Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsCitigroup faces setback as Prince Alwaleed arrested

Change text size

Gift Premium Articles

to Anyone

C

itigroup may face new obstacles to rebuilding its Saudi Arabia business after the bank’s longstanding shareholder and promoter was arrested in an anti-corruption drive.

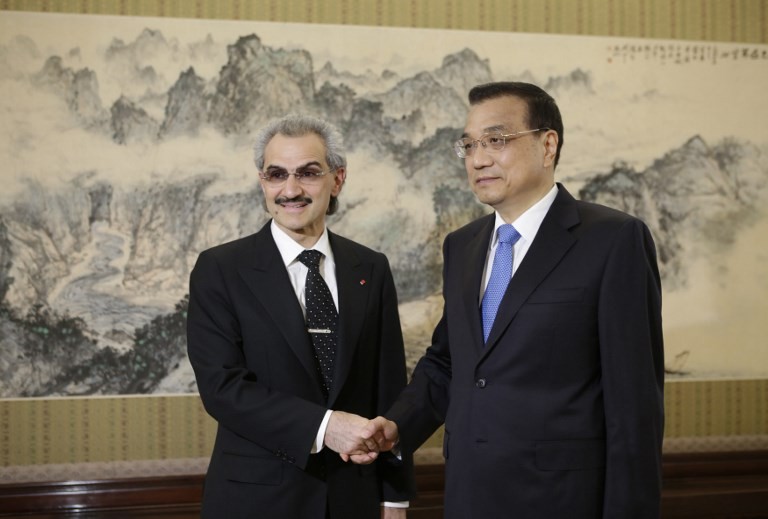

Prince Alwaleed bin Talal, the 62-year-old Saudi billionaire, was detained by authorities on Saturday without disclosure of the allegations.

The government also named former HSBC Holdings Middle East and North Africa head Mohammad Al Tuwaijri as economy and planning minister as part of the crackdown.

International lenders are expanding their foothold in the kingdom as the nation overhauls its economy and plans to list Saudi Arabian Oil Company, or Aramco, in what could be the largest initial public offering in history.

Citigroup, which lost its Saudi investment banking license by selling its stake in Samba Financial Group in 2004, has been plotting a return. The bank got a new license in April.

Alwaleed’s arrest is “likely to make things more difficult for Citigroup in Saudi due to companies and individuals being cautious of any association,” said Emad Mostaque, co-chief investment officer of emerging-markets hedge fund Capricorn Fund Managers.

The bank had a “turbulent time in Saudi Arabia after they backed out of Samba and have steadily built their presence back up,” he said.

A spokeswoman for Citigroup declined to comment.

Alwaleed’s Kingdom Holding, which has held Citigroup shares since 1991, increased its stake during the global financial crisis as shares plunged.

While the size of Alwaleed’s position isn’t disclosed, neither he nor his company were listed among owners with a stake of 5 percent or more in the New York-based lender’s latest proxy filing this year.

Citigroup tried and failed to get a license to return to Saudi Arabia in 2006 and again in 2010, despite lobbying by Alwaleed. The prince said in an interview that year that he was helping the bank set up in the kingdom.

If Alwaleed faces charges even remotely connected to the licensing of Citigroup, its ability to get future business from the kingdom would be diminished, said Joice Mathew, head of equity research at United Securities in Muscat.

“It would no longer be a cakewalk for them as we anticipated earlier. Their license is there to stay, but they would have to sweat a lot for generating business.”