Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsA year of Snakes and Ladders

The mainstream media has overlooked the fact that the Chinese economy has leapfrogged the West in engineering and increasingly in technology.

Change text size

Gift Premium Articles

to Anyone

A

s China celebrates the Year of the Snake, the first angpao (red packet money gift) was the DeepSeek AI software that shook Wall Street to the tune of nearly US$1 trillion in market capitalization.

This reminded me of the classic game called Snakes and Ladders, where players roll the dice to climb up ladders and slide down via snakes. The element of chance (dice-rolling) and its multiplayer form reflects the specter of widening volatility whereby United States President Donald Trump gives daily stunning executive orders amid huge uncertainty from natural disasters to game-changers like DeepSeek on the whole AI tech wealth generation game.

How do we figure out who and what is up and down in this snaky, slippery year?

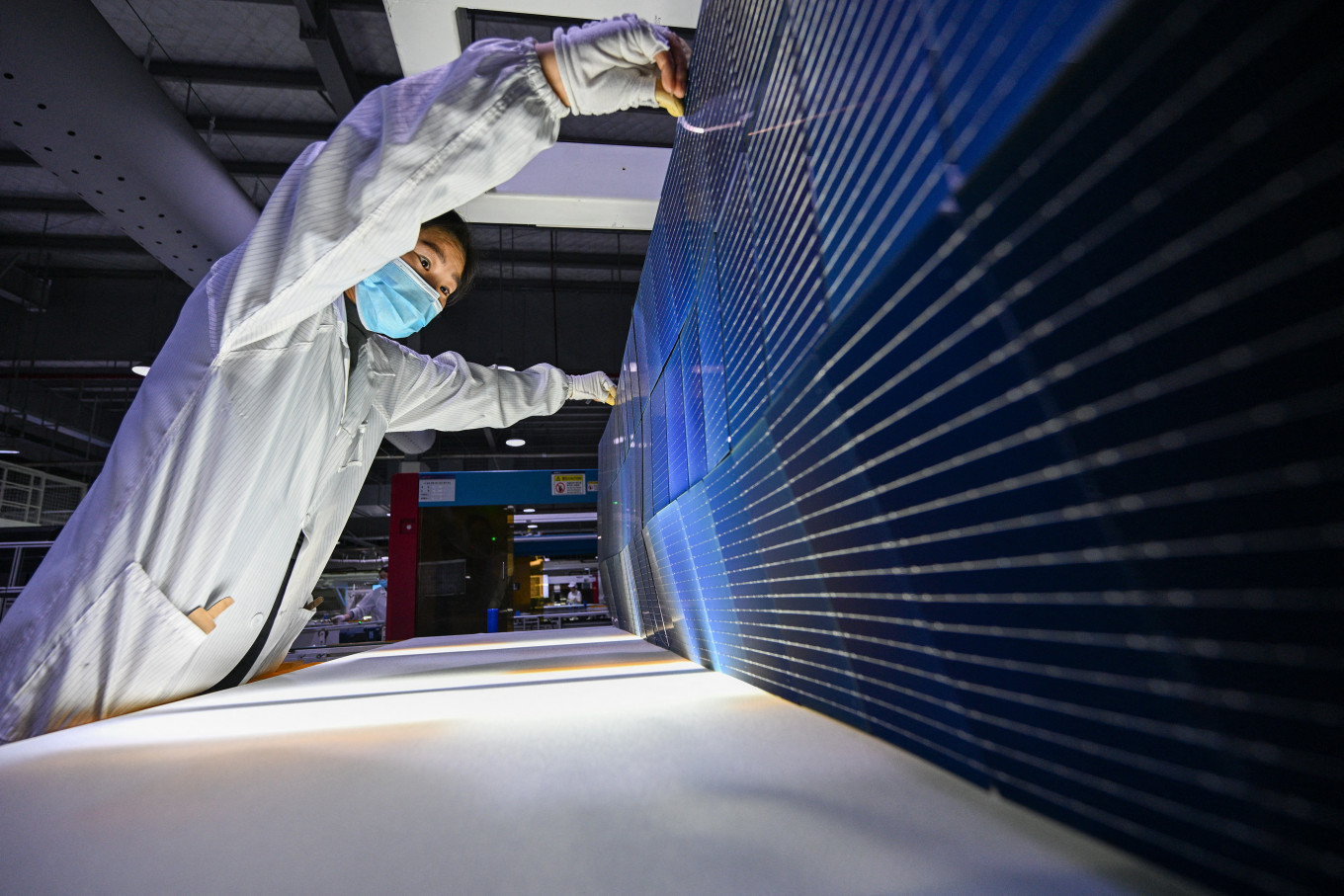

Reflecting on this during the Chinese New Year holidays, the best analysis I have heard was from the insightful Hong Kong-based Louis-Vincent Gave, who argued that the mainstream media has overlooked the fact that the Chinese economy has leapfrogged the West in engineering and increasingly in technology.

