Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsMarkets mostly up as US producer price data stokes rate cut bets

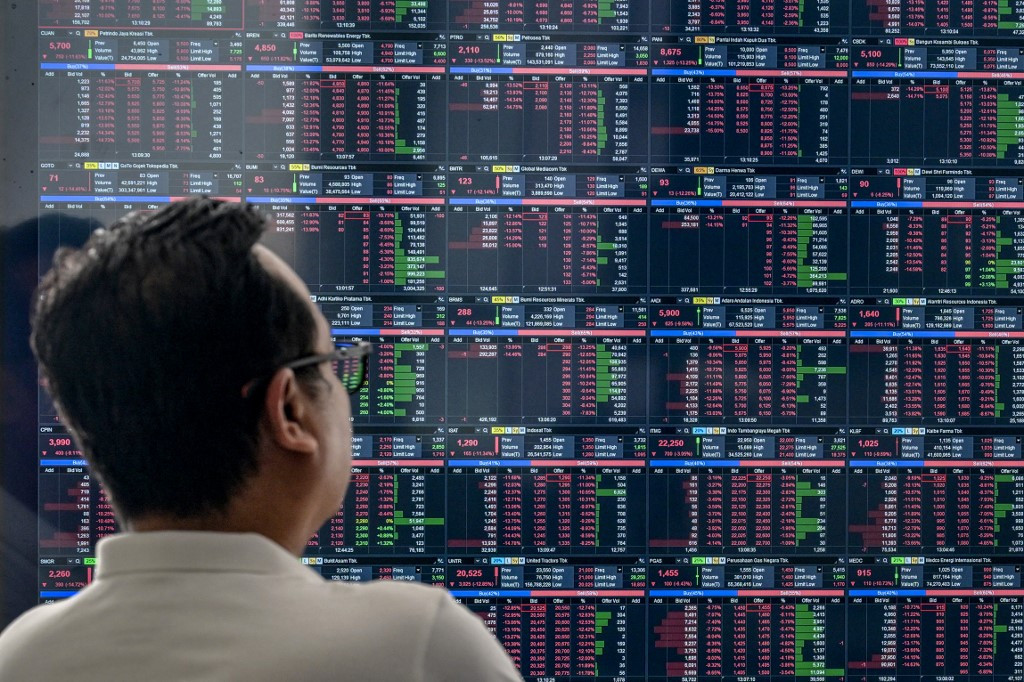

Asian equities mostly rose Thursday as investors built on this week's rally after US data ramped up expectations for a string of interest rate cuts. Jakarta jumped after the government said it plans to inject around $12 billion into the economy.

Change text size

Gift Premium Articles

to Anyone

A

sian equities mostly rose Thursday as investors built on this week's rally after US data ramped up expectations for a string of interest rate cuts.

Markets have enjoyed a healthy run in recent months -- with some hitting record highs -- on growth optimism that the Federal Reserve will resume its monetary easing process as figures indicate the world's top economy is slowing.

Those bets ramped up Friday on a report showing jobs creation was well below forecasts, while another this week revealed there were more than 900,000 fewer new posts than thought in the 12 months through March.

And on Wednesday, the Department of Labor said the producer price index (PPI) fell on-month in August for the first time since April, confounding forecasts for a rise. July's figure was also revised down.

The data soothed worries that US President Donald Trump's tariff war would reignite inflation -- as many have warned -- and gave the Fed room to cut rates and address weakness in the jobs market.

Focus is now on the more crucial consumer price index report due Thursday, which could play a major role in how many cuts the Fed makes, and how big they are.

The PPI reading was "a red carpet unfurled straight to the September Federal Open Market Committee, with (boss Jerome) Powell cast as the reluctant guest of honor", wrote SPI Asset Management's Stephen Innes.

"What markets heard wasn't just a tick lower in input prices; it was confirmation that the worst inflation ghost stories aren't materializing. Producers aren't shoving tariffs straight onto consumers; they're eating some of it to stay competitive."

He added that if the consumer price figure "comes in tame, the conversation tilts from a careful quarter-point shuffle to the possibility of a half-point swing".

Vincenzo Vedda, global chief investment officer at DWS, predicted five rate cuts by September 2026.

Wednesday's figures helped push the S&P 500 to another record high on Wall Street, and most of Asia followed suit.

Tokyo and Seoul hit their own fresh peaks, while Shanghai, Singapore, Taipei and Manila also rose.

Jakarta jumped after Indonesia's government said it plans to inject around $12 billion into the economy.

The gains pushed it back above Monday's close, having tumbled Tuesday after President Prabowo Subianto removed finance minister Sri Mulyani Indrawati following anti-government protests.

There were losses in Hong Kong, which retreated from a four-year high and was weighed by selling in the tech sector, while Sydney, Wellington and Manila also fell.