After the G20 Summit, what’s next for Indonesia?

A few weeks ago, Indonesia and Egypt were again in the global spotlight. They hosted global meetings that could hopefully reverberate for years to come and transform climate commitments into real action.

Change text size

Gift Premium Articles

to Anyone

Indonesia and Egypt are two nations that have historically been in the spotlight amid pressing global challenges. In the 1950s and 1960s, the two were the key members of the global movement that later became known as the Non-Aligned Movement.

A few weeks ago, the two countries were again in the global spotlight. They hosted global meetings that could hopefully reverberate for years to come and transform climate commitments into real action.

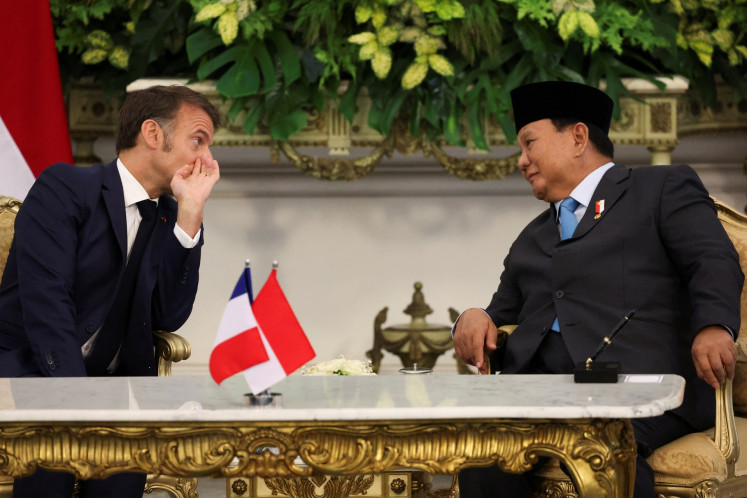

Indonesia recently hosted the Group of 20 Summit in Bali with global climate action as one of the key commitments in the G20 Leaders’ Statement. Meanwhile, in parallel, Egypt hosted the United Nations climate summit (COP27) in Sharm el-Sheikh.

These two summits appear to echo concerns over future global risks presented by the 2022 Global Risk Report by the World Economic Forum. That is, the very top risk threating our civilization in the next decade, according to the report, is that we are not taking enough action to address climate issues.

Progress from COP27, G20 Summit

While some may be disappointed by the outcomes of COP27, we can celebrate certain positive results. The first is the loss and damage fund. One good outcome of COP27 is that the attending countries finally agreed on a dedicated fund to address damages from climate change, and this should be settled before COP28.

Another important piece of progress from COP27 is regarding blended finance. At COP27, there were calls for more active measures by multilateral development institutions such as the World Bank and Asia Development Bank. Out of climate investment funds, Indonesia was offered a new financing deal worth US$1 billion in concessional loans and grants to fund the transition away from coal to clean energy.

In parallel, at the G20 Summit, we also heard about a sustainable agenda spanning sectoral issues – agriculture, energy, industry – to development and growth strategies. At the summit, United States President Joe Biden and President Joko “Jokowi” Widodo announced a massive climate financing deal, worth $20 billion, under the Just Energy Transition Partnership (JETP).

An interesting feature of the deal is that the JETP is perhaps the largest ever instance of blended finance aimed at supporting transition. The commitment of $20 billion was split between government dollars and private finance. The private sector financing – likely taking the form of debt and equity – will come from contributions of the Glasgow Financial Alliance for Net Zero group of banks and asset managers.

Meanwhile, the details of the deal will be discussed further. Some have said that financing deals would be acceptable as long as the rates were competitive.

Opportunities in net-zero transition

As Indonesia has become more ambitious in its commitments, will they bind us in difficult situations in the transition?

Indonesia recently submitted its enhanced nationally determined contribution (NDC) to the UN with an emissions reduction target that had increased from 29 percent in the first NDC and updated NDC to 31.89 percent unconditionally, as well as from 41 percent conditionally in the updated NDC to 43.20 percent conditionally. Indonesia is now more ambitious, and it will not be easy to walk the talk.

However, we may not be aware that Indonesia has actually undergone significant transformations in transition pathways. And this is the right way to be more ambitious.

There have been initiatives and pipeline projects among the private sector in renewable energy projects. Indonesia has indeed hid untapped opportunities in the green economy.

First, Indonesia’s nature-based solutions to emissions offer huge opportunities. Indonesia’s land and oceans are forms of natural “carbon sinks” that absorb more than half of all greenhouse gas emissions. Indonesia’s tropical forest accounts for 10 percent of global tropical forest. Indonesia’s mangrove forest cover is among the largest in the world, consisting of 23 percent of global mangrove forests. These nature-based solutions will position Indonesia at a strong advantage in the green economy.

With regard to industry, Indonesia could tap opportunities to become a global battery manufacturing hub. Rising sales of global electric vehicles will drive substantial growth in demand for lithium ion batteries over the next three decades. With about a quarter of all nickel reserves globally, Indonesia could become a critical part of the global electric vehicle battery supply chain.

A recent report by the Bloomberg New Energy Forum (BNEF) suggested that Indonesia’s transition would open investment opportunities worth of $2 trillion to $3.5 trillion over the next three decades. The biggest driver of this investment would come from the power sector. This benefit does not account yet for potential green jobs created during the transition.

Challenges ahead

Now, the critical part is the support of the financial industry. So far, Indonesia’s financial sector has been moving forward. Since 2012, there have been various milestones and advancements from the sustainable finance road map to the green taxonomy announced by the Financial Services Authority (OJK). There are supporting regulations as well as OJK Regulation No. 51/2017 on sustainable finance and carbon pricing regulations.

Players from the financial industry and other parts of the private sector certainly welcome these regulations. However, there are also need to be more advancements for the regulations to be workable. This is when challenges surface.

Research conducted by Mandiri Institute shows that various government strategies and road maps toward a low-carbon economy may risk causing confusion. For example, various decarbonization pathways released by the government often result in different emission targets. This may create confusion in the private sector and thus prevent it from taking consistent steps toward decarbonization.

On sustainable investing, environment, social, governance (ESG) investment products – as a proxy for the resources allocated toward sustainability projects – suffer from a lack of product differentiation. This could be attributed to poor understanding of sustainable investing. We find that around 61 percent of fund managers surveyed view understanding ESG as a challenge. Another possible explanation is that a lack of ESG data appears to be almost universal across all fund managers.

What to do next

To address challenges related to various road maps, we need to align these targets. This will provide clear guidance to market participants and help focus efforts on the most important steps to enable Indonesia’s net-zero future.

On the financing side, it is also expected that there are clear guidelines and specific incentives that align with global best practices on frameworks, reporting and other standards of sustainable finance practice. This would encourage “affordable” green financing or sustainability-linked initiatives from financial institutions.

Developing awareness programs to improve our understanding of sustainable investing is also important. The sustainable finance road maps were intended to increase awareness. However, we need initiatives beyond these programs.

To attract green investment, we may need to undertake regulatory and market reforms. This could meet the needs of investors’ interest in renewable energy and green projects. Lastly, we need to ensure that the decarbonization pathway takes the just transition aspects into account. Speeding up the adoption of a carbon emission trading system to optimize revenue and finance the transition could be an option.

Indonesia is now at a crossroads in transforming its economy into a greener and more sustainable form. With huge opportunities, we need to act swiftly to tap into these potentials.

*****

The writer is head of the Mandiri Institute