SOE anomalies: stock price hikes not always in line with financial performance

Change Size

A trading floor at the trading floor of Indonesia Stock Exchange (IDX). (thejakartapost.com/Wienda Parwitasari)

A trading floor at the trading floor of Indonesia Stock Exchange (IDX). (thejakartapost.com/Wienda Parwitasari)

PPRO, INAF and NIKL stocks have jumped by at least four times their value early in the year

The stocks of the three state-owned enterprises (SOE) have been skyrocketing since the beginning of this year, a phenomenon that seems to have no relation to their first-half performances.

The trio PP Properti (PPRO), Pelat Timah Nusantara (NIKL) and Indofarma (INAF) jumped four times from December 2015 to August this year with the initial stock prices starting at less than Rp 200, or 1.5 US cents.

PPRO rose 338.20 percent while NIKL climbed 16 fold from the bottom price from Rp 50. Over the same period, the value of pharmaceutical company INAF’s stocks increased nine fold.

The massive stock price hikes do not seem to be in line with the three companies' financial performances. The stock prices are relatively high compared with their profits.

PP Properti in the first six months this year booked a 35 percent increase in revenue, compared with the same period last year. Relying on selling apartments, the company also claimed to have achieved 80 percent of its yearly target within six months.

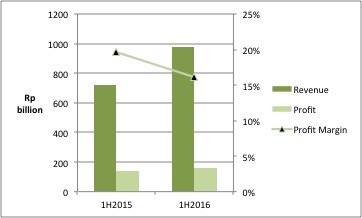

The property-based company that was officially listed on the Indonesia Stock Exchange in May 2015 posted declining margins. In the first half of 2015, the company’s net profit margin shrank to 16 percent compared to 20 percent earlier, while its net profit grew by 11 percent, slower than its revenue growth during the period.

Chart: Financial Performance of PPRO 1H-2016 vs. 1H-2015

Unlike PP Properti, Pelat Timah Nusantara, better known as Latinusa, posted a 10 percent decrease in sales. The tinplate producer affiliated with state company Krakatau Steel recorded sales of Rp 858 million in the first half of 2016, down 7.2 percent from Rp 925 billion in the same period last year.

Although revenues fell, the company’s profits rose significantly. Latinusa recorded a gain of Rp 9.5 billion this year after a net loss of Rp 25 billion in 2015. The strengthening of the rupiah in the first half of 2016, which generated a foreign exchange gain of Rp17.5 billion during the period, led to the company’s profit improvement this year.

Indofarma’s revenue increased 2 percent to Rp 471 billion from Rp 462 billion last year although the medicine-based company did not make any profit. INAF recorded a net loss of Rp 27 billion, extended from Rp 23 billion in the same period last year.

Expensive valuation

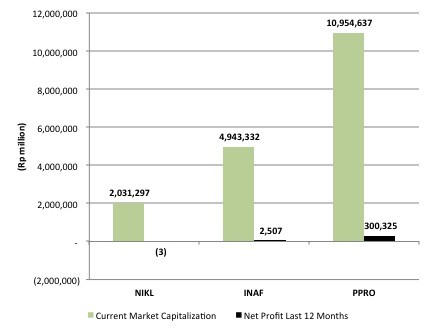

Nonetheless, without balanced improvement in profit, the stock price hikes in the last seven months are becoming more expensive, calculated by the price-to-earnings ratio (PER) method. A higher PER means more expensive stock. Below are the prices represented by market capitalization and earnings over 12 months.

Chart: Current market capitalization compared to last 12-month net profit

Based on the PER valuation, PPRO stock is being traded 31 times higher than its profit and more expensive than other property companies average prices at 27.4 times their earnings. According to the chart above, the gap between the market cap and net profit is too steep.

The chart shows a negative PER for Latinusa because the company suffered significant losses. The stock price increase should therefore be irrelevant to its financial record.

INAF is being traded 1,000 times higher than its annual profit, which means an excessive price. (dan)

Source: Bareksa.com