Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe untold story of payroll

Many HR practitioners still spend a lot of time doing menial tasks like handling employees’ attendance, overtime, leave of absence, monthly payroll, etc. It is unproductive and error-prone. This menial job could easily be replaced by using a modern digital payroll system.

Change text size

Gift Premium Articles

to Anyone

M

any people are afraid that technology will replace their jobs. In reality, most people will lose their jobs because they do not know how to use technology. Technological advancements are accelerating and competition is intensifying. We need to know how to leverage state-of-the-art technology to stay competitive, either as a representative of a company or as an individual scared of not being able to keep up in the new digital world.

Technology has disrupted all industries, including payroll.

Although the concept of payroll has been around since ancient times, payroll is now going through a time of technological transformation.

Payroll was previously carried out manually with employees physically submitting their time cards to a clerk who would then manually tally hours in ledgers to calculate wages during the early 20th century (1920-1940). Errors were frequent and employees would sometimes receive back payments months late.

Read also: History of the two-day weekend offers lessons for today’s calls for a four-day week

Computerization of payroll became a reality with the inception of the Lyons Electronic Office (LEO), the world’s first business computer developed to handle clerical tasks in the 1950s.

The introduction of email technology over the last couple of decades meant that employees could email timesheets electronically. Microsoft Excel provided payroll administrators with another powerful tool for undertaking payroll calculating and reporting. But although technology has advanced, payroll data was still being manually entered into Excel documents, leading to human errors, lack of historical data and no backups.

Fast forward to today and many companies in Indonesia still process payroll manually, by using outdated software or using overpriced foreign payroll software that has not been localized to the Indonesian market and human resource (HR) policies.

Many HR practitioners still spend a lot of time doing menial tasks like handling employees’ attendance, overtime, leave of absence, monthly payroll, etc. It is unproductive and error-prone. This menial job could easily be replaced by using a modern digital payroll system.

Read also: 5 overlooked secrets of a great email

What is modern digital payroll? It is a system based on modern technology that utilizes the internet, smartphones and artificial intelligence (AI).

How does this benefit companies and their employees?

The internet is the fastest and the most efficient distribution channel. It runs continuously. It helps you to run a company with offices across Indonesia and even globally. It makes cloud-computing possible. Cloud-computing is the on-demand availability of computer servers on the internet. Governments, large multinational companies and startups have been aggressively adopting cloud computing. Modern digital payroll leverages the same cloud-computing technology used by world-class consumer technology companies.

Some of the benefits include eliminating capital expenses to buy computer servers, networking equipment, uninterrupted power supply and software. There are no operational expenses to hire software engineers to install and maintain the software, and no need to backup and restore the database - customers only pay for what they use.

Smartphones are the connectors between consumers and services provided by various companies, like email, music and video streaming, social media, etc. They have become ubiquitous because they are like digital Swiss Army knives. There is an app for just about anything. Some people say that smartphones have become our third hand as we carry them anywhere we go. Mobile computing was born due to powerful smartphones that enable human-computer interaction. Modern digital payroll provides the benefits of cloud computing and mobile computing: available anytime and anywhere, it provides convenient self-service. Some companies provide digital payroll applications on the mobile web on smartphones. These programs can easily perform actions such as checking your pay slip, requesting annual leave or approving/rejecting annual leave requests.

AI demonstrated by machines, has been headline news in recent years. Billions of people have been using AI daily without realizing it. Popular applications used by billions of people daily are powered by AI technology: auto-correct in smartphones, search engines like Google and Bing, or recommendation engines by YouTube, Spotify, Amazon, Facebook, Google Maps and Gmail.

