Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGovernment oversells PT Freeport Indonesia agreement

Law expert Hikmahanto Juwana pointed out that the HoA contained errors from a legal perspective.

Change text size

Gift Premium Articles

to Anyone

T

he agreement made on Thursday between PT Indonesia Asahan Aluminium (Inalum) and United States mining company Freeport-McMoran Inc. (FCX) was largely welcomed by the government, which claimed that the future of PT Freeport Indonesia (PTFI) was now clearer.

It added that the heads of agreement (HoA) signed by FCX and Inalum, which represents the government, was binding and would assure stability for PTFI in terms of investments, tax issues, royalties and operational transitions.

However, law and economics experts have accused the government of overselling the deal and suggesting it would settle every issue relating to PTFI’s future operations in Papua.

University of Indonesia (UI) international law expert Hikmahanto Juwana pointed out that the HoA contained errors from a legal perspective.

He emphasized that the deal was not a stock trading agreement, but merely an agreement in principal and should be followed up with another contract.

“It must be thoroughly scrutinized because for lawyers, there is the adage ‘the devil is in the details’,” Hikmahanto said.

He believes that a done deal should be in the form of a sales and purchase agreement.

In this case, the US$3.5 billion is payment to Anglo-Australian miner Rio Tinto for its 40 percent participating interest (PI), which would be converted into shares in PTFI, and $350 million to local miner PT Indocopper Investama, another local FCX subsidiary, which owns a 9.36 percent share in PTFI.

Only after the payment is made will Indonesia officially control 51 percent of PTFI’s shares and become the majority owner of the company, which operates the world’s largest gold mine.

Both Rio Tinto and PTFI agreed with Hikmahanto, saying that Thursday’s agreement was merely one step toward completing the deal — which still has the possibility to collapse.

Rio Tinto clearly stated in a press release distributed last week that the HoA was a non-binding agreement, and the binding agreement was expected to be signed before the end of 2018.

“Given the number of terms that remain to be agreed, there is no certainty that a transaction will be completed,” the press release reads.

During a press conference on Thursday, Finance Minister Sri Mulyani Indrawati and State-Owned Enterprises Minister Rini Soemarno assured that the deal was a binding agreement.

“Unfortunately, the impression that government officials gave regarding the deal was overwhelming. It misled the people, who then posted messages [on social media] such as ‘Thank you, Pak Jokowi’ without fact checking [the deal],” said Drajad Wibowo, a senior economist at the Institute for Development of Economics and Finance (Indef).

Drajad, a politician from the National Mandate Party (PAN), which is known to be critical of the Jokowi administration, said the public should know that larger issues had yet to be finalized.

“I hoped the transaction will not overstretch Inalum’s finances, as the $3.85 billion deal is equivalent to 61 percent of the firm’s assets,” he explained. “Not to mention that Freeport still wants to control PTFI’s operations, even though Indonesia has become the majority owner.”

Hikmahanto added that the HoA was in violation of prevailing laws, because it gave Freeport operational rights until 2041.

According to Law No. 4/2009 on mineral and coal mining, no further agreement can be made when a contract of work (CoW), which Freeport technically still has, is due. Freeport’s CoW will expire in 2021.

However, in February last year, the Energy and Mineral Resources Ministry issued a special mining permit (IUPK) for Freeport, saying the company had agreed to change its CoW into to an IUPK and agree to waive the benefit of a 50-year extension.

Freeport previously refused to comply, arguing that an IUPK was not a nail-down scheme because the stipulations, including the taxation scheme, can change according to a change in government regulation.

“The investment stability agreement also contradicts Article 1337 of the Civil Code, which prohibits any deal that goes against a prevailing legislation,” Hikmahanto said.

