Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFrom 'warung' to insurance and e-money: Tech is key to surviving pandemic, beyond

The pandemic's impacts on technology have been transformative, but the transformation can leave some businesses behind.

Change text size

Gift Premium Articles

to Anyone

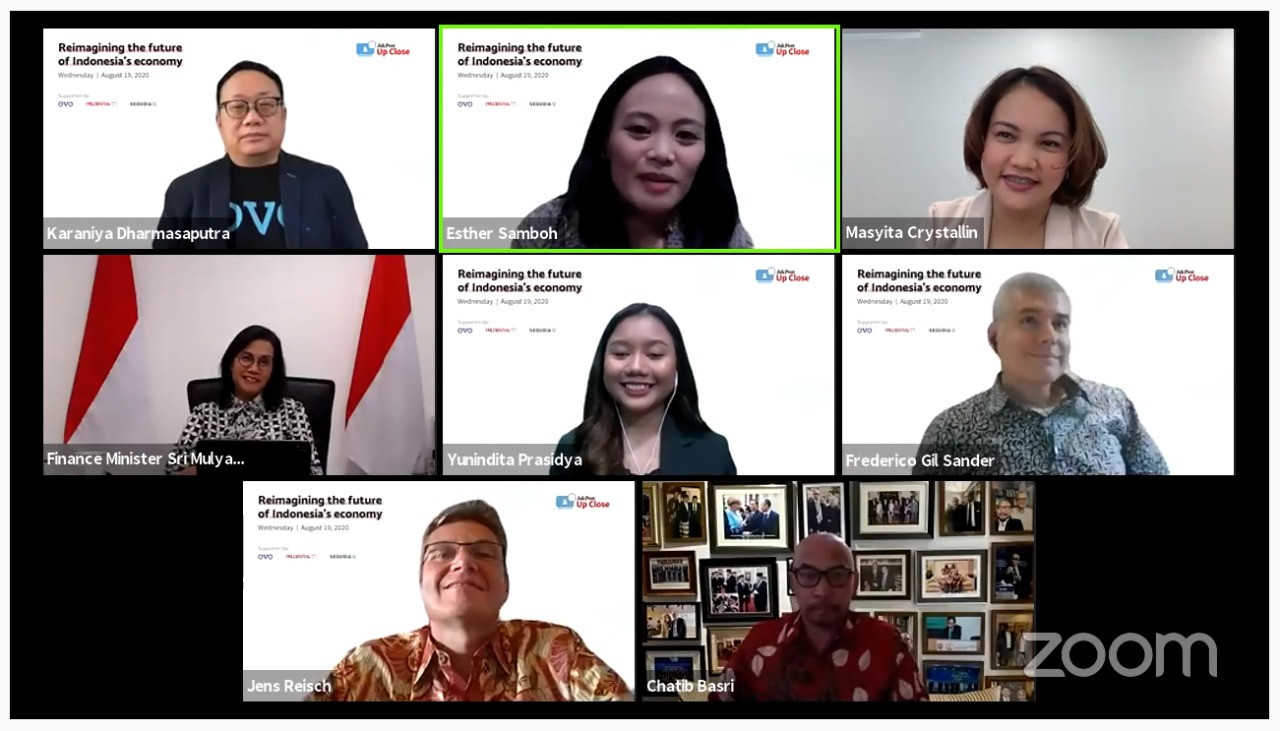

Speakers at the Jakpost Up Close: Reimagining the Future of Indonesia's Economy webinar on Aug. 19 included (clockwise, from upper left) OVO president director Karaniya Dharmasaputra, "The Jakarta Post" deputy managing editor Esther Samboh, Special Advisor to Finance Minister Masyita Crystallin, World Bank lead economist for Indonesia and Timor Leste Frederico Gil Sander, "The Jakarta Post" journalist Yunindita Prasidya, Finance Minister Sri Mulyani Indrawati, Prudential Indonesia president director Jens Reisch and Former Finance Minister Chatib Basri. (JP/-)

Speakers at the Jakpost Up Close: Reimagining the Future of Indonesia's Economy webinar on Aug. 19 included (clockwise, from upper left) OVO president director Karaniya Dharmasaputra, "The Jakarta Post" deputy managing editor Esther Samboh, Special Advisor to Finance Minister Masyita Crystallin, World Bank lead economist for Indonesia and Timor Leste Frederico Gil Sander, "The Jakarta Post" journalist Yunindita Prasidya, Finance Minister Sri Mulyani Indrawati, Prudential Indonesia president director Jens Reisch and Former Finance Minister Chatib Basri. (JP/-)

T

echnology has become a key tool for businesses to survive during the pandemic and going forward, it should benefit all existing sectors in Indonesia’s economy, from warung (kiosk) to the manufacturing industry, industry insiders say.

