Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsCommunity development loans feed entrepreneurial spirit

Even after it was explained to him that the group was in his shop to collect data to submit his enterprise as a candidate for revolving funding assistance, Tukiman was still angry.

Change text size

Gift Premium Articles

to Anyone

H

e still remembers how angry he was when he found reporters and several people wearing PT Riau Andalan Pulp and Paper (RAPP) uniforms taking pictures of his motorbike repair shop. He was upset because no one had asked for his permission first.

Even after it was explained to him that the group was in his shop to collect data to submit his enterprise as a candidate for revolving funding assistance, Tukiman was still angry.

“I told them, ‘It’s not that I’m being arrogant. It’s just about ethics. Unless there was a notice beforehand or you have given me financial help, even if it’s just Rp 100, I don’t like being treated this way’. They all went straight back home after I scolded them,” he said, laughing.

Tukiman was sharing his story about the first time he met with employees from RAPP’s community development unit.

A few days after the incident at the shop in front of Tukiman’s home in Gabung Makmur village, Kerinci Kanan district, Siak regency, the data collection team’s manager came to him to apologize.

Tukiman explained that he had been duped once, many years ago, by a man claiming to be able to help him obtain government assistance in Lampung. “He was using me to get the money for himself. He had come to me, asked me questions, took my photograph and said that he’d train me. As it turned out, he was just using me. After he got the money, he wouldn’t even look at me,” he said.

Thanks to his hard work and with help from his wife, who sadly died five years ago, Tukiman was able to purchase a 20 by 50-square-meter plot of land for his own home and auto shop. “I had many clients, not only from this village but from other villages as well,” Tukiman said.

Nevertheless, Tukiman had difficulties growing his business as he did not have the capital to do it. After receiving an annual soft loan of Rp 5 million from RAPP for three consecutive years, his business bloomed. “Now I can repair around four or five motorbikes in one day yielding revenue of around Rp 1 million” he said.

He said he immediately used the assistance he received to purchase motorbike spare parts so that he did not need to dig into his personal funds. “I put the money straight into the business. The RAPP representative comes with me to the shop and he pays for the spare parts I buy. I even give the receipt to him as proof that I used the money to boost my business,” he said.

“I used to be frustrated about not being able to find the money to fix up my clients’ motorbikes. If I don’t have the money, I needed to ask around. Now, I am never short of spare part supplies in my shop,” he added.

Despite the 10-month deadline to pay back any loans, he said RAPP never forced him to pay everything back on time. “If I don’t have Rp 500,000 in one month, I can delay paying back the month’s arrears to the next month. What’s important is that I keep note of this to keep the bookkeeping in order,” Tukiman explained.

Even at 61 years old, Tukiman still dreams of expanding. “I never worry about competing with other repair shops. The key is to ensure clients’ satisfaction. Even though I cannot move as quickly as other people, I understand everything about motorbike repairs. You can tear a motorbike completely apart and bring all the parts here. I’ll put it back together,” he said.

Cooperation program

“I was afraid that this program was just a repeat of that incident. After hearing my story, the manager understood my situation and asked me not to reject the offer. As he visited me with good intentions, I could not possibly reject him. And so finally, I became a recipient of RAPP’s soft loan without interest,” he explained.

Before arriving in Riau to live with his nephew, who had taken part in the government’s transmigration program in 1989, the father of three from Banyuwangi in East Java had lived in Metro, Lampung, for a while.

Having a mobility disability has not quenched Tukiman’s entrepreneurial spirit and he worked at odd jobs before participating in auto shop training for people with disabilities held by the local government. “After hearing that my nephew had become a successful oil palm farmer in Siak regency, I decided to follow him,” he said.

He then brought his wife and children to Gabung Makmur village. The family lived in house left behind by a transmigration participant who had left for another town. “I opened a motorbike repair shop. Back then, only a handful of people had motorbikes. I had no competition and my business flourished,” he said.

In the last few months, Tukiman has had a new side job as a collector of loose oil palm fruits. “I don’t have to go anywhere. People will come here with their loose oil palm fruits. Sometimes I can collect 12 tons in a day. I sell all of it to another collector and I take a profit of Rp 100 per kilogram. It’s completely without risk. Sometimes I just need to watch the weigher. I don’t have to go anywhere, just stay right here in my home and the money comes to me,” he said.

