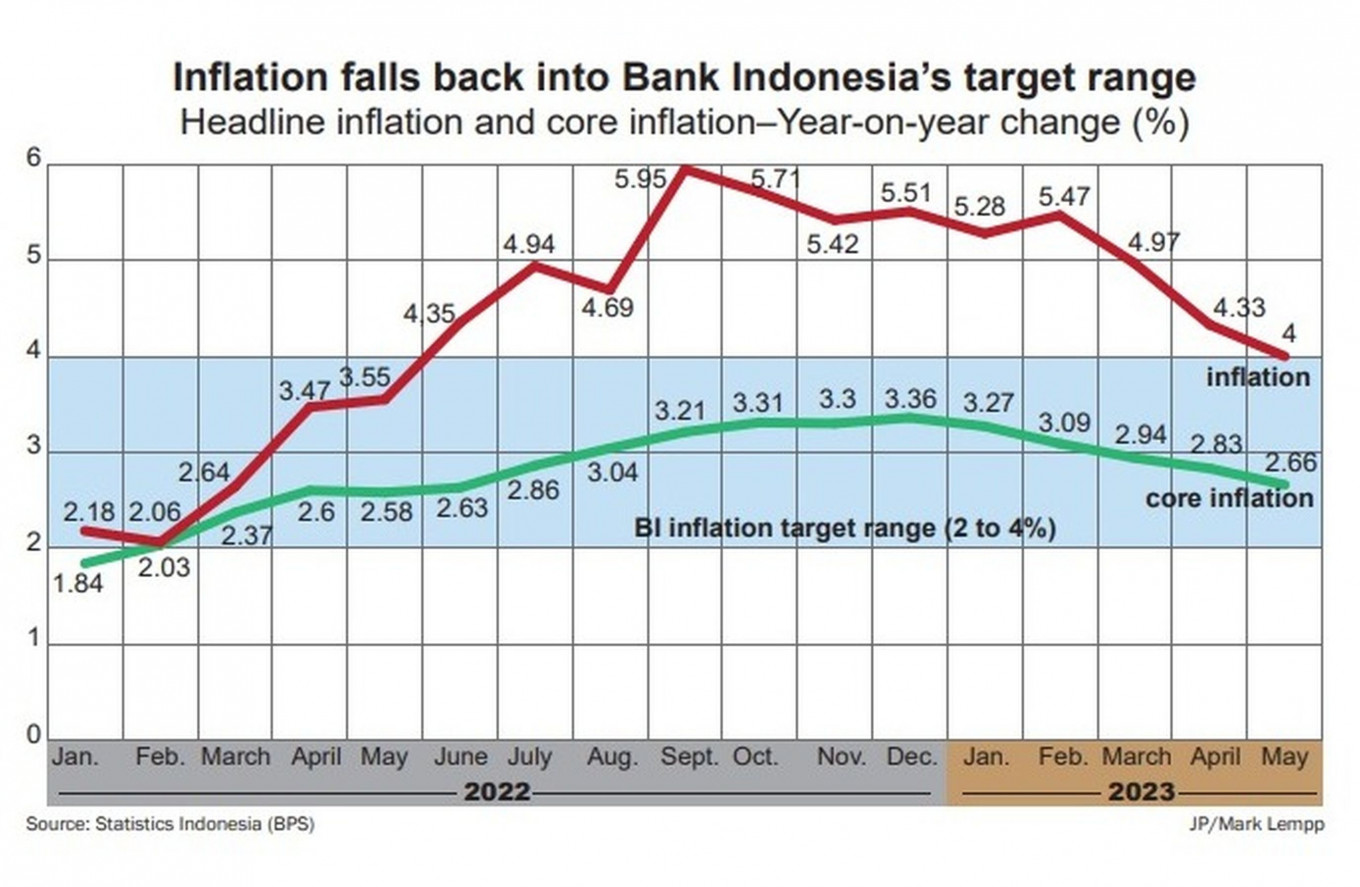

Inflation brought under control faster than expected

Headline inflation has dropped back into Bank Indonesia’s target range, yet analysts do not expect the central bank to lower interest rates anytime soon.

Change text size

Gift Premium Articles

to Anyone

I

nflation has dropped to the lowest level in 12 months and is now back within Bank Indonesia’s (BI) target range, yet a swift reduction of interest rates is not expected.

