Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBareksa books record-high retail bonds sales amid pandemic

“This is a good opportunity to democratize and broaden our debt market so that the government may have a new source of funding from retail investors,” Bareksa's CEO says.

Change text size

Gift Premium Articles

to Anyone

I

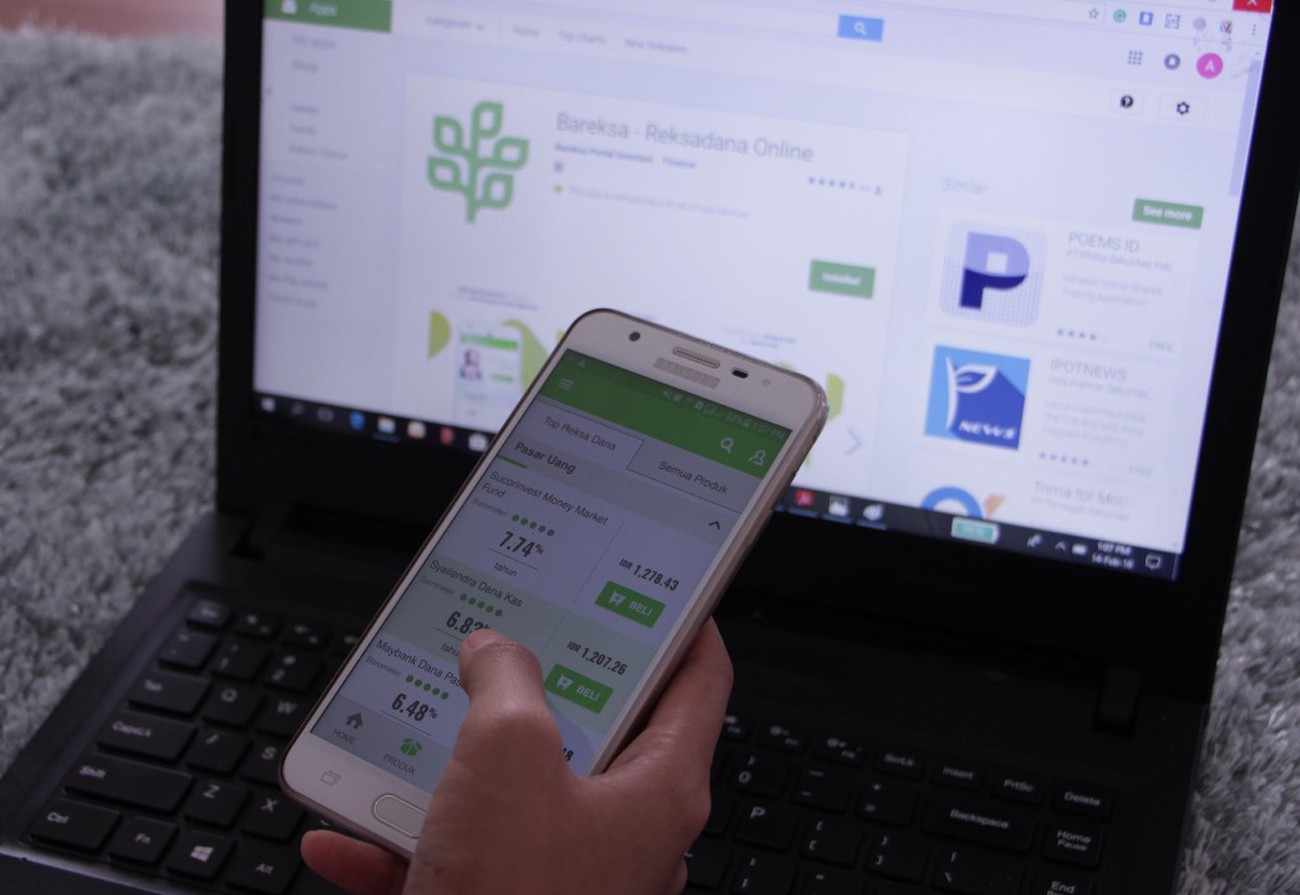

nvestment marketplace Bareksa has booked record-high retail government bonds sales as individual investors flock to safe-haven assets during the coronavirus pandemic.

The company recorded an increase of 608 percent in sales from retail government bonds series ORI-017 compared to ORI-016 issued by the government last year, with buyers soaring by 382 percent compared to last year.

“This is the highest record of sovereign debt papers sales in Bareksa,” said Bareksa CEO Karaniya Dharmasaputra in a statement. “Despite the COVID-19 pandemic, we’ve managed to accelerate retail sales through digital technology and democratizing debt papers.”

According to the government’s initial estimation, it had raised Rp 18.3 trillion (US$1.26 billion) from ORI-017 needed to fund the battle against the coronavirus pandemic, up by 123 percent from sales of ORI-016 last year.

Read also: Retail investors growing as brokerages intensify online access

“This is a good opportunity to democratize and broaden our debt market so that the government may have a new source of funding from retail investors,” Karaniya went on to say.

The ORI-017 series carry a fixed coupon rate of 6.4 percent and has a tenor of three years, set to mature on July 15, 2023. ORI-017, offered from June 15 to July 9, was available online across 25 of the Finance Ministry’s distribution partners, including banks, brokerage houses and fintech.

The minimum order is Rp 1 million, while the maximum Rp 3 billion. The bond will be tradable between domestic investors after a two-month holding period.

“High interest from retail investors to ORI-017 showed that retail bonds were the right investment instrument in times like these, in which people are looking for safe-haven assets,” said the Finance Ministry’s director for government debt securities, Deni Ridwan.

The government is facing a daunting task to cover a fiscal deficit of 6.34 percent of GDP this year as it allocates Rp 695.2 trillion to prevent a more severe economic fallout from the coronavirus pandemic. Most of the funding to plug the widening deficit will come from debt financing.