Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

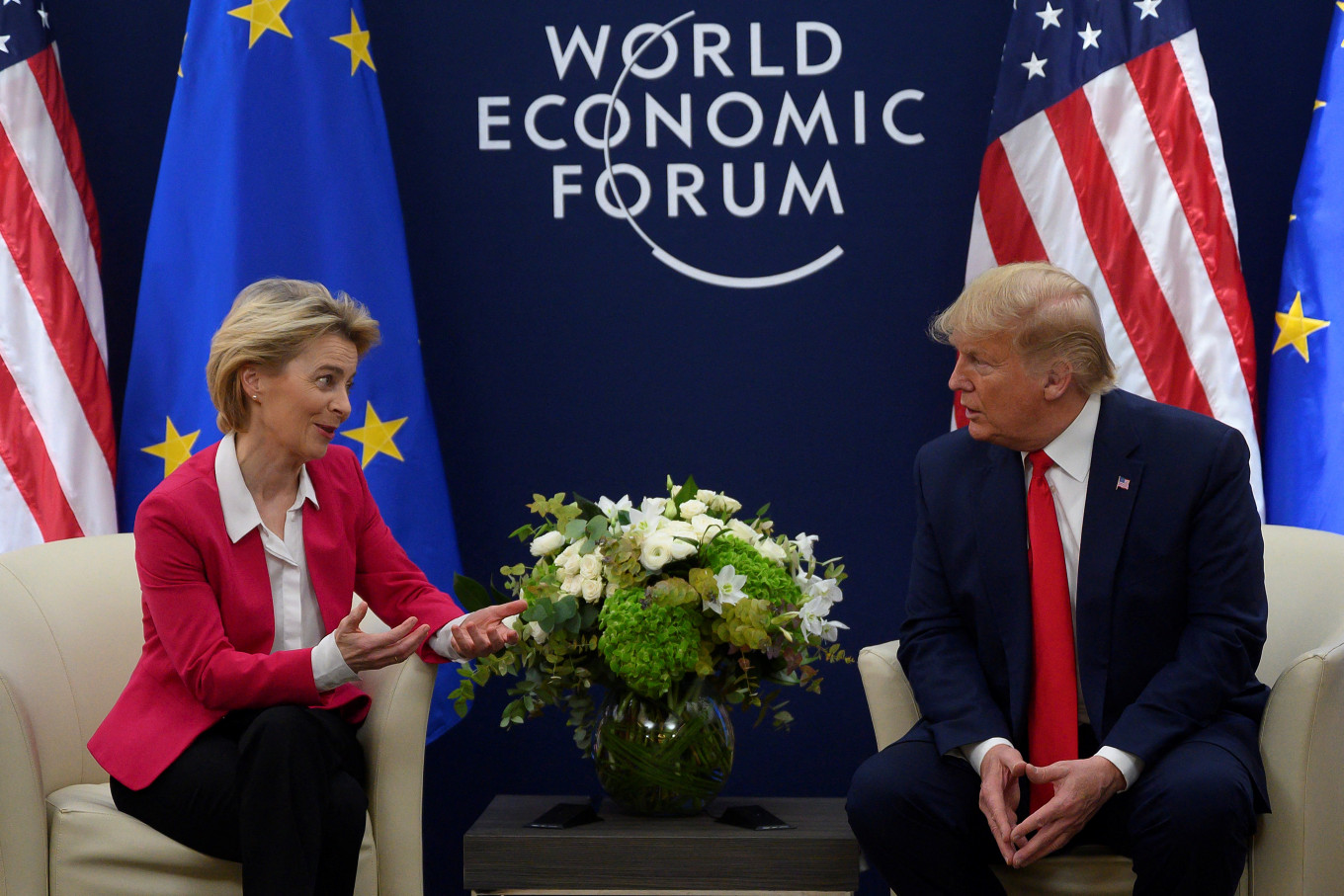

View all search resultsTrump’s trade threats: A test of Europe’s unity and strength

From auto tariffs to trade wars, Trump’s protectionist policies are back, leaving Europe struggling to form a unified response.

Change text size

Gift Premium Articles

to Anyone

A

fter four relatively quiet years in United States-European Union relations, Donald Trump’s return to the White House risks reviving the trade tensions of his first term between the two allies, just as Europe faces growing instability, both political and economic.

To "protect American labor," Trump repeatedly floated the idea of a blanket 10 percent or 20 percent tariff on all imports into the US and a 60 percent special tariff on goods from China during his campaign.

He also threatened retaliatory tariffs against US firms moving production abroad, such as machinery maker John Deere, which has plans to shift some lines to Mexico. Additionally, Trump has proposed a 100 percent tariff on automobile imports, particularly from Mexico, claiming China is setting up factories there to evade US trade policies.

Trump’s threats have raised widespread concern. Observers have warned of potential damage to US gross domestic product (GDP) and inflation, as well as higher prices and reduced consumer choice.

