Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFintech's role in financial inclusion rises but infrastructure, literacy challenges loom

Seventy-five percent of the fintech companies reported they were still facing low financial literacy among the target market, 57 percent reported facing basic infrastructure problems and 44 percent reported facing limited capital or resources challenges.

Change text size

Gift Premium Articles

to Anyone

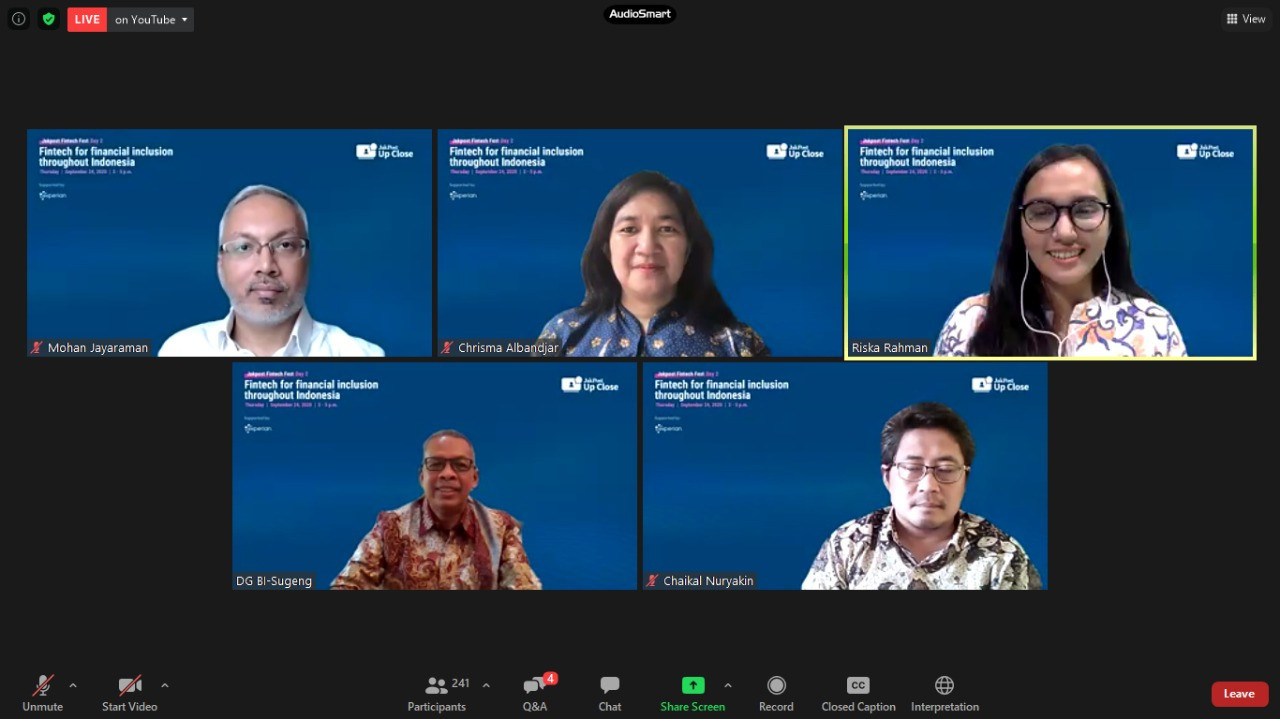

(Clockwise, from upper left) Experian Asia-Pacific managing director for Southeast Asia and regional innovation Mohan Jayaraman, Indonesia Fintech Association (Aftech) board member Chrisma Albandjar, The Jakarta Post journalist Riska Rahman, head of the research group for digital economy and behavioral economics at the University of Indonesia's Social and Economic Research Institute (LPEM-UI), Chaikal Nuryakin, and Bank Indonesia deputy governor Sugeng pose during the Jakpost Fintech Fest webinar series on Thursday, September 24, 2020, titled Fintech for financial inclusion throughout Indonesia. (JP/-)

(Clockwise, from upper left) Experian Asia-Pacific managing director for Southeast Asia and regional innovation Mohan Jayaraman, Indonesia Fintech Association (Aftech) board member Chrisma Albandjar, The Jakarta Post journalist Riska Rahman, head of the research group for digital economy and behavioral economics at the University of Indonesia's Social and Economic Research Institute (LPEM-UI), Chaikal Nuryakin, and Bank Indonesia deputy governor Sugeng pose during the Jakpost Fintech Fest webinar series on Thursday, September 24, 2020, titled Fintech for financial inclusion throughout Indonesia. (JP/-)

I

ndonesian fintech companies are still facing basic infrastructure and literacy issues in their attempt to increase financial inclusion in the country.

