Role of taxation to achieve growth target

To achieve the targeted economic growth, the government needs to make concerted efforts to encourage consumption, government spending, investment and international trade. Among the fiscal policy tools that can be used by the government are tax instruments.

Change text size

Gift Premium Articles

to Anyone

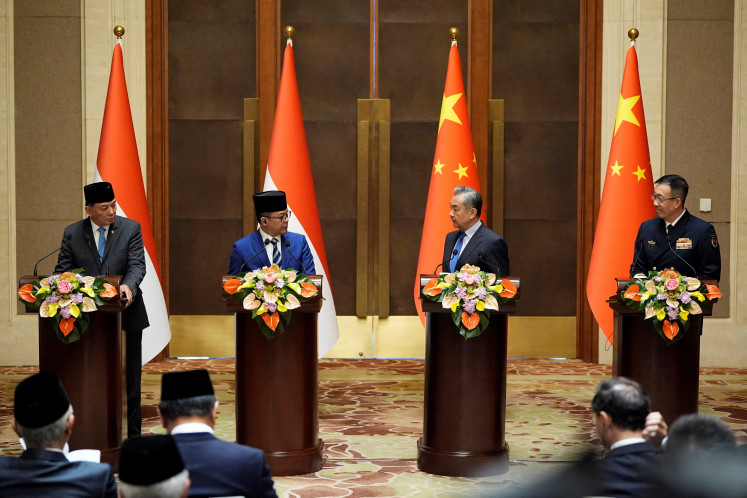

Infrastructure race: President Joko “Jokowi” Widodo (third from right) inspects a section of a toll road construction project in Bogor, West Java. (JP/Ayomi Amindoni)

Infrastructure race: President Joko “Jokowi” Widodo (third from right) inspects a section of a toll road construction project in Bogor, West Java. (JP/Ayomi Amindoni)

I

n the 2017 state budget, Indonesia is aiming for gross domestic product (GDP) growth of 5.1 percent. To support this target, the state budget would set a tax ratio of 11.5 percent against the GDP. It means that taxation plays an important role in promoting economic growth. In other words, to achieve the targeted economic growth, the government needs to make concerted efforts to encourage consumption, government spending, investment and international trade. Among the fiscal policy tools that can be used by the government are tax instruments.

To increase consumption and purchasing power, the role of government is to increase the amount of non-taxable income (personal exemptions) so that the amount of disposable income will increase and be used for greater consumption. As we know, economic growth in developing countries, including Indonesia, is generated mainly by high consumption. The amount of non-taxable income since the 2016 fiscal year was increased by 50 percent from that of 2015. This provision is stipulated in the Finance Minister Regulation No. 101/PMK.010/2016.

In this regulation, the amount of non-taxable income per taxpayer, namely for an individual taxpayer, amounted to Rp 54 million (US$4,000); a married taxpayer received an additional personal exemption of Rp 4.5 million; and for each dependent family member related by blood and by marriage in a direct lineage and for each adopted child, to a maximum number of three, taxpayers got an additional exemption of Rp 4.5 million. Expected adjustments for taxable income in 2017 should be in line with the inflation rate and the standard of living.

To increase government expenditures, tax revenues should be increased as well. The government has set the target for tax receipts in 2017 at Rp 1.49 quadrillion, including revenues from the tax amnesty.

There are several policy proposals that can be used by the government to increase tax revenues, for example by increasing the income tax rate on income received or accrued by the upper middle class. This policy can be done for example by raising the final income tax rates on income from the sales of shares traded in the stock exchange. The proposed tax rate is from 0.2 percent to 0.5 percent. Previously 0.1 percent was charged on the gross amount. It is necessary to remember that the previous rate of 0.1 percent was stipulated in Government Regulation No. 41/1994 as amended by Regulation No. 14/1997 and until today it has not yet been revised.

Furthermore, the government needs to raise the final income tax rate on dividends received or accrued by domestic individual taxpayers from 10 percent to 15 percent of the gross amount. It is necessary to ensure that the rate is consistent with the treatment of income tax on interest and royalties that are subject to a withholding tax of 15 percent of the gross amount.

To increase investment, the government needs to launch more business-friendly policies to attract investors, for example by lowering the corporate income tax rate from 25 percent to about 20 percent or even 17 percent.

The proposed corporate tax rate is equal to the 17 percent rate applied by Singapore and the 20 percent rate applied by Thailand. Corporate tax rate reductions are aimed at improving investment competitiveness, especially with ASEAN countries and also at preventing capital outflows and encouraging the repatriation of money under the tax amnesty.

In addition, to attract foreign direct investment to Indonesia, the government needs to provide tax facilities for sectors that have a great positive impact on economic growth and are export oriented, employ labor and encourage technology transfer both horizontally and vertically.

Foreign direct and domestic investment will generate more jobs and increase tax revenues from the wages of workers. To increase international trade, especially net exports, the government should reduce imports and increase exports. To reduce imports, the government needs to charge a high tax on imported goods, particularly consumer goods.

Finance Minister Regulation No. 107/ PMK.010/2015 has raised income tax on imported consumer goods by stipulating that taxpayers who import certain consumer goods shall be subject to a withholding tax of 7.5 percent to 10 percent of the value of the imports, which were previously subject to a lower rate of 2.5 percent of the import value.

In addition, the government can also provide tax facilities for export-oriented foreign direct investment, especially for sectors that produce high value-added export commodities. Thus, to achieve economic growth of 5.1 percent in 2017, the government needs to optimize tax collection from consumption, government spending, investment and international trade.

***

The writer is a tax practitioner and teacher at the Institut Bisnis Nusantara, Jakarta. He is an alumnus of MEP-FEB UGM, Yogyakarta and GRIPS, Japan.

---------------

We are looking for information, opinions, and in-depth analysis from experts or scholars in a variety of fields. We choose articles based on facts or opinions about general news, as well as quality analysis and commentary about Indonesia or international events. Send your piece to community@jakpost.com. For more information click here.