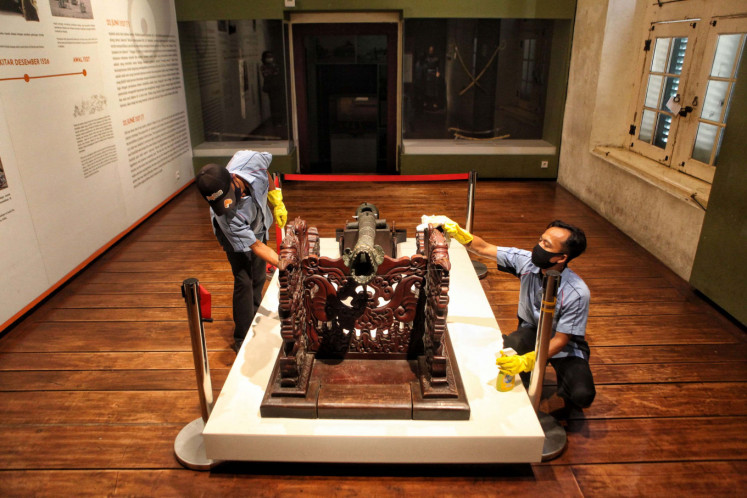

BWS records positive performance growth for the year 2022

On March 30, Bank Woori Saudara (BWS) held its Annual General Meeting of Shareholders (AGMS). This meeting was a particularly important event because although in 2022 the COVID-19 pandemic had started to subside.

Change text size

Gift Premium Articles

to Anyone

O

n March 30, Bank Woori Saudara (BWS) held its Annual General Meeting of Shareholders (AGMS). This meeting was a particularly important event because although in 2022 the COVID-19 pandemic had started to subside, the world economy suffered through slowed growth due to a variety of geopolitical conflicts. Amid the global challenges, BWS managed to achieve positive performance growth, recording an exceptionally positive operational and financial performance in 2022.

In 2022, BWS achieved a Rp 860.57 billion (US$57.45 million) net profit, and that figure was a 32.6 percent increase of 2021’s Rp 629.16 billion. Moreover its total third party funds (DPK) were recorded at around Rp 28.79 trillion, a 20.73 percent increase from the previous year’s Rp 23.85 trillion.

Aside from that, its net credit also achieved Rp 39.45 trillion, an increase of 18.02 percent from Rp 33.43 trillion the previous year. Aligning with its credit growth in 2022, the amount of assets owned by BWS also grew by around 17.57 percent, amounting to Rp 51.50 trillion from Rp 43.80 trillion in 2021.

Furthermore, during its 2023 AGMS, the company appointed Abdurachman Hadi as a new candidate for the BWS’ board of directors. With a renewed focus in 2023, BWS will accelerate the development of its mobile banking in parallel with its ongoing digitalization programs. Currently, BWS is planning to make digitalization one of its competitive advantages, indicated by the launch of its WON by BWS app, which is an upgrade from the old BWS mobile banking app. BWS will also continue to develop multiple digital products and services so that it can best cater to its customers’ transactional needs.

As for the structure and composition of BW’ shareholders, as of the Feb. 28, a majority of it was held by Woori Bank Korea, amounting to 84.2 percent, while the rest of its shares were held by individuals, companies (in the form of investment) and the public. Furthermore, in February, there was a change in share ownership of around 5 percent, amounting to around 581.1 million shares on behalf of Arifin Panigoro to PT. Apramesis Meta Investama.