Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsNo severe disruption to Indonesian trade from Suez backlog, but shipping concerns loom

The shipping backlog and the alternative route that some operators have chosen, around South Africa’s Cape of Good Hope, are expected to raise fuel costs.

Change text size

Gift Premium Articles

to Anyone

T

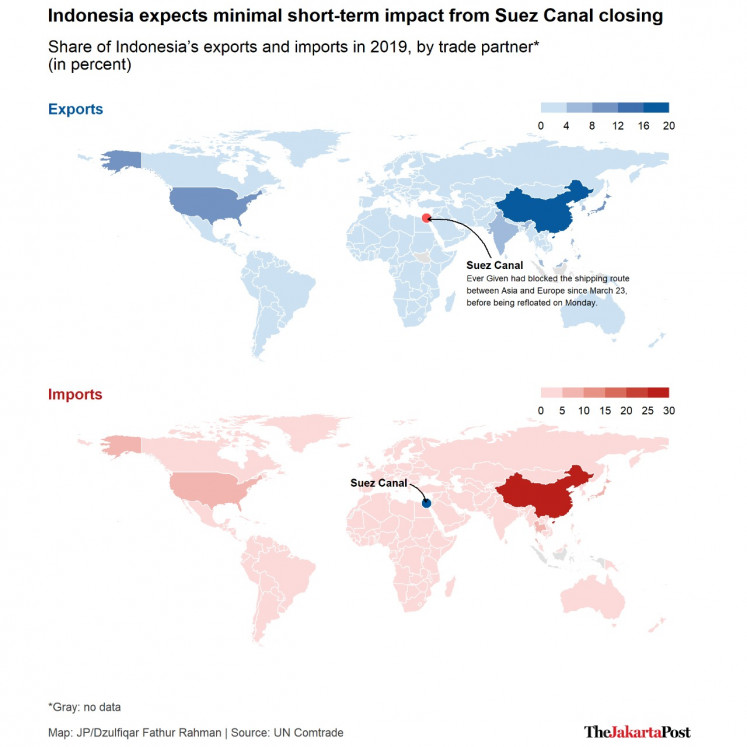

he shipping backlog at the Suez Canal is expected to cause only modest disruption to Indonesia’s trade in the coming weeks as the route serves relatively minor trading partners Africa and Europe, but the episode may lead to rising transportation costs and uncertainties in shipping schedules, observers have noted.

Egypt’s 193-kilometer long Suez Canal has opened again after the nearly 400-meter long container ship Ever Given, one of the world’s longest, was refloated on Monday. The ship became stuck in the vital global shipping route on March 23, bringing billions of dollars worth of trade to a standstill.

Read also: Ever Given container ship blocking Suez Canal has started to move

Canal authorities are now working to clear a queue of ships near the canal, a process that may take four to five days, while clearing the knock-on backlog at other ports might take months, according to a United Nations Conference on Trade and Development (UNCTAD) official reported by Reuters.

Shinta Kamdani, deputy chair of the Indonesian Chamber of Commerce and Industry (Kadin), said the obstruction of the canal was expected to disrupt the country’s trade with European and African countries.

The interruption was also expected to lead to increases in logistics prices as businesses were facing shortages of shipping containers. The backlog of shipping and the alternative route that some operators chose, around South Africa’s Cape of Good Hope, were expected to raise fuel costs.

“Other markets are fine as we do not take the Suez route or we can take alternative routes, such as the Pacific for trade with the United States,” Shinta told The Jakarta Post on Monday.

Indonesia’s exports to the European Union (EU) accounted for 7.84 percent of its total exports in February, according to data from Statistics Indonesia (BPS). The country’s top exports to the EU include palm oil, footwear and machinery parts.

The EU accounted for 6.67 percent of Indonesia’s imports in February. Major imports include machinery, electronics, chemicals, pharmaceuticals, steel and aircraft.

Indonesia’s largest trade partners remain China and other Southeast Asian countries. In February, the former received about one fifth of Indonesia’s exports and was the source of one third the country’s imports. Southeast Asia accounted also for about one fifth of Indonesia’s exports and one fifth of imports.

Shinta said the logistical disruption in the Suez Canal might hit manufacturers the hardest as it could delay imports of machines, electronic components and steel from Europe.

“This is the impact from the supply side that will occur if the situation in the Suez lasts for a short time or less than two weeks,” Shinta said.

Read also: Indonesia sees first annual import growth in 20 months as manufacturing picks up

Even before the Suez Canal obstruction, Indonesian manufacturers had reported longer delivery times for thirteen consecutive months because of pandemic-induced logistical disruptions around the world, leading to higher costs for raw materials, business information provider IHS Markit reported on March 1, quoting its monthly survey of some 400 companies.

Indonesia’s manufacturing Purchasing Managers’ Index (PMI) fell to 50.9 in February from 52.2 in January, according to the survey. While the index stayed above the 50-point threshold separating sectoral expansion from contraction, the February figure marked the first slowdown since November.

Steven Cochrane, chief economist for Asia-Pacific at financial intelligence firm Moody’s Analytics, said it could take up to four days to clear the backlog in the canal and up to a month to clear congestion at ports across Europe and Asia.

“The biggest impact for Indonesia is that shipping schedules may be uncertain for the next several weeks. There could be some delay in incoming or outgoing shipments. Shipping rates could be elevated, although not for an extended period,” Cochrane told the Post on Tuesday.

Cochrane added that the country’s low exposure to trade with directly affected regions, especially Europe, would likely render the impact of the Suez Canal’s disruption modest.

Although delays were expected, no Indonesian ships were stuck in the canal’s backlog, said Carmelita Hartoto, chair of the Indonesian National Shipowners’ Association (INSA), on Monday.

Kasan Muhri, director general for national export development at the Trade Ministry, said the Suez Canal’s closure was not expected to have an impact on Indonesia’s exports or imports this month.

“The impact will be more pronounced for exporters with a just-in-time strategy, in which case the arrival of raw materials must be on schedule,” Kasan told the Post on Tuesday.