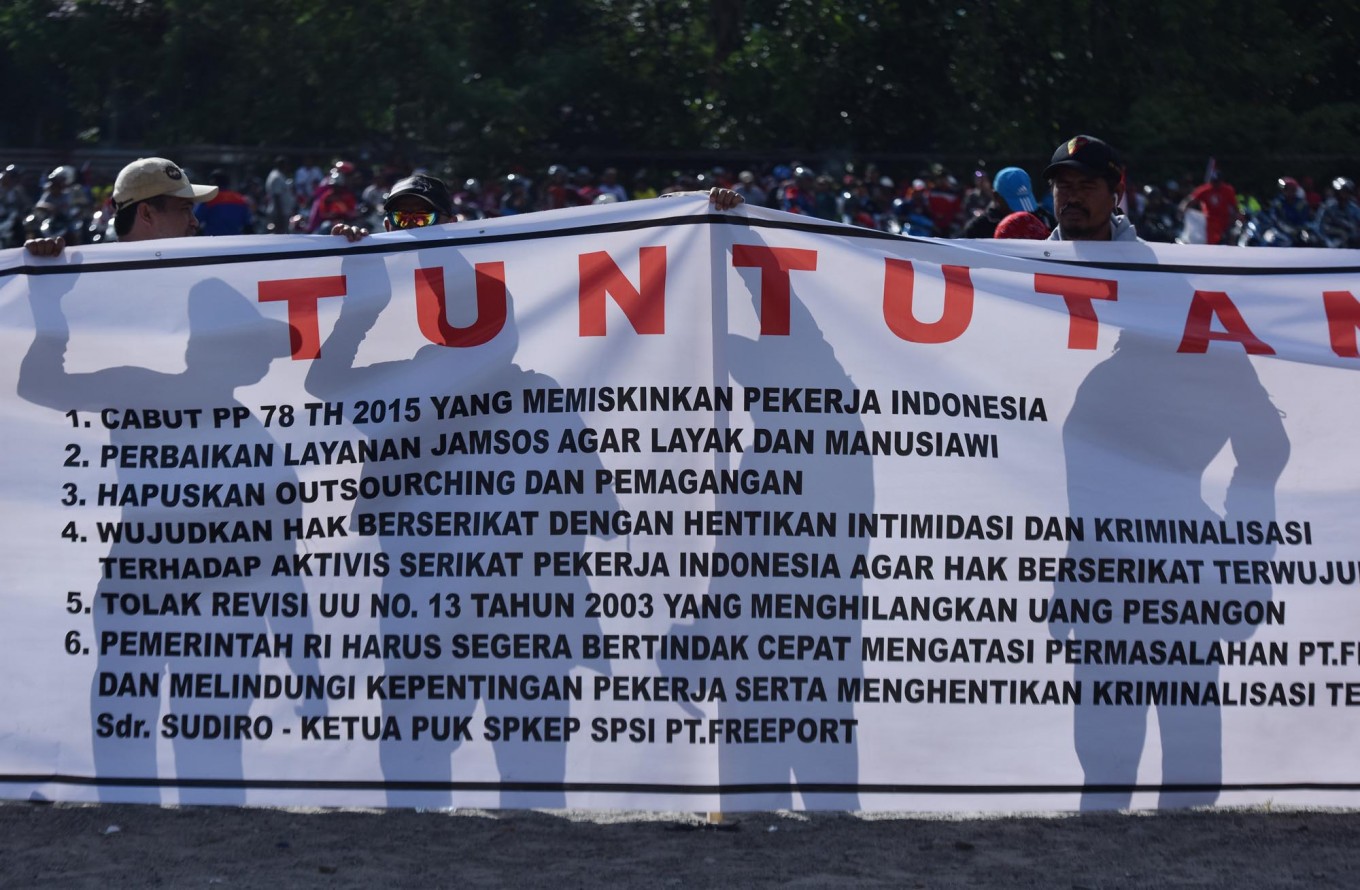

Meanwhile, non-governmental organization Mining Advocacy Network (Jatam) has taken a hard stance against the deal, believing that any agreement would have zero benefits for the people of Papua.