Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsLatest rate cut to raise lending rate: BI

Change text size

Gift Premium Articles

to Anyone

B

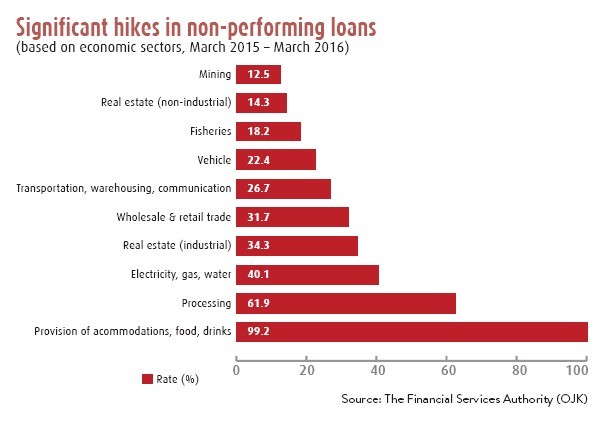

ank Indonesia expects that its latest rate cut will quicken monetary transmission to the banking industry, to balance the impact from the bank's decision to be cautious in disbursing loans due to a rising non-performing loan (NPL) rate, which as of July stood at 3.2 percent.

The central bank now projects lending growth to reach 7 to 9 percent by the end of this year, lower than its previous estimate of 10 to 12 percent.

Bank Indonesia Governor Agus Martowardojo explained that the100 basis point (bps) rate cut between January to August was only able to decrease lending interest by 52 percent.

"With the rise in NPL, banks tend to be more cautious in disbursing loans. We can see that loan growth has remained weak and the lending rate remains slow," Agus said in Jakarta on Friday.

The weak demand in lending, Agus continued, was due to the global economic slowdown. In fact, Bank Indonesia revised down its estimation on global economic growth, which it previously predicted would reach 3 percent, to only 2.9 percent. (evi)