Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsEuropean shares slide to 4-week lows as US slaps tariffs on dozens of countries

Change text size

Gift Premium Articles

to Anyone

E

uropean stocks hit a 4-week low on Friday at the end of a busy week as investors worried about the impact of fresh US levies on dozens of countries, including a 39 percent tariff on Switzerland.

Trump continued his tariff blitz, announcing steep levies on exports from dozens of trading partners including Canada, Brazil, India and Taiwan with countries not listed subject to a base 10 percent rate ahead of a Friday trade deal deadline.

Healthcare stocks dropped 1.6 percent after US President Donald Trump sent letters to the leaders of 17 major pharmaceutical companies, including Novo Nordisk and Sanofi, outlining how they should slash US prescription drug prices.

Denmark-listed Novo Nordisk shed 4.9 percent, falling to an almost four-year low. Shares of the Wegovy-maker are also set for the steepest-ever weekly fall.

"Trump is trying to force these foreign companies to reduce the cost of drugs and medicines exported to the US in order to balance the cuts in subsidies with the big beautiful bill," said Mabrouk Chetouane, head of Global Market Strategy at Nataxis Investment Managers.

"I think the pressure will be extremely strong on the healthcare sector because the US is clearly one of the markets where margins are quite significant."

The pan-European STOXX 600 index fell 1.3 percent by 0915 GMT, down for the third straight session and on track to end the week in the red.

The benchmark index has slipped 4.4 percent from its March peak, after coming within 2 percent of that level earlier this week, dragged down by a record plunge in Novo Nordisk shares following a profit warning, and as investors assess the implications of the US-EU trade deal.

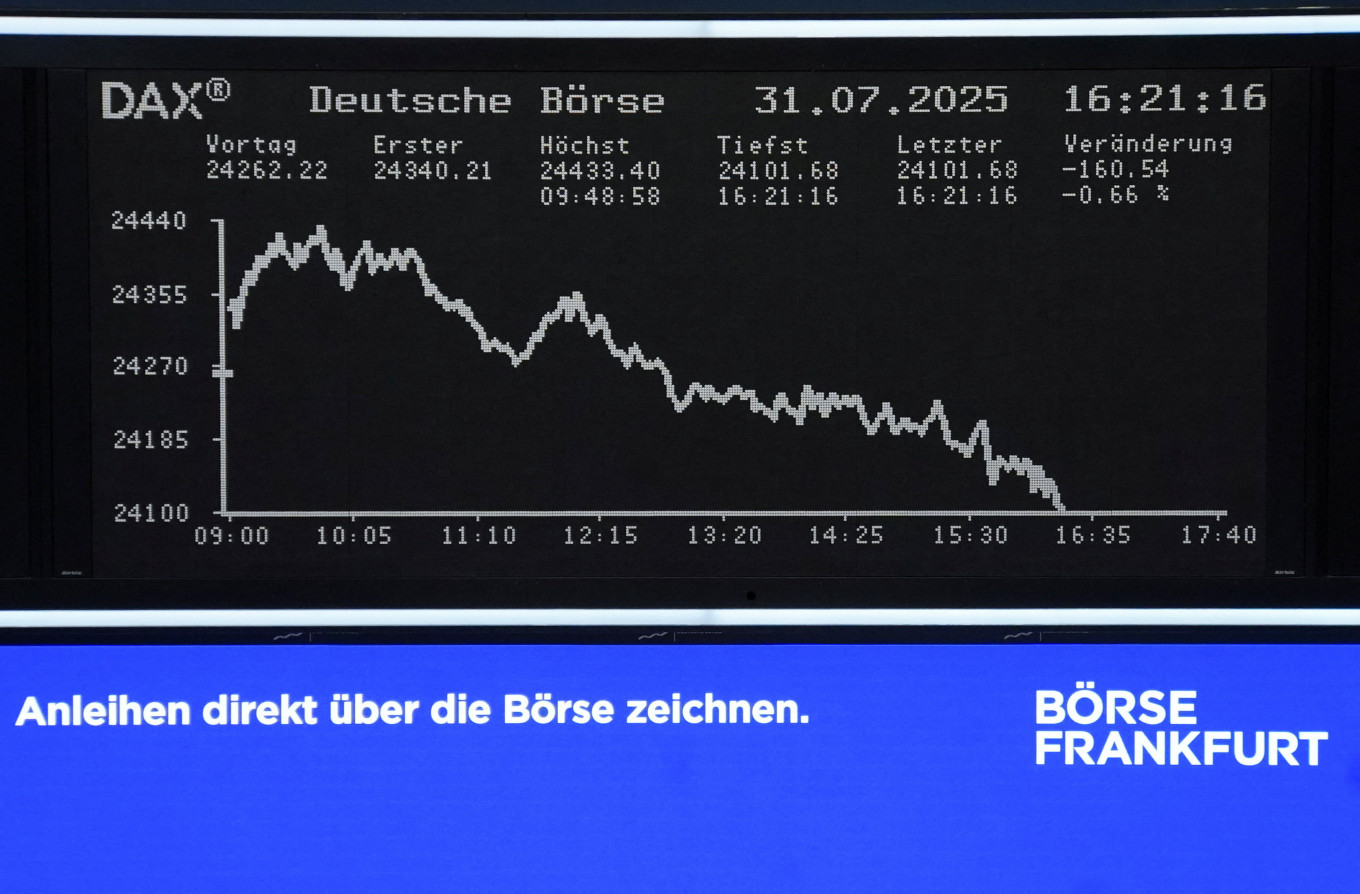

Germany's blue-chip DAX shed 1.7 percent, while Denmark's OMXC fell 3 percent to a nearly two-year low. Most regional bourses were in the red. Stock markets in Switzerland were shut for a holiday.

Among individual stocks, Italy's Campari was the top gainer on the STOXX 600 index, adding 6.7 percent after reporting an increase in second-quarter operating profit.

UK's Melrose Industries' shares rose 6.4 percent and ranked among the top gainers after the defense company beat analysts' operating profit expectations on strong demand.

British Airways owner IAG shares dropped 1.8 percent after rising in early trade on quarterly earnings, after the airline group said it expected a slight rise in costs linked to air traffic control issues.

A latest survey showed euro zone manufacturing moved closer to stabilization in July, giving further credence to European Central Bank's modestly upbeat assessment of the economy last week.

Eyes will be on US payrolls data slated for later in the day after euro zone inflation held steady at ECB's 2 percent target in July.

Investors have pared bets on ECB rate cuts, placing only a 44 percent chance of another quarter-point move by December.