Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOil and gas outlook still gloomy next year

Change text size

Gift Premium Articles

to Anyone

D

espite potential crude price hikes after a nearly two-year slump, the upstream oil and gas sector may not benefit much from higher global investment due to overbearing policies and lack of business certainty.

Global crude price has gained around 17 percent since the Organization of Petroleum Exporting Countries (OPEC) agreed to cut output by 1.2 million barrels of oil per day (bpod) next year, according to Bloomberg.

Although the output reduction will only be partially applied by its members, lower production will still lead to an annual crude price average of US$53 to $58 per barrel on benchmark Brent Crude, according to energy think tank Wood Mackenzie.

Prices may further increase to $60 to $65 per barrel by May next year if non-OPEC members meet their commitment to trim output by 558,000 bopd.

According to Andrew Harwood, Wood Mackenzie’s Asia Pacific research director for upstream oil and gas, global investment in exploration and production activities, in line with the price trend, global investment in exploration and production activities will also climb to $450 billion, up 3 percent from this year, despite still 40 percent below investment in 2014.

In addition, around 20 to 25 financial investment decisions will be completed in 2017, rising exponentially from a measly nine this year.

In spite of this brighter outlook, the energy consultancy group predicts Indonesia would not benefit from higher crude prices as well as bigger global investment due to the country’s notorious reputation of rampant red tape.

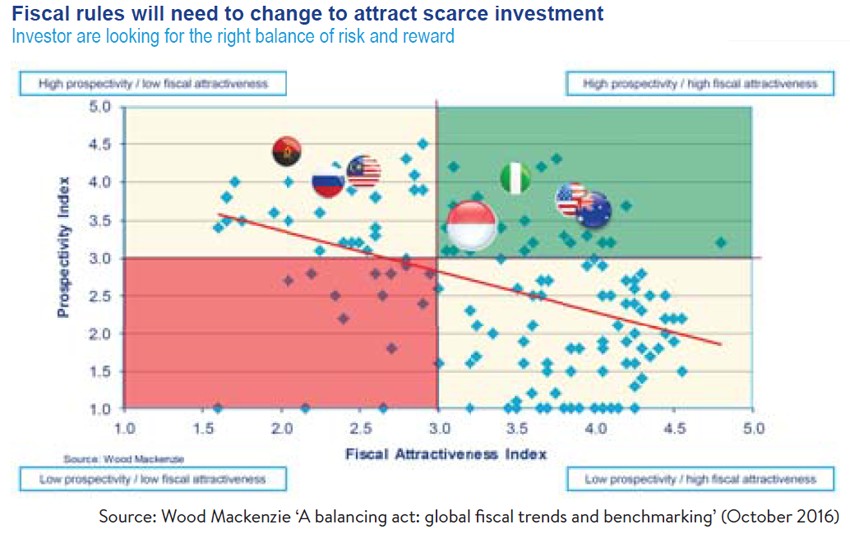

“On a pure fiscal basis, Indonesia compares with some of the countries we’ve mentioned,” Harwood said at the 2016 Pertamina Energy Forum on Tuesday.

“What investors are looking for, though, is legal certainty and policies that stimulate investment and I think that is an area where Indonesia falls down.”

Indonesia falls into the category of countries with high prospectivity and fiscal attractiveness to lure investment, which also include the United States and Australia.

Despite this potential, as of end of November, investment in the upstream oil and gas sector only stood at US$10.43 billion, comprising $10.3 billion for production activities and $309 million for exploration activities, according to data from the Upstream Oil and Gas Regulatory Special Task Force (SKKMigas).

Although the government aims to garner $12.05 billion, total investment is expected to reach only $11.4 billion, dropping from about $14 billion booked last year.

Several major investors, including Total E&P Indonesie, Chevron Indonesian and ConocoPhillips Indonesia, will likely decrease their investment in Indonesia, according to the consultancy group.

Acknowledging ongoing policy reforms, Harwood, however, noted that the efforts to address red tape did not run as rapidly as expected, while the offered fiscal terms remained undesirable.

“More needs to be done and quicker, and you’re not going to see the tangible benefits of it, for example more wells, more investment until toward the end of this decade,” he said.

Oil and gas industry players also shared similar concerns.

Indonesian Chamber of Commerce and Industry (Kadin) head of energy, oil and gas regulations Firlie Ganinduto maintained a gloomy outlook, particularly about domestic oil exploration, as investors would be reluctant to place their money without legal certainty.

“Basically, they all want to invest in a long-term plan, at least for around 10 to 20 years. But it’s hard to convince them if we change regulations each time a new president, or even a new minister, takes office,” Firlie said.

All players were waiting to see the results of the government’s plan to replace the cost recovery scheme for the upstream oil and gas industry with the so-called gross-split sliding scale, he added.