According to Sequoia Capital India managing director Abheek Anand, the impacts of COVID-19 on technology has been transformative, but the transformation can leave some businesses behind.

“While we are facing a recession, from the technology perspective, there are opportunities like never before,” he said on Wednesday during The Jakarta Post webinar Jakpost Up Close: Reimagining the Future of Indonesia’s Economy.

He went on to say that such opportunities were seen in the “old-school” digital economy sectors such as e-commerce and cashless payments, but there should also be opportunities for the existing economy, such as warung, manufacturing and financial services.

Read also: Pandemic an opportunity for reforms in Indonesia: Sri Mulyani

Anand also noted that digitalizing the existing economies is one of the growth areas for start-ups in the country.

Some start-ups like Ula and Gudang Ada have been digitalizing warung, others are building apps for small businesses and some are pushing for better quality education technology, he said.

“For Sequoia, our bread and butter are consumer products and services. We are seeing more entrepreneurs creating world-class consumer products in Indonesia and then going regional,” he said, giving an example of its portfolio company Kopi Kenangan, which is set to operate in Thailand, the Philippines and Malaysia, post-pandemic.

Regarding funding, Anand said Indonesia could expect more capital going into the country as it already enjoyed the highest flow of funds in Southeast Asia after Singapore.

“Another good thing about Indonesia is that it has a relatively more mature investing ecosystem in the region and there are definitely opportunities going forward,” he said.

Sequoia has also invested in technology heavyweights Gojek and Tokopedia.

Prudential Indonesia president director Jens Reisch said the digital economy had enabled partnerships that could boost the insurance industry, with the insurer currently partnering with OVO, HaloDoc and Tokopedia.

“It’s a new beginning, and I hope if we can work together, trigger demand but also provide online-offline advise, I hope that we can crack this insurance penetration into something more dominant,” said Reisch.

Read also: Indonesia can expect more start-up investment: Sequoia Capital India

Only 19 million people in Indonesia have life insurance policies, out of a population of 260 million. Meanwhile, only 64 million have some form of small insurance coverage, said Reisch.

Prudential currently has 285,000 agents in 160 cities across Indonesia, which can now serve their clients virtually thanks to a new Financial Services Authority (OJK) regulation that now allows insurers to sell their products digitally.

“We’re very thankful that at the moment, we can transform all of our services, all of our sales, into a choice of face-to-face or virtually,” added Reisch. “If you asked me a couple of months ago, I would not imagine it was possible — while working from home — to develop all this innovation in such a short time.”

OVO president director Karaniya Dharmasaputra said digital payments had enabled a lot of business sectors to digitalize, with e-money growing tremendously and surpassing conventional payment solutions such as debit and credit cards.

“I think we can see that the future of Indonesia’s economy would be highly driven by the digital economy and financial technology,” said Karaniya.

E-money usage grew almost 600 percent from 2016 to 2019, 78 percent of which came from non-bank e-money, he added.

“During this pandemic, contactless payments are tremendously needed to grow our economy,” he said. “The government should explore this promising trend further so it can serve the public better during the pandemic.”

Read also: Indonesia looking at near-zero growth as govt struggles to spend budget, Sri Mulyani says

Karaniya, who is also president director of online investment platform Bareksa, said that in the past three years, financial technology (fintech) had been able to democratize and deepen Indonesia’s financial market.

“When COVID-19 hit Indonesia, I thought Bareksa would be in trouble,” he added. “But surprisingly, our assets under management [AUM] is growing amid the pandemic.”

In the last five years, mutual fund investors in Bareksa have grown from 2,456 to 1.1 million. Similarly, the company also saw success in the sales of its retail government bonds. It also reported a 31 percent AUM growth between October 2019 and June 2020, while the industry’s total AUM dropped 13 percent over the same period.

In July, the investment marketplace saw a 608 percent increase in sales of retail government bond series ORI-017 from the ORI-016 bonds issued by the government last year, setting a record-breaking high for the company.