasury Scott Bessent (left) and Chinese Vice Premier He Lifeng shake hands as they pose for a photo during trade discussions at the Lancaster House in London on June 9, 2025. China and the United States began a new round of trade talks in London on June 9, Beijing's state media reported, as the world's two biggest economies seek to shore up a shaky truce after bruising tit-for-tat tariffs. (AFP/US Treasury Department/Handout)

US Secretary of Treasury Scott Bessent (left) and Chinese Vice Premier He Lifeng shake hands as they pose for a photo during trade discussions at the Lancaster House in London on June 9, 2025. China and the United States began a new round of trade talks in London on June 9, Beijing's state media reported, as the world's two biggest economies seek to shore up a shaky truce after bruising tit-for-tat tariffs. (AFP/US Treasury Department/Handout)

A

sian stocks squeezed out more gains Tuesday as the latest round of China-US trade talks moved into a second day, with one of Donald Trump's top advisers saying he expected "a big, strong handshake".

There is optimism the negotiations -- which come after the US president spoke to Chinese counterpart Xi Jinping last week -- will bring some much-needed calm to markets and ease tensions between the economic superpowers.

The advances in Asian equities built on Monday's rally and followed a broadly positive day on Wall Street, where the S&P 500 edged closer to the record high touched earlier in the year.

This week's meeting in London will look to smooth relations after Trump accused Beijing of violating an agreement made at a meeting of top officials last month in Geneva that ended with the two sides slashing tit-for-tat tariffs.

The key issues on the agenda at the talks are expected to be exports of rare earth minerals used in a wide range of things including smartphones and electric vehicle batteries.

"In Geneva, we had agreed to lower tariffs on them, and they had agreed to release the magnets and rare earths that we need throughout the economy," Trump's top economic adviser, Kevin Hassett, told CNBC on Monday.

But even though Beijing was releasing some supplies, "it was going a lot slower than some companies believed was optimal", he added.

Still, he said he expected "a big, strong handshake" at the end of the talks.

"Our expectation is that after the handshake, any export controls from the US will be eased, and the rare earths will be released in volume," Hassett added.

He also said the Trump administration might be willing to ease some recent curbs on tech exports.

The president told reporters at the White House: "We are doing well with China. China's not easy.

"I'm only getting good reports."

Tokyo led gains in Asian markets, with Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei, Wellington and Jakarta also well up.

"The bulls will layer into risk on any rhetoric that publicly keeps the two sides at the table," said Pepperstone's Chris Weston.

"And with the meeting spilling over to a second day, the idea of some sort of loose agreement is enough to underpin the grind higher in US equity and risk exposures more broadly."

Investors are also awaiting key US inflation data this week, which could impact the Federal Reserve's monetary policy amid warnings Trump's tariffs will refuel inflation strengthening the argument to keep interest rates on hold.

However, it also faces pressure from the president to cut rates, with bank officials due to make a decision at their meeting next week.

While recent jobs data has eased concerns about the US economy, analysts remain cautious.

"Tariffs are likely to remain a feature of US trade policy under President Trump," said Matthias Scheiber and John Hockers at Allspring Global Investments.

"A strong US consumer base was helping buoy the global economy and avoid a global recession."

However, they also warned: "The current global trade war coupled with big spending cuts by the US government and possibly higher US inflation could derail US consumer spending to the point that the global economy contracts for multiple quarters."