Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe likely road map for Indonesia’s SWF

The IIA plans to proxy itself to Russia's SWF, the Russian Direct Investment Fund (RDIF), because it has the same goal of establishment in the early years, namely accelerating infrastructure development and strategic sectors.

Change text size

Gift Premium Articles

to Anyone

O

bserving the government's rhetoric recently, we may be confused about the planned sovereign wealth fund (SWF). Why is that? Because one may not understand what kind of SWF Indonesia will establish as the fund does not fit into any of the three most popular SWF categories in international markets: To manage natural resources fund surplus or income diversification as the United Arab Emirates, to manage foreign exchange surplus or energy security as China, or to manage a fiscal surplus and pension fund.

Well, as Article 157 Chapter X of the Job Creation Law stipulates, the SWF, known as the IIA (Indonesian Investment Authority), is an investment institution specially formed by the central government to collaborate with domestic and foreign investment to invest in projects and assets. The IIA is a special platform provided for investors who are interested in partnering directly with the central government specifically or limited to investing in certain assets or projects to be developed to boost the domestic economy.

In this framework, it can be said, that if the central government contributes Rp 1 trillion, it is expected that direct partner investors will contribute as much as, for example, Rp 3 trillion or, in other words, a co-invest ratio of 1:3 in the initial stage.

We understand from government explanations that the IIA plans to proxy itself to Russia's SWF, the Russian Direct Investment Fund (RDIF), because it has the same goal of establishment in the early years, namely accelerating infrastructure development and strategic sectors.

The RDIF is a little different from countries that have many idle funds, such as the some in the Middle East and Scandinavia. The RDIF serves to attract foreign investors to enter projects, especially domestic infrastructure. In the past 10 years, the RDIF has expanded from the infrastructure sector to the healthcare sector, especially health facilities for cancer treatment. Russia has grown its coinvest ratio tenfold to 1:10, that is, for every 1 trillion rubles the government of Russia’s contributes, they get a 10 trillion-ruble contribution from partner investors.

If in the initial stage the IIA will follow Russia’s RDIF, then in the next stage the IIA can follow countries that have idle funds from economic surpluses and redirect itself to maintaining retirement savings for the current generation of youth who in 20 years’ time will be 50 years and above.

Indonesia suffers an oil deficit, its foreign exchange reserves are mostly short-term portfolio money and its state budget has always been in deficit at least over the last decade. Economists like to call this a twin deficit. So, how will the government put up the seed capital of $5 billion (Rp 70 trillion) in cash?

I believe the central government will take the seed capital of up to Rp 70 trillion from a combination of sources, including redirecting some of the infrastructure budgets, and state-owned goods, receivables, as well as shares. Based on Article 170 Paragraph (2) of the Job Creation Law, the initial capital of the LPI is set at least Rp 15 trillion in cash. Based on Article 170 paragraph 1, the initial capital can come from cash, state-owned assets, state receivables from State-owned enterprises (SOEs) and shares in SOE. Thus said, the seed capital could then be raised from Rp 15 trillion cash into a total of Rp 70 trillion with a mixture of budget relocation and state government injection (goods, receivables, shares).

Those are the available sources of funds for the government’s contribution to the seed capital of the IIA, which will be joined by overseas partners, such as Abu Dhabi Investment Authority (ADIA), a sovereign wealth fund of the United Arab Emirates, Japan’s JBIC (Japan Bank for International Cooperation), Singapore’s GIC (Government of Singapore Investment Corporation), and the United States’ International Development Finance Corporation (IDFC) and will attract investment from other partner investors.

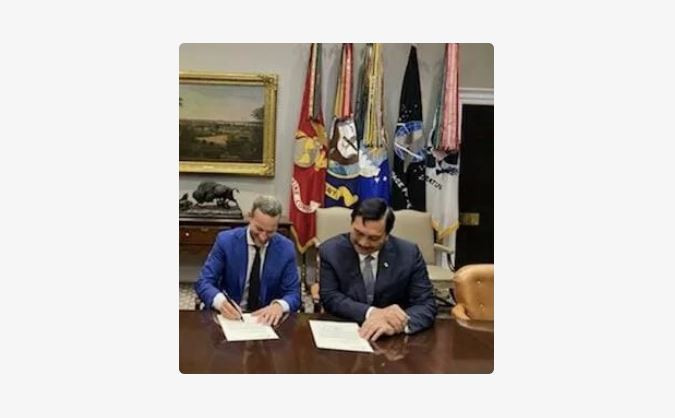

Coordinating Maritime Affairs and Investment Minister Luhut Pandjaitan recently received a commitment of $2 billion from the IDFC to coinvest with Indonesia’s SWF. The government is also in discussion with ADIA and Mubadala on the prospect of coinvesting around $1 billion with the IIA.

Let us not forget that our relationship with China is also flourishing, and we have not yet included Japan and Singapore which have been the major contributors to Indonesian FDI, meaning they are not new to direct investment in our country and will enthusiastically look into the new structures and schemes of the SWF.

Southeast Asia, once sought for yield and growth, especially Indonesia is used to be a darling of investors. The commodity capex cycle and the recent slash in borrowing rates should slowly trickle down to the wider economy later in the year, and the weaker economic numbers and heated geopolitical situation should largely be temporary.

Since SWFs such as the IIA are long investors, one may ask whether foreign investors would have confidence in the IIA in view of Indonesia’s notorious reputation in public and private sector governance.

The IIA will be managed and overseen by directors or advisors from well-known figures, namely those who represent the best talents in a particular sector or industry, those who represent direct investment partners, even community leaders and prominent global figures, which we anticipate will help spearhead corporate governance and fine-tune the IIA according to global SWF standards.

Moreover, judging from Transparency International’s corruption perceptions index (CPI), more than two thirds of the 180 countries surveyed are below the score of 50 with a global average score of 43. The scoreboard ranges from 0 (highly corrupt) to 100 (very clean). Meanwhile in ASEAN the average CPI score is at 46, while Indonesia's CPI in 2019 was at a score of 40, ranked 85th out of 180 countries surveyed.

This score increased by 2 points from last 2018. This is a sign that the collective struggle against corruption carried out by the government, the Corruption Eradication Commission (KPK), financial and business institutions and civil society is showing positive efforts.

Thirdly, Indonesia’s willingness to join the club of SWF issuers has shown that the current administration knows what it is doing and following the path of success of at least the examples of the Russian model or even the Indian model.

Will the international market have confidence in the Indonesian Investment Authority? Time will tell, folks.

***

The writer is chief marketing officer in an asset management company. The views expressed are his own.