Analysts believe currency volatility and a lack of clarity about the monetary policy of the United States Federal Reserve (Fed) will deter BI from loosening the reins for the time being.

As Statistics Indonesia (BPS) announced on Monday, headline inflation, or consumer price index (CPI) growth, dropped to 4 percent year-on-year (yoy) last month from 4.33 percent in April.

That means CPI growth now sits exactly at the upper limit of BI's target range of 2 to 4 percent. The central bank itself had only expected to reach that milestone in the third quarter of this year.

Monthly inflation also dropped as the rate fell to 0.09 percent in May from 0.33 percent logged in April.

The headline inflation figure is in line with a forecast from Moody's Analytics but lower than predictions of Bank Permata and KB Valbury Sekuritas, respectively, for CPI growth of 4.24 and 4.25 percent.

The food, beverages and tobacco segment was the biggest contributor to monthly inflation in May, according to the BPS data, while consumer prices in the apparel and footwear category as well as in transportation actually dropped last month.

"After Lebaran, there was deflation of 5.26 percent in airfares. That marks an improvement over last year, when inflation in that category still continued after Lebaran," Pudji Ismartini, who is in charge of statistical services and distribution at BPS, said in a press conference on Monday.

Disinflation

Bank Danamon economist Irman Faiz said the "disinflation" was broad-based across segments.

Core inflation, which has become the de-facto basis for BI's interest rate policy, eased to 2.66 percent yoy in May from 2.83 percent in April. The indexes for volatile food prices and administered prices also slowed to 3.28 percent yoy and 9.52 percent yoy, which compares to 3.74 percent yoy and 10.32 percent yoy in the preceding month.

"The easing of core inflation was driven by prices of apparel as well as deflation in information and communication. [Meanwhile,] volatile food inflation moderated further, as a successful harvest season continued amid favorable weather," Irman told The Jakarta Post on Monday.

However, Bank Permata's chief economist Josua Pardede said to the Post that the significant slowdown in core inflation needed attention, as it pointed to a “potential of slower consumption growth”.

BPS' Pudji said the drop in core inflation did not necessarily indicate weak purchasing power and could be attributed to a post-Ramadan decline in demand, especially for manufactured products.

"High demand was moved to the volatile food component, especially the food and beverage category. There is a tendency of increased social activity, such as festivities and picnics," Pudji said.

Banjaran Surya Indrastomo, chief economist at Bank Syariah Indonesia, projected that the downtrend in inflation would continue in the short term. However, there was a risk of food prices rising should the El Niño weather phenomenon disrupt agricultural output in June, he said, citing a report from the Meteorology, Climatology and Geophysics Agency (BMKG).

"Aside from that, the upcoming holiday season of Idul Adha and the end of the school year would also arrive in June and could increase air travel and intercity transportation fares," Banjaran said.

Bank Permata expects headline inflation between 3 and 3.5 percent for the full year, which would be in line with a projection of BI Governor Perri Warjiyo for 2023 inflation of around 3.3 percent.

However, Bank Danamon maintains its expectation for a year-end inflation rate of 3.8 percent.

BI seen to keep interest rates unchanged

Fikri C. Permana, an economist with KB Valbury Sekuritas, said the lower inflation rate, along with a decline in Indonesia's manufacturing purchasing managers index (PMI) to 50.3 in May, could be factors contributing to a reduction of BI's interest rate in the upcoming quarter.

However, Bank Danamon's Irman pointed to risks around global food prices and oil prices, with the latter rising Monday in response to production cuts. Thus, he expected the central bank to keep its policy rate at 5.75 percent until the end of the year.

Rully Wisnubroto, senior economist at Mirae Asset Sekuritas, said the slower CPI growth in May reflected the country’s success in controlling inflation and opened up room for monetary easing.

"However, currency volatility and the unclear direction of the [federal funds rate in the US] are factors that hinder monetary easing," Rully told the Post.

Bank of America Securities stated in a report on Monday that BI rate cuts were more likely to begin next year, once the Fed’s monetary policy and the potential impact of El Niño were clearer.

“Before cutting rates, BI may make other policy tweaks, such as lowering bank reserve requirements to revive credit growth,” the report said.

On May 25, BI kept the benchmark seven-day reverse repo rate at 5.75 percent and said that decision was consistent with its monetary policy stance to push headline inflation back into its target range between 2 and 4 percent.