Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBig caps suffer trillions of rupiah in losses amid market crash

The 10 largest companies trading on the Indonesian Stock Exchange (IDX) suffered trillions of rupiah in losses in their market capitalization due to the sharp drop in their prices in the past two weeks

Change text size

Gift Premium Articles

to Anyone

The 10 largest companies trading on the Indonesian Stock Exchange (IDX) suffered trillions of rupiah in losses in their market capitalization due to the sharp drop in their prices in the past two weeks.

Although there was a rebound in share prices at the end of weekly trading on Friday, their market capitalization was still way below the level recorded on May 20, when the Jakarta Composite Index (JCI) reached its record high level of 5,214.98.

The index sank as deep as 4,609.95 on June 11 as foreign institutional investors sold their shares amid concerns that the US would reduce its bond buying program, a move which could result in the tightening of global liquidity, as well as on fears of the slow recovery of the Chinese economy, the second largest in the world.

Equity analysts are skeptical that the rebound in share prices at the weekend will continue.

'There are still plenty of factors that may trigger further negative sentiments, such as the expected price increases of staple goods and fuel, which will drive inflation higher,' said Danpac Sekuritas analyst Teuku Hendry Andrean.

As a result of index volatility for the past two weeks, the 10 largest publicly listed firms by market capitalization suffered from combined losses of Rp 219.7 trillion (US$22.2 billion) in their market capitalization, according to the latest data from the IDX.

The 10 largely capitalized companies ' also called 'big caps' ' include cigarette firm PT HM Sampoerna (HMSP), automotive firm PT Astra International (ASII), PT Bank Central Asia (BBCA), consumer goods manufacturer PT Unilever Indonesia (UNVR), PT Bank Mandiri (BMRI), telecommunication firm PT Telekomunikasi Indonesia (TLKM), PT Bank Rakyat Indonesia (BBRI), gas distributor PT Perusahaan Gas Negara (PGAS), cement producer PT Semen Indonesia (SMGR) and cigarette firm PT Gudang Garam (GGRM). They had a total Rp 2,057 trillion market valuation as of last Friday, down 9.6 percent from May 20, when the JCI reached its peak.

The 10 companies account for more than 40 percent of the total IDX market capitalization, which stood at Rp 4,672 trillion on June 14. The value of HMSP, which topped the list of the blue chips, fell by

Rp 23.23 trillion to Rp 361.6 trillion, while BBCA lost Rp 26.85 trillion in its market capitalization to reach

Rp 239.2 trillion.

The market capitalization of UNVR dropped Rp 20.61 trillion to Rp 220.12 trillion, while that of BMRI sank Rp 21.95 trillion to Rp 218.29 trillion.

TLKM's value was downsized by Rp 35.28 trillion to Rp 212.69 trillion and PGAS' value by Rp 24.24 trillion to Rp 128.48 trillion.

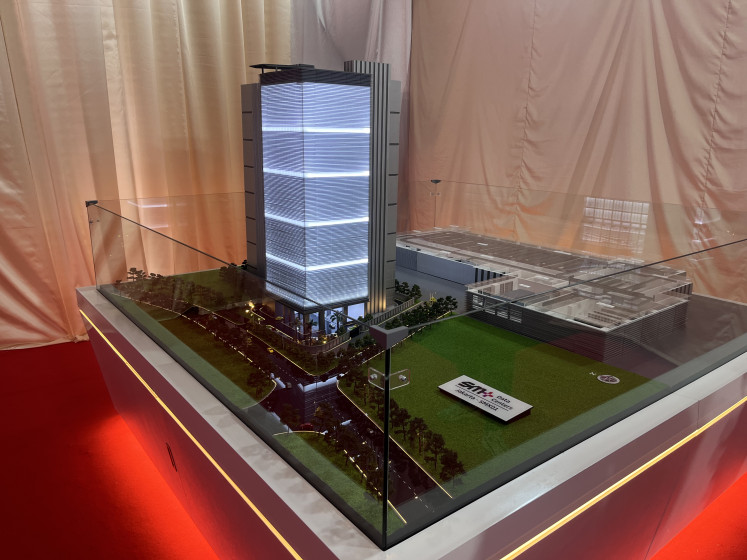

Meanwhile, SMGR dipped by Rp 6.53 trillion to stand at Rp 10.39 trillion and GGRM decreased by Rp 15.87 trillion to Rp 95.05 trillion.

Data from the IDX shows that BBRI posted Rp 39.07 trillion in losses in its capital market capitalization, the biggest drop of companies listed on the IDX. Its market capitalization dropped to Rp 191.72 trillion on Friday from Rp 230.79 trillion on May 20. ASII suffered the least losses, with Rp 6.07 trillion in the same period.

Hendry estimated that the market would slowly pick up after the Idul Fitri holidays ended in late

August. However, it would still be cautious entering the second half of the year, with companies expected to start publishing their second quarter financial reports in July, he said.

'Their operational performances may also influence the market,' he said, adding that the companies should hold on buying back their shares immediately, given the possibility of another price drop.

Similar to Hendry, Onix Sekuritas research head Bagus Hananto said he expected the market to return to a more stable state after Idul Fitri.

'Prices will increase as people start preparing for the holidays and inflation will grow as well, but I am certain that BI [Bank Indonesia] will be proactive in adjusting the BI rate, especially with the planned fuel price hike,' he said.

According to SMGR investor relations head Agung Wiharto, SMGR did not suffer significantly from its lower market capitalization. He said that the state-owned firm, whose assets amounted to Rp 27.61 trillion as of March 2013, possessed strong business fundamentals.

Separately, ASII investor relations representative Tira Ardianti acknowledged that ASII's shares were among those affected when foreign investors ditched their rupiah assets. The shares fell to Rp 7,050 apiece on June 14 from Rp 7,200 on May 20.

'I'm certain the crisis is only temporary. We also have long-term shareholders, which have gone through crisis after crisis in Indonesia, and they are still with us,' she said in a text message.