Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia pays price of protectionism as commodity exports sink

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s economy is losing out on commodity gains after lawmakers wrapped protectionist policies around the nation’s resources. Their next problem: finding a lucrative replacement.

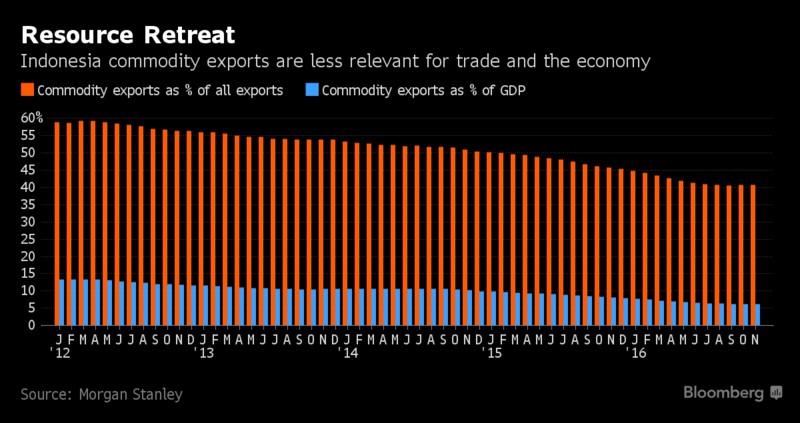

Commodities now account for about 40 percent of all exports, down from almost 60 percent five years ago, according to Morgan Stanley. They make up just 6 percent of gross domestic product, half as much as in 2012, as trade restrictions worsened the impact of a price rout over much of that period. Crude oil and gas output has declined to levels last seen in the early 1970s.

While Indonesia’s coal output will be higher next year than in 2013, production of key mineral exports including bauxite, tin and nickel will still be well behind the commodity cycle’s peak, BMI Research estimates. The drag on activity may complicate President Joko "Jokowi" Widodo’s plans to accelerate economic growth to 7 percent, with an investment push in manufacturing to offset lost commodity income yet to yield results.

“Indonesia is growing 5 percent -- that’s pretty good -- but it used to grow 6 percent because of commodities. To go back to 6 percent you need to have another sector that would replace it,” said Gundy Cahyadi, an economist at DBS Group Holdings Ltd. in Singapore. “The problem is that there is no support from manufacturing.”

While global commodities slumped for five years following their 2011 peak, last year saw a rebound in prices. But investment in Indonesia’s sector has been sapped by tighter environmental rules and nationalist policies, including import tariffs and tighter visa requirements for foreign workers. The crackdown has led to mine closures and the exit of big foreign resource companies including Newmont Mining Corp. and BHP Billiton Plc last year.

The timing isn’t great. In a country where 40 percent of incomes hover above the poverty line, the government has sought to stimulate domestic demand amid forecasts that the middle class population may double to 141 million by 2020. Cahyadi says if that happens without a rapid expansion of manufacturing, there won’t be enough jobs to go around.

Indonesia halted the export of metal ores in 2014 to encourage local smelter construction; despite relaxing the ban in January, shipments of nickel have yet to restart. The government last week said it would take a majority stake in the local unit of the owner of the world’s second-biggest copper mine, deepening a dispute that’s curtailed output and prompted thousands of job losses.

While the government in January raised taxes sixfold on exports of palm oil, Indonesia’s biggest earner, that was expected to have limited impact on shipments because of possible supply disruptions in Malaysia. The commodity accounts for about 10 percent of the nation’s overall exports.

There may be a silver lining to relying less on commodities, says Wellian Wiranto, an economist at Oversea-Chinese Banking Corp. in Singapore.

Less dependence should be a mid-term positive for the economy as it forces government and business to find other growth drivers, says Wiranto. Now is the perfect time for Indonesia to build new infrastructure, which it’s been doing at a slower pace than its neighbors, he says. Historically, its ports and roads have been optimized to service mining pits and not residents and businesses.

“Relying on commodities, you’ve had a very exposed economy for decades,” Wiranto said. “You don’t want to put all your eggs in one basket.” (bbn)