After eight visits to the Mainland last year, I arrived at the same conclusion, which is that most of us have overlooked the qualitative change in the Mainland economy because few outside “experts” visited the factories and looked at what was really going on.

The macro-statistics that outsiders examine in excruciating detail suggest that the Chinese economy is in deep trouble, whereas what we are witnessing is a qualitative change in supply (production) and demand (consumption or investment) which Louis-Vincent identified brilliantly. A structural and cyclical change has happened in China largely within a world distracted by the Ukraine and Gaza wars and the domestic political turmoil in the West.

We need to see these nuanced changes within the context of a world being transformed by technology (especially social media) and the discrediting of mainstream Western media churned out by liberal elites who have lost touch with reality and the masses.

Wall Street reads the economic tea leaves that show a booming US economy, but underplays the fact that the boom in both stock market and employment was stimulated by unsustainable fiscal and trade deficits.

The US debt has ballooned and net international investment position (NIIP), or what the US owes the rest of the world in foreign currency, has worsened from US$8.3 trillion or 44.2 percent of gross domestic product (GDP) by end 2016 (Trump1.0) to $19.9 trillion or 72.6 percent of GDP by end 2023. I use the just published Brookings External Wealth of Nations dataset that presents a globally consistent view of which nation owes what to whom.

As China is portrayed as an existential threat to the US, you would have thought that China gained the lion share of global surpluses at the expense of the US’ rising external debt. Unfortunately, the facts show otherwise. China’s NIIP grew by $900 billion from $2.0 trillion or 18.5 percent of GDP in 2016 to $2.9 trillion or 16.6 percent of GDP by end-2023, small compared to the $11.6 trillion in US net NIIP growth during the same period.

What is truly intriguing was that between 2016 and 2023, the cumulative Chinese current account balance was $1.8 trillion, while FX reserves increased by only $272 billion during the same period. In short, there were unexplained outflows of roughly $1.5 trillion, which I interpret as “footloose Chinese capital”, comprising mostly Chinese private sector money accumulated offshore through various means not captured by official data.

Some of this money can be crudely monitored through the increases in NIIP of the international financial centers of Hong Kong (+$631 billion), Singapore (+$141 billion) or United Arab Emirates (+$707 billion). But it does not preclude that footloose Chinese money could be invested directly in the US stock market. After all, rich Chinese love US dollars as much as any other capitalist.

The point is that Chinese money is not simply money controlled by the Chinese state, but also private money that has become a significant player in global capital markets. This is where geopolitical strategic considerations cannot ignore the impact of both state-led sanctions and market-driven interest rate/exchange rate considerations.

It is the fear of both internal and external sanctions that is driving Chinese capital “footloose”. But where such funds are allocated depends on prospects of future returns and risk-considerations. It is no secret that US stock markets are touching record highs and are highly concentrated in the Magnificent Eight tech stocks, some of which are dependent on their trade with China. If the US market is over-valued by some metrics, whereas the West is under-rating the Chinese stock market, it is small wonder that events like DeepSeek could spark a short US-long China tech play.

Furthermore, it is exactly the revival of the Chinese stock market, amid compression of the real estate market, that would revive Chinese domestic consumption. Thus, Louis-Vincent is correct to say how mainstream Western analysis of China is under-rating how Beijing is engineering a fundamental shift from an investment-driven growth model to one that is consumption-driven.

Something similar is happening in Japan. Japanese monetary policy is beginning to normalize as Japanese inflation is returning due to an excessively cheap yen. Japan is the largest NIIP surplus country in the world, with a $3.3 trillion surplus at the end 2023 or 79.5 percent of GDP. Between 2016 and 2023, NIIP grew $442 billion, whereas the cumulative current account surpluses were $1.3 trillion. In other words, Japanese footloose capital may be at least $858 billion. Because of the weak Yen, Japanese GDP in USD terms fell from $5 trillion in 2016 to $4.2 trillion by the end of 2023.

What are the signs of market moves? The biggest recent sellers of US Treasuries between November 2023 and November 2024 were Japan (-$28.7 billion) and Mainland China (-$13.4 billion). Global footloose money is getting nervous that the recent spike in 30-year US Treasuries yields to nearly 5 percent per annum may be signs that US stocks and bonds are at risk due to geopolitical or other random events.

This does not mean that Trump’s bullish outlook on the US economy may not play out. We are after all in a game of real Snakes and Ladders. You climb up slowly but can slide down quickly. Good luck in what you wish for in the snake-filled investment game in 2025.

---

The writer is a distinguished fellow of the Asia Global Institute, University of Hong Kong.