Others highlight the risks for European economies, recalling the 2018 “mini trade war” over steel and aluminum tariffs, which caused significant disruption to European exporters.

Despite mounting tensions and Trump’s vocal stance, including threats to impose tariffs if Europe does not buy more US oil and gas, the European Union has maintained a low-profile approach, likely waiting to assess Washington’s actual policy in the early months of the new administration.

Forging a common EU position will be challenging. US tariffs will impact European countries unevenly, with trade-reliant economies such as Germany and the Netherlands suffering the most.

Similarly, industrial sectors will feel the effects differently. The automotive industry is expected to bear the brunt of new tariffs, and electric car producers will suffer more than traditional producers. These disparities add to existing EU divisions, worsened by domestic political instability in France and Germany and declining support for Ursula von der Leyen’s European Commission.

A fragmented Europe plays into Trump’s hands. During his first term, he leveraged European divisions to advance his transactional trade policy, capitalizing on Brexit’s psychological impact to weaken EU cohesion.

This strategy was effective in deepening Europe’s divisions, and today’s landscape appears even more conducive to US pressure. Euroskeptic forces are on the rise, European institutions are increasingly viewed with skepticism and national governments remain divided on their priorities.

With US-China tensions potentially escalating and a renewed trade war on the horizon, Europe risks being caught in the middle, further strengthening Trump’s negotiating position.

Former European Commission president José Manuel Barroso described Trump’s return as “shock therapy” for Europe. While disruptive, he argued, it could force the EU to confront its structural weaknesses, not just in trade, but also in broader economic and security policies.

This concept is not new. During Trump’s first term, and again at the beginning of the last presidential race, some European leaders sought ways to “Trump-proof” the EU, aiming to reduce reliance on the US. However, these efforts have remained limited, and some leaders now appear inclined toward appeasement, seeking to minimize economic fallout by pursuing closer bilateral ties with Washington.

New US tariffs will undoubtedly provoke EU retaliation, but whether this escalates into a trade war remains uncertain. A direct confrontation with a protectionist US carries significant risks for Europe’s economy.

Financial markets have already reacted. Since Trump’s election, fears of new tariffs have driven the euro-dollar exchange rate down, from 1.09 on Nov. 5, 2024, to 1.03 on Jan. 15, 2025. If Trump implements his proposed tariffs, the exchange rate is likely to decline further, hitting EU exports and exacerbating economic pressures on European businesses.

At the same time, Chinese goods barred from the US may flood global markets, with excess supply diverted to Europe, undercutting domestic manufacturers and eroding profit margins.

During 2024, the EU faced a fragile economic outlook, and forecasts depict a situation that will remain more or less the same in the coming year .

Structural challenges remain unresolved, particularly in manufacturing, while high energy costs and rising competition from China add further pressure. Against this backdrop, European leaders are reluctant to escalate tensions with the US, fearing economic repercussions.

Beyond trade, US-Europe relations are deeply intertwined, particularly in defense and security. NATO remains the cornerstone of European security, and the EU depends heavily on the US defense industry, which currently supplies 63 percent of its military capabilities.

Washington’s intelligence, strategic transport and military technology remain critical assets for Europe. Additionally, around 100,000 US troops are stationed across the continent, forming a key component of European defense infrastructure.

Trump’s past threats to reduce NATO commitments unless allies increase military spending have already caused friction. In an increasingly volatile security environment, many European nations are unlikely to risk further alienating Washington, even in response to aggressive US trade policies.

In the current security environment and facing the risk of possible US disengagement, several European countries will hardly renounce Washington’s umbrella to contest Trump’s hawkish commercial policy. Instead, the situation provides them with incentives to reframe their postures on new bilateral bases. Once again, the rise of the right-wing populist and sovereignist parties and the lack of viable alternatives push in the same direction.

Poland, in particular, is moving closer to Trump’s stance. Polish Defense Minister Władysław Kosiniak-Kamysz recently called for European allies to raise defense spending to 5 percent of GDP, echoing Trump’s long-standing demands. Warsaw’s alignment with US policy suggests Poland could position itself as a key US ally in Europe, potentially influencing EU decision-making

Political, economic and security factors continue to weaken EU cohesion. Europe’s inability to “Trump-proof” itself underscores its limited capacity to counter US pressure. Diverging national interests and slow EU decision-making give Washington the upper hand in trade negotiations and broader US-Europe relations. Trump’s approach to Europe hinges on exploiting these weaknesses, using pressure tactics to extract economic concessions.

New tariffs are unlikely to alter this dynamic. Instead, they will further strain the EU’s fragile political landscape, reinforcing Trump’s longstanding skepticism of multilateralism and his preference for bilateral deal-making.

---

Gianluca Pastori is an associate professor in the faculty of political and social sciences, Università Cattolica del Sacro Cuore. The article is republished under a Creative Commons license.