Indonesia aims for double-digit growth in online transactions

Indonesia is forecast to record double-digit growth in digital transactions this year, with a notable acceleration of digital banking and e-commerce transactions.

Change Size

I

ndonesia is forecast to record double-digit growth in digital transactions this year, with a notable acceleration of digital banking and e-commerce transactions, as the COVID-19 pandemic prompts consumers to shift to digital platforms, Bank Indonesia (BI) has stated.

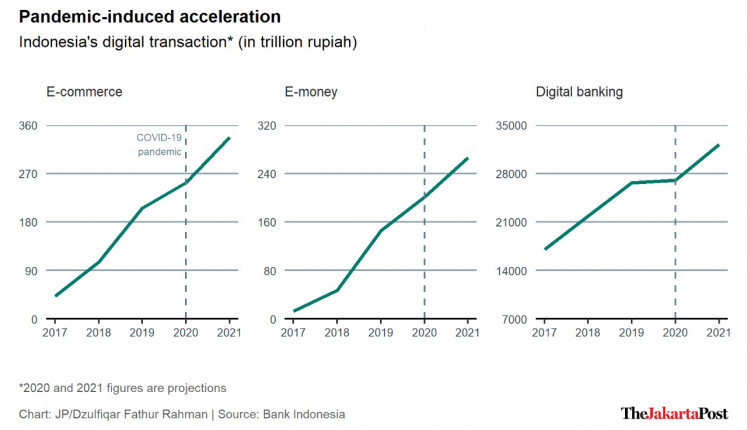

The value of e-commerce transactions is projected to grow by 33.2 percent year-on-year (yoy) to Rp 337 trillion (US$24 billion) this year from an estimated Rp 253 trillion in 2020, according to BI data. That growth rate would mark an acceleration from 23 percent yoy growth between 2019 and the estimated 2020 figure.

Meanwhile, digital banking transactions are forecast to grow by 19.1 percent yoy to Rp 32.2 quadrillion in 2021, much faster than 1.5 percent yoy growth between 2019 and the estimated 2020 figure. E-money is projected to grow by 32.3 percent yoy to Rp 226 trillion.

“This is, among other factors, supported by Bank Indonesia’s acceleration of digital payment systems as well as public preference and acceptance of digital transactions on the back of COVID-19,” BI Governor Perry Warjiyo said in a virtual event on Thursday.

With the government limiting mobility, more consumers are now buying groceries, clothes and other products from home using digital services.

Some 37 percent of all digital service consumers are new, and the majority of them plan to stick with their new behavior after the pandemic, according to the e-Conomy SEA 2020 report by Google, Singapore state-owned investment company Temasek and management consulting firm Bain & Company.

The report describes e-commerce as the key driver behind overall growth of the digital economy in Indonesia and forecasts that the overall internet economy will reach $124 billion in value by 2025.

Meanwhile, a separate study by management consulting company Redseer shows that the number of Indonesian online shoppers grew to 85 million during the pandemic from 75 million pre-COVID-19.

Read also: E-commerce firms bank on ‘Double Day’ shopping campaign as consumers go online

Bank Indonesia has also sought to capitalize on the growth in cashless transactions, expecting to expand the number of users of the Quick Response Indonesia Standard (QRIS) to 12 million this year. Last year, the number of users was recorded at around 5.8 million.

“Overall, our digital payment system will integrate the ecosystem of our digital economy and finance,” said Perry.

“To support that, we have issued our regulatory reform, which supports the fast-growing industry of digital payments, simplifies our licensing, our regulations, clusters the industry, as well as strengthens risk management and supervision.”

Publicly-listed Bank Central Asia (BCA), the largest private lender in the country, benefitted from the growth and thus booked 28.4 percent annual growth in its mobile banking transaction value at Rp 1.89 quadrillion and 4.1 percent annual growth at Rp 8.1 quadrillion through its internet banking in the first nine months of last year.

The bank plans to launch its first digital bank, Bank Digital BCA, before the end of the first half of this year The digital bank will allow consumers to access a wide range of banking services fully online.

“We notice that developing a digital platform will be key in the banking business, and cashless transactions will keep growing in the future,” Hera Haryn, the executive vice president of secretary and corporate communication, told The Jakarta Post via text message on Wednesday.

“Going forward, we expect there will be more and more cashless and cardless transactions that will be a significant part of life in a new normal.”

State-owned Bank Rakyat Indonesia (BRI) also booked growth in its digital banking services, according to Aestika Oryza Gunarto, the corporate secretary. The bank recorded last year more than seven-fold annual growth in the number of transactions through its mobile app, called BRImo, to 765.8 million.

“In the past few years, the rise in digital transactions was quite significant, especially with the COVID-19 pandemic that limits public activity and mobility, which accelerates the growth in digital banking transactions,” Aestika told the Post via text message on Wednesday.

With new users joining online shopping platforms, e-commerce company Bukalapak estimated that its transactions value grew by 130 percent yoy in 2020, according to its statement provided to the Post.

Bukalapak VP marketplace Kurnia Rosyada said in the statement that the platform “will continue to innovate in developing its features and products” this year.

Although Indonesia has a huge potential to grow its digital economy, the country still faces challenges, as there are some 4,400 villages without internet access, according to Finance Minister Sri Mulyani.

“When this [network] can be connected down to the level of villages, then we also expect that this can be used for business, especially small and medium enterprises so they are going to be able to access the market easily and in a more efficient way,” she said in a virtual event on Wednesday.