Recently, Tukiman had also sold vegetables, fish, cooking condiments and other goods on a pickup truck at the RAPP employee housing complex in Pangkalan Kerinci, Pelalawan regency. He finished before 9 a.m. every morning. “However, I need to leave the business for a while. I needed to go to the market in Pangkalan Kerinci at 2 a.m. My job at the repair shop was disrupted as I needed to rest at daytime,” he said.

“Perhaps when my son gets married, but does not have a steady job, he will be the one who sells the vegetables at the RAPP housing complex. I will still help manage it as not everyone is allowed to go into the housing complex. I have permission to go in there because the RAPP community development division employees fought for me to be let in and I am registered as a development partner,” he said.

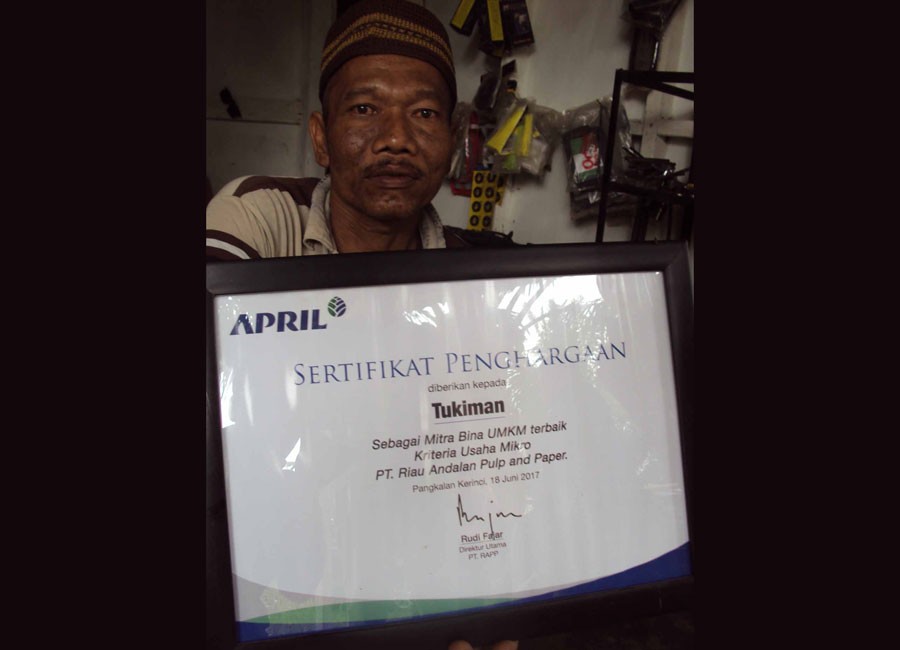

PT RAPP SME offline coordinator Raden Ade Pramono said Tukiman was the best of the company’s 73 local business partners in the five regencies where RAPP operated. Apart from repair shop owners like Tukiman, the company’s local business partners include tailors, coffee shop owners, caterers, farmers, salon owners and fish abon (shredded and fried meat) makers. “Tukiman has obtained RAPP certification as he has the highest points. The certificate was given to him by Trade Minister Enggartiasto Lukita during Ramadhan” he said.

“Included in the assessment criteria were revenue growth, discipline, honesty and commitment to pay back loans. Tukiman’s side job was also a point of consideration. From there, we can see the economic development based on his main job and the development of the loan,” he added.

According to Raden, the success of RAPP’s local partners in improving their economies was a key element of their cooperation with RAPP. “We don’t just give them money. We also monitor their development monthly. If there’s any problem, we will discuss it with them and find the solutions together,” he said.

Raden said the end target of RAPP’s community development program was to support people with small businesses. “RAPP is here not to create businesses but to boost and develop existing ones. This is why the main requirement for recipients of the revolving fund is that they have businesses of their own,” he said.

“RAPP’s cooperation with local partners will go on until they no longer need help. The cooperation program is designed in a way that, in the end, the partners will no longer be dependent on RAPP but will switch to bank loans. This is why we keep on training them and checking on their bookkeeping as, later on, it will be required by the banks as prerequisites in handing out loans,” he added.