Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsRestructuring of major state firms in motion

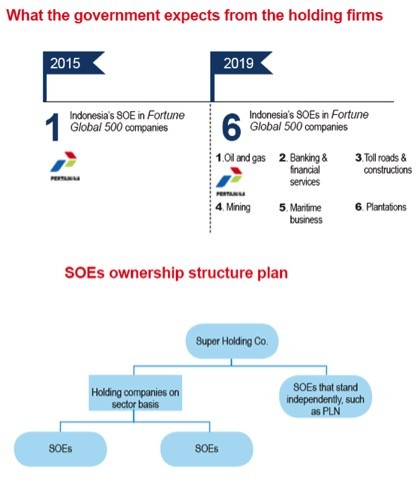

Attempts to continue with the restructuring of state-owned enterprises (SOEs) have gained traction, with the government planning to form six new holding companies to synergize firms operating in the same sectors.

Change text size

Gift Premium Articles

to Anyone

I

t took newly appointed Finance Minister Sri Mulyani Indrawati around 45 minutes to convince lawmakers last week of the urgent need to restructure several major state-owned enterprises (SOEs) so that they could punch above their weight.

She told them: “1+1+1+1+1 equals three, not five is an illustration of how our SOEs have largely failed in their operations to create added value.”

“It is now our job to make 1+1+1+1+1 equals not five, but 10.”

In the hearing with House of Representatives Commission VI on SOEs, industry and trade, Sri Mulyani initiated the government’s bid to get legislative support for a plan to form six holding companies operating different sectors with the aim of boosting their value, debt leverage and efficiency.

The proposal was first floated by SOE Minister Rini Soemarno in June, but it failed to gain traction until Sri Mulyani officially laid out a plan to legislators, most of whom demanded that the finance minister lead the restructuring plan.

Rini has been banned from attending any meetings at the House since last year and has since been represented at the House by the finance minister. The ban is in part due to a row she had with Indonesian Democratic Party of Struggle (PDI-P) chairwoman Megawati Soekarnoputri, President Joko “Jokowi” Widodo’s patron.

While Sri Mulyani acknowledged that she had not discussed the plan specifically with Rini, she fully shared Rini’s objective to have all SOEs restructured so that they could operate more efficiently.

Finance Minister Sri Mulyani Indrawati (left) and State Enterprises Minister Rini Soemarno (right)(JP/Jerry Adiguna)

Finance Minister Sri Mulyani Indrawati (left) and State Enterprises Minister Rini Soemarno (right)(JP/Jerry Adiguna)

Under the restructuring plan, oil and gas company Pertamina, the only Indonesian company listed on the Fortune Global 500 in terms of revenue, will become the holding company for oil and gas, overseeing only publicly listed PT Perusahaan Gas Negara (PGN).

Aluminum producer PT Indonesia Asahan Aluminium (Inalum) will be the parent company for mining, overseeing diversified mining company PT Antam, coal miner PT Bukit Asam and tin miner PT Timah. Inalum will also hold the government’s 9.36 percent shares in copper and gold producer PT Freeport McMoran Indonesia.

The State Logistics Agency (Bulog) will function as the holding company for food companies, which include agriculture firm PT Pertani and fishery firm PT Perikanan Nusantara, among others.

Investment company PT Danareksa will be the holding company for banking and financial services, overseeing Bank Mandiri, Bank Rakyat Indonesia, Bank Negara Indonesia, Bank Tabungan Negara Indonesia, financing firm PT PNM and pawn operator PT Pegadaian.

Construction company PT Hutama Karya will be the parent company of toll road and construction companies, such as toll road operator PT Jasa Marga and construction firm PT Wijaya Karya.

Public housing company PT Perumnas will function as the holding company for housing firms, which include property contractor PT Adhi Karya and property firm PT Pembangunan Perumahan, among others.

A government regulation is planned to serve as the legal umbrella for the forming of the holding companies.

With the structure of the holding companies having been drafted, there is the question of what the actual gains will be from the restructuring proposal.