Some two-thirds of surveyed fintech companies were already serving both the unbanked and underbanked population, including in rural areas, according to a recent survey by the Indonesia Fintech Association (Aftech), which has 362 members offering various financial services.

However, 75 percent of the fintech companies reported they were still facing low financial literacy among the target market, 57 percent reported facing basic infrastructure problems and 44 percent reported facing limited capital or resources challenges.

“So if we can work on this part, all of these three things, we can actually reach our target even faster,” Aftech board member Chrisma Albandjar said on Thursday during the Jakpost Fintech Fest webinar series organized by The Jakarta Post.

“If we are very focused on that part we will actually achieve the 90 percent financial inclusion,” she added, referring to the national target in 2024.

According to a 2019 survey by the Financial Services Authority (OJK), Indonesia’s financial inclusion rate stood at 76.1 percent, marking an increase of some 40 million unbanked adults from 2017, when the rate was nearly 50 percent.

To overcome the challenges, 45 percent of fintech companies told the Aftech survey they collaborated with traditional financial institutions such as banks and 23 percent took part in the government’s strategic partnership.

Chrisma was expecting the COVID-19 pandemic to accelerate the progress because it was leading to faster adoption of digital financial services as people had to stay at home or at least comply with social distancing rules.

The government also has interest in more and more people having a formal financial account so it can transfer its Rp 695 trillion (US$46.4 billion) coronavirus relief package efficiently, said Chaikal Nuryakin, head of the research group for digital economy and behavioral economics at the University of Indonesia’s Social and Economic Research Institute (LPEM-UI).

Still, challenges remain as the proportion of villages deemed financially remote stood at 57.3 percent and those deemed digitally remote at 8.1 percent, said Chaikal, quoting 2018 Village Potential (Podes) data from Statistics Indonesia (BPS).

Moreover, 63.6 percent of villages still did not have access to bank branches, ATMs and bank agents.

“That is huge,” said Chaikal. “[With] these village characteristics, who is going to offer these people financial services?”

Chaikal added that even if fintech companies could get into the villages, they still needed to compete with informal lending services like loan sharks, which provided financing for the locals to pay school tuition.

According to the Aftech survey, only 23 percent of fintech companies have operations outside Java island.

The association has worked with the National Committee for Financial Inclusion (DNKI) and the World Bank in doing pilot projects on digital payment in Kalimantan, according to Chrisma. It is also providing training for small businesses that are mostly based outside Java to use digital payment.

Bank Indonesia (BI) is working on an interconnected application programming interface (API) to bridge fintech companies and traditional banks in hopes that it will enable more people to use just one app to access financial services.

“With an interconnected ecosystem, people will not face difficulties. The existing one is inefficient,” said BI deputy governor Sugeng.

“Going forward, it will be a lot easier with IPT, an integrated payment interface. One touch will cover everything. Very efficient,” he added.

State-owned Bank Mandiri has allowed fintech companies like Dana and LinkAja to access its API, thus allowing its customers to top up their e-wallet accounts without having to switch from the e-wallet mobile app to the bank’s mobile app.

To get more people into formal financial services, Indonesia could also leverage alternative data such as people’s telecommunication services usage to create a credit scoring system for the un-included population, said Mohan Jayaraman, the managing director for Southeast Asia and regional innovation at Experian Asia-Pacific, a consumer credit reporting company.

“In the Indonesian context, we have already got this live with alternate data and with the content that we put together with alternate data providers like telcos, for instance,” said Mohan.

“What we then do is try and see if we can support these lenders through a broader analytical platform.”