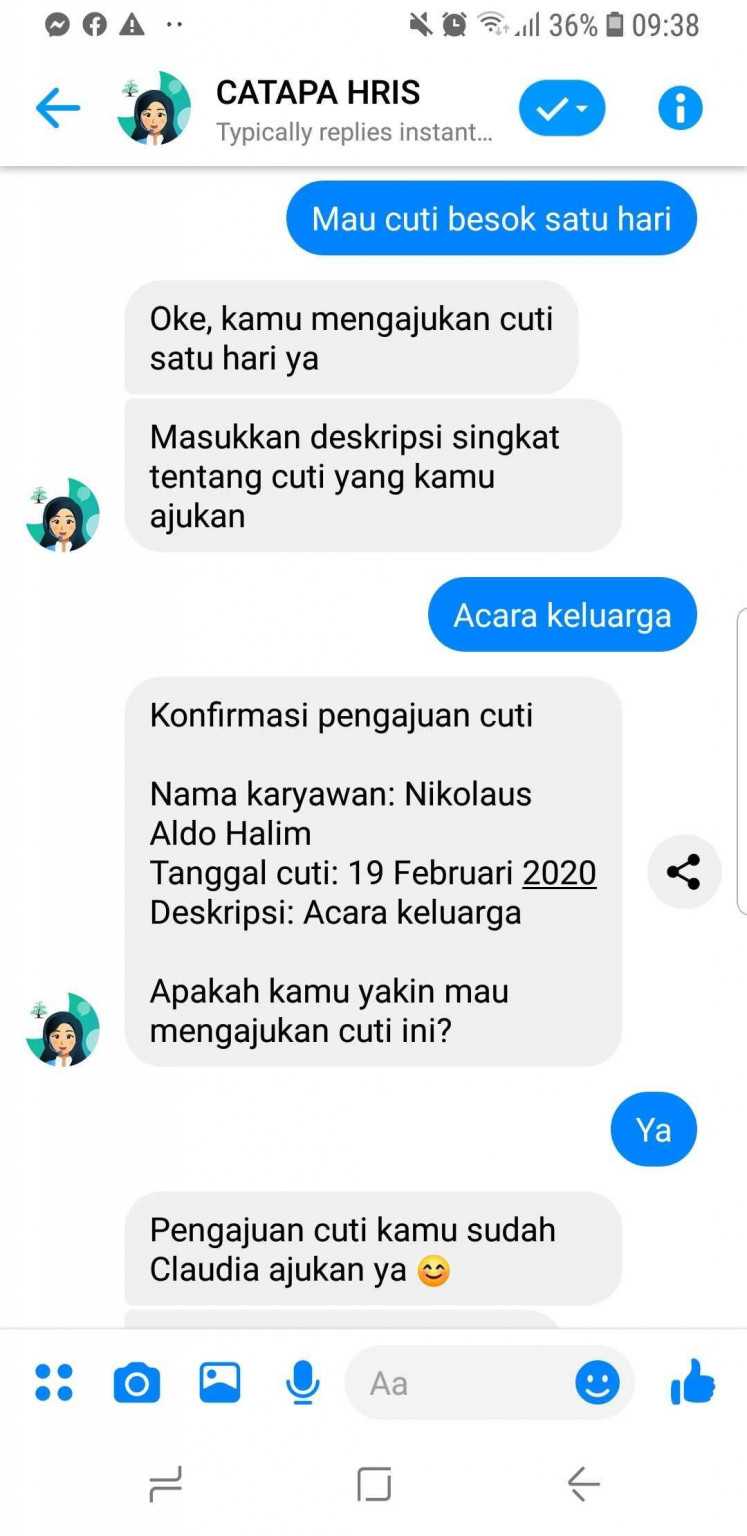

Cloudia, the first HR chatbot which uses the Indonesian language in the country, created by Catapa (Catapa/File)Modern digital payroll adopts AI technology with the following features. Descriptive analytics uses data aggregation and data mining to provide insights into the past and could answer the question “How much money have we spent?” Predictive analytics uses statistical models and forecasting techniques to understand the future. It is able to figure out “How much money could we spend next week, month, year?” Prescriptive analytics uses optimization and simulation algorithms to advise on possible outcomes and answer “What should we reserve in the bank for payroll, bonuses, insurance and salary increases?” AI amplifies modern digital payroll benefits: powerful analytics and deeper insights so people can learn from the past, where you are at the present and plan for the future accordingly.

In summary, companies thrive when they succeed in exploiting technology. Those who fail to keep up have fallen behind and will eventually go bankrupt. The benefits of modern digital payroll are increased reliability, auditable, automation, transparency, security, accountability, scalability and predictive analysis. Yet it is affordable even for small companies. Digital payroll is one of the most important foundations to achieve operational excellence without human intervention in the digital age. Upgrade your outdated payroll system to a modern digital payroll to make your company survive and thrive in the digital age.

***

Stefanie Suanita is the founder and CEO of CATAPA, digital payroll and HR Intelligent System that empowers companies in Indonesia.