Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsLiquidity challenges and growth expectations in the new government era

Going forward, the prospect of interest rate cuts and the new government’s policies are expected to further support potential loan acceleration.

Change text size

Gift Premium Articles

to Anyone

T

he global economy is currently preparing for a period of recovery, marked by the prospect of global interest rate cuts, including in Indonesia. Economic policy is expected to be expansive, especially with the start of a new government. Banking performance has been strong, with several major banks reporting optimistic Q3 results. Loan growth has accelerated significantly, driven by recovery, particularly in the corporate segment. Going forward, the prospect of interest rate cuts and the new government’s policies are expected to further support potential loan acceleration.

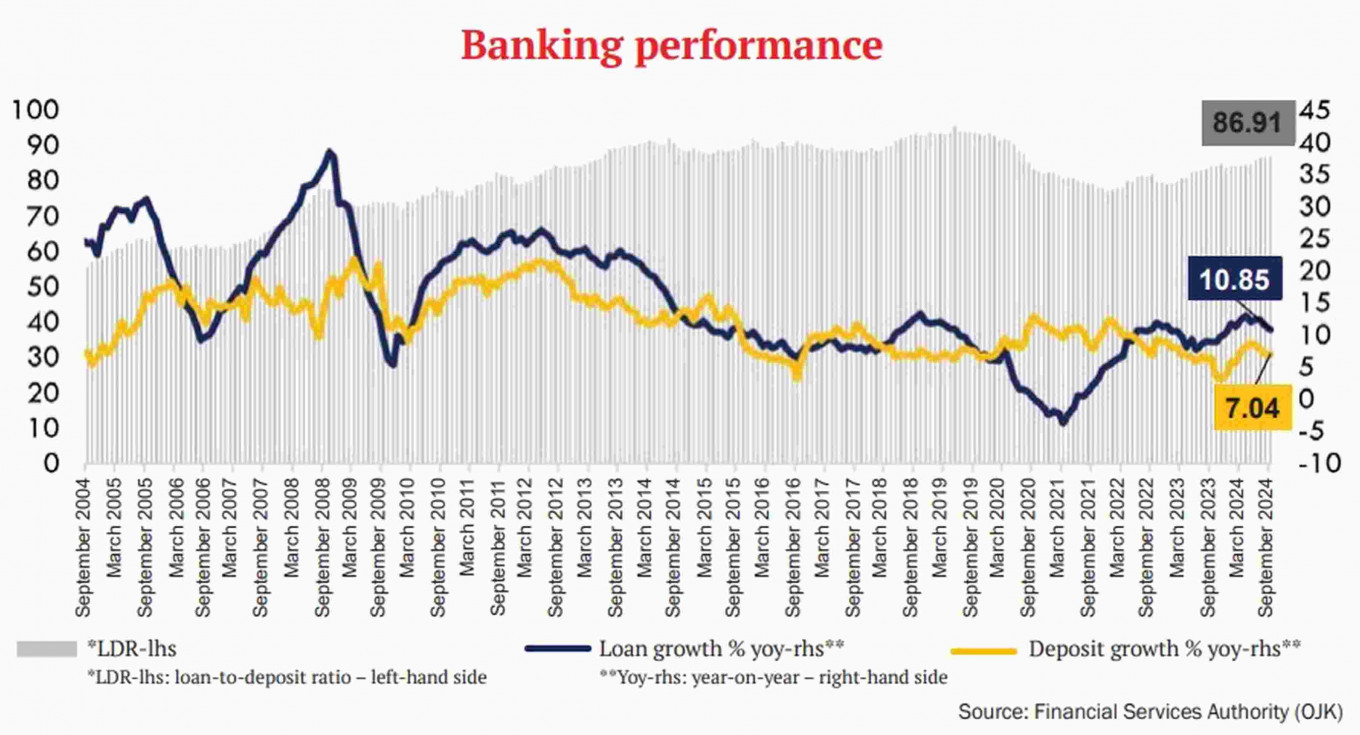

However, amid optimism for Indonesia’s economic recovery, the banking sector still faces challenges related to increasingly tight liquidity conditions. Recent data shows loan growth of 10.85 percent year-on-year as of September 2024, which is higher than the third party funds (DPK) growth of only 7.04 percent year-on-year. This has led the loan-to-deposit ratio (LDR) in banking to rise to 86.91 percent in September 2024 from 83.87 percent at the beginning of the year, indicating that banks’ capacity to lend is becoming more constrained.

The sluggish growth in DPK is due to several structural factors. Firstly, the global economic slowdown has reduced commodity revenues in line with the normalization of global commodity prices, especially in the oil and gas, coal and agriculture sectors. Secondly, the middle-to-lower income group's earnings have also been affected, reducing their savings in banks. Third, funds are still being placed abroad because of more attractive international interest rates. Fourth, alternative investment instruments offer more appealing returns.

Banks also need to be aware of the global economic situation. Currently, the United States election is a significant factor affecting financial market volatility. Future US economic policy is expected to be expansive, potentially increasing the fiscal deficit and US debt levels. This expansionary policy could increase inflation in the US, which may delay the rate-cutting phase. Various issues and economic data from the US could cause financial market turbulence and drive capital outflows from emerging markets, including Indonesia. We are now awaiting the outcome of the Federal Open Market Committee (FOMC) Meeting on Thursday, which will provide insights into the US interest rate outlook. Markets anticipate that the Federal Reserve will lower the Federal Funds Rate (FFR) by 25 basis points.

Amid these global challenges, the banking sector must be vigilant regarding US political and economic policies and prepare risk mitigation strategies to maintain financial stability and performance. Liquidity conditions, both in rupiah and foreign exchange currency, must be managed effectively. Banks with exposure to foreign currency assets or liabilities should employ prudent and measured hedging transactions.

To sustain loan acceleration momentum, liquidity conditions must be continuously monitored and maintained. With the right policies, banking liquidity is expected to improve, giving banks more room to lend to productive and pro-growth sectors. This is crucial to stimulate growth in the real sector, which requires loan flows to maintain its growth momentum. This approach is also vital to ensure sufficient bank liquidity to face potential global economic instability, including possible interest rate fluctuations. All of this, of course, must be done while still adhering to prudential principles and risk management.

Bank Indonesia (BI) has announced plans to continue its macroprudential liquidity incentives in 2025. These incentives are provided to banks that successfully channel loans to sectors that create high employment and promote growth, in the form of reduced minimum reserve requirements. These incentives not only provide more room for loan expansion but also support economic recovery, particularly for sectors that are still slow to recover.