According to the restructuring document submitted by the government to the House, the companies, through the holding companies, could borrow more for expansion as their debt capacity leverage would increase in line with the merging of their assets. The cost of borrowings could also be trimmed down.

Synergy between companies under the same holding company could be maximized through resource sharing, project collaboration and a shared transactional program, thus improving efficiency, according to the document.

Data:(Research /The Jakarta Post)

Data:(Research /The Jakarta Post)

The holding companies would also accelerate the creation of downstream companies as supplies and processing units would be shared between companies. This would also increase the use of local components and commodities.

The idea of forming such holding companies was conceived in 2004, during the president Susilo Bambang Yudhoyono administration, but progress in the implementation remained sluggish.

Only three holding companies have been formed over the past decade: PT Semen Indonesia to oversee three cement companies, PT Pupuk Indonesia Holding Company to manage six fertilizer producers and PT Perkebunan Nusantara to direct 13 plantation companies.

But the forming of such companies is not without problems, particularly over the blending of different company cultures and the ego of their executives, who often have an array of politicians as their backers. In some cases, infighting pared down profitability of the holding companies in the early years.

“Consolidation is the key. Failure to do so will undermine decision-making and harm company performance,” said Budi Gunadi Sadikin, an expert staff member of the SOE minister.

“That’s why the SOE Ministry is taking the matter very seriously,” said the former Bank Mandiri president director, who is tipped to lead the holding company for mining companies.

As the restructuring plan seems to be politically tricky and will have far-reaching impacts on the economy, Sri Mulyani urged lawmakers not to engage in endless debate to question whether the move was needed.

(Read also: Holding company: The Astra International way)

She argued that corporate actions in SOEs should be flexible without having to deal with a mountain of red tape, and that restructuring should be considered a normal corporate action that was deemed normal in many advanced economies.

“The real debate should be on the ‘how’; on the process of the restructuring itself. How can we resolve the political process, combine the balance sheets, blend the different corporate cultures and limit the socioeconomic impacts,” said the iron lady.

Since the restructuring will involve a number of publicly listed companies, Sri Mulyani has pledged to protect and listen to the interests of minority shareholders, whom she said had demonstrated goodwill by owning shares.

Indonesia has 119 SOEs, from monopolistic state power company PLN, the biggest state company by assets, to publicly listed Bank Mandiri, the nation’s biggest bank in terms of assets.

As the backbone of the economy, the SOEs are engaged in almost all sectors, from producing food and medicine to condoms and computer components.

Despite progress in the past decade, most of the companies are mired in protracted inefficiency despite the many facilities they are awarded by the state.

Some firms have often been used to accommodate the cronies of the President. For example, the position of commissioners in toll road operator Jasa Marga is filled by the President’s campaign member and cousin.

Graft is also rampant in some companies, as evident in the prosecution of executives from Adhi Karya, PGN, PLN, port operator PT Pelindo, to name but a few.

(Read also: Consolidating state companies)

Decision-making in SOEs is considered sluggish, with major undertakings needing to secure approval from ministries and the House.

Hinging on the lack of flexibility, Minister Rini has proposed abolishing the State-Owned Enterprises Ministry and replacing it with a superholding company. That is, if the forming of the holding companies proceeds smoothly as planned.

Rini has rekindled Indonesia’s long-held desire to have highly valued SOEs, such as a sovereign wealth fund or an investment company, more or less like Temasek Holdings in Singapore or Khazanah Nasional Berhad in Malaysia.

She said the planned restructuring was also in line with a plan to revise Law No. 19/2003 on SOEs, which has been included among the House’s priority bills for deliberation for this year, with the intention of granting SOEs the needed flexibility in decision-making.

“There should be an entity that can manage the SOEs in a fast, efficient and effective way as in the best practices of corporations. The current format only allows SOEs to punch below their weight,” Rini, former CEO diversified conglomerate PT Astra International, said recently. (dan)