Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsE-wallet firms incorporate investment features to lure young investors

Indonesian e-wallet firms are aiming to tap into the growing number of young investors during the pandemic, by partnering with investment platforms to access to investment products like mutual funds and gold.

Change text size

Gift Premium Articles

to Anyone

I

ndonesian e-wallet firms are aiming to tap into the rise in the number of young investors during the pandemic, by partnering with investment platforms to offer ease of access to invest in products like mutual funds and gold.

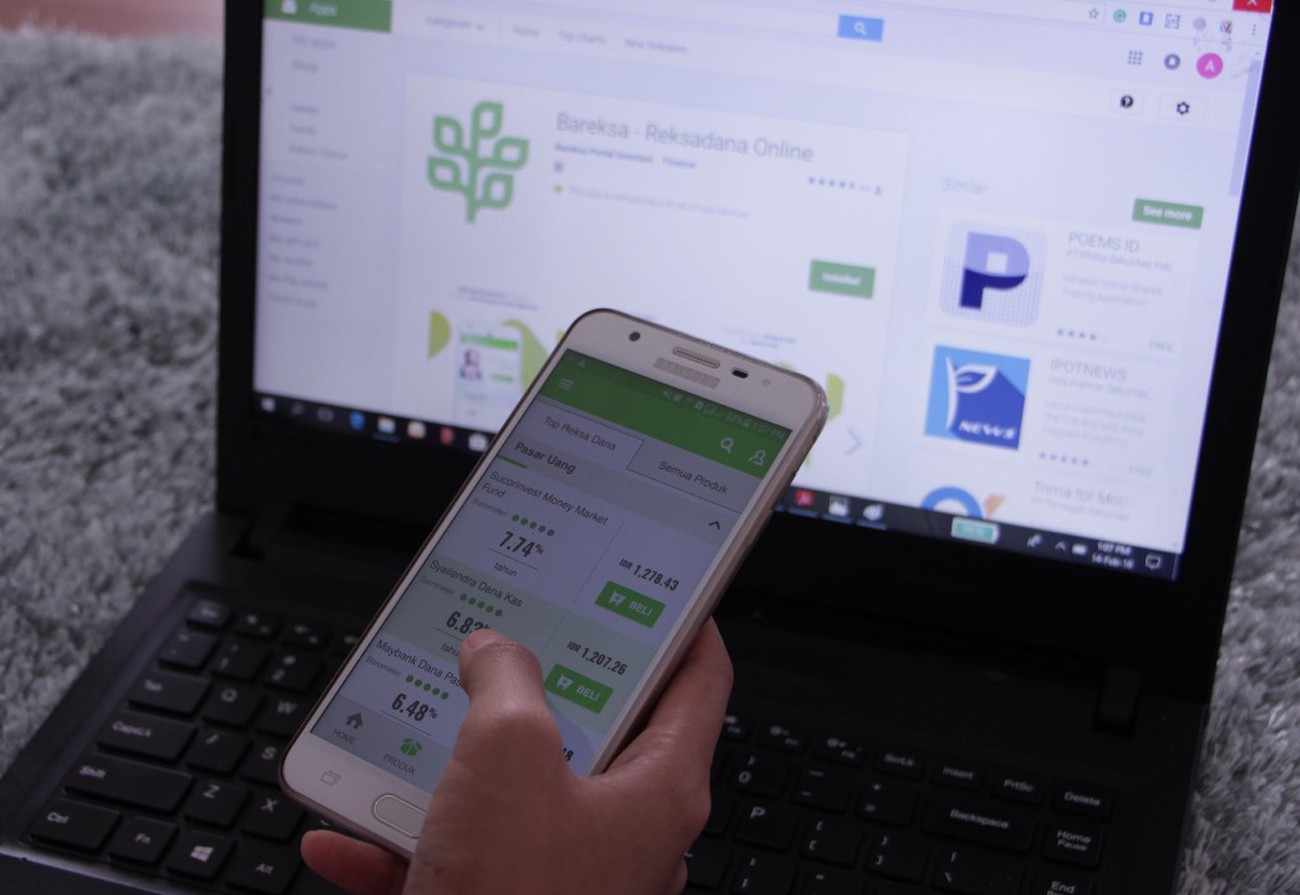

Digital financial services firm OVO (Visionet Internasional) is the latest e-wallet player to partner with a mutual fund e-investment platform. The company announced on Tuesday that is collaborating with investment marketplace Bareksa to provide an “invest” feature within its mobile application.

“There is a lack of a seamless investment platform to bring investing to the next level. This new feature is part of our commitment to creating affordable, reliable and comfortable investment management, especially for novice investors,” OVO president director and Bareksa CEO Karaniya Dharmasaputra said in a virtual press conference.

New investors can spend as little as Rp 10,000 (71 US cents) to buy the platform’s exclusive investment product called Manulife OVO Bareksa money market mutual fund (MOBLI), which is managed by investment management firm PT Manulife Aset Manajemen Indonesia.

The users can also top up and withdraw their investment from OVO’s platform faster than the usual wait time of up to seven days, Karaniya said, adding that such a feature was expected to appeal to younger investors. Prior to OVO, Bareksa also established partnerships with e-commerce platforms like Tokopedia and Bukalapak back in 2018 and 2017, respectively, as it set its eyes on young investors.

The COVID-19 outbreak has enticed young people who are stuck at home with extra money and time on their hands, to start investing.

According to data from the Indonesia Stock Exchange (IDX) and the Indonesian Central Securities Depository (KSEI), 3.87 million single investor identifications (SIDs) had been issued as of Dec. 29 last year, a 55.83 percent year-on-year increase from the total SIDs at the end of 2019. This includes investors in equities, bonds and mutual funds.