Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsCoal cash dip: PNBP and stabilization strategies

The PNBP of the mining sector depends on three key factors, which are global coal prices, production volumes and government-set royalty rates.

Change text size

Gift Premium Articles

to Anyone

Banking on coal: Excavators pile up coal on June 20, 2024 at a storage facility near the Batanghari River in Muaro Jambi regency, Jambi. Statistics Indonesia (BPS) reported that the value of the country’s coal exports reached US$2.5 billion in May of this year, down 4.04 percent from the previous month.

(Antara/Wahdi Septiawan)

Banking on coal: Excavators pile up coal on June 20, 2024 at a storage facility near the Batanghari River in Muaro Jambi regency, Jambi. Statistics Indonesia (BPS) reported that the value of the country’s coal exports reached US$2.5 billion in May of this year, down 4.04 percent from the previous month.

(Antara/Wahdi Septiawan)

I

ndonesia's non-tax state revenue (PNBP) declined by 4.6 percent in 2024, marking a reversal after three consecutive years of growth that were driven by rising coal prices, which had peaked in 2022.

According to the Energy and Mineral Resources Ministry, coal plays a pivotal role in PNBP generation, accounting for approximately 75 percent of the general mining or mining sector's contributions.

Within Indonesia's PNBP structure, the mining sector stands as the largest contributor from natural resources. Note that, natural resources collectively form the biggest component of total PNBP.

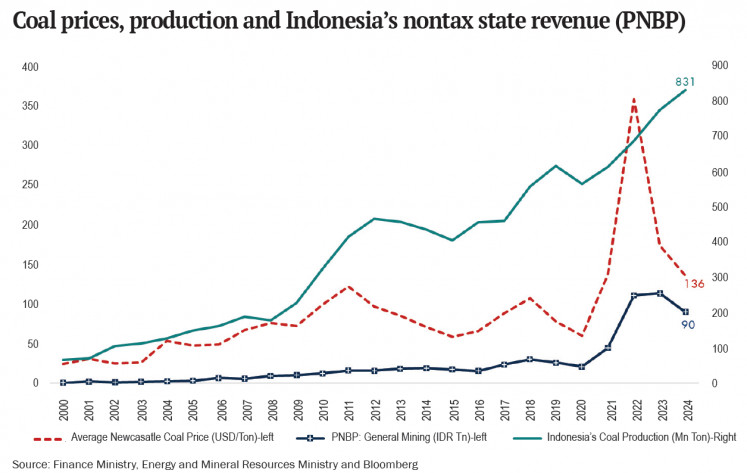

Coal prices, production and Indonesia’s non-tax state revenue (PNBP) (Bank Mandiri/-)This raises a critical question: How did the decline in global coal prices and other factors contribute to Indonesia's 2024 PNBP drop, and what strategies could stabilize revenue?

The PNBP of the mining sector depends on three key factors, which are global coal prices, production volumes and government-set royalty rates.

With coal contributing approximately 75 percent of the mining sector PNBP, revenues remain highly vulnerable to price volatility, demand fluctuations and policy adjustment.

Indonesia’s 2024 PNBP decline, primarily due to falling global coal prices, highlights the country’s heavy reliance on commodity-driven revenue. Although coal production increased, weaker prices and the limited effect of new royalty regulations under government regulation (PP) No. 18/2025 reduced fiscal intake.

The drop in the mining sector PNBP in 2024 is largely attributed to the sharp decline in global coal prices following their 2022 peak. Coal prices had surged during the post-pandemic energy crisis and the Russia-Ukraine war but normalized in 2023-2024 as supply stabilized and alternative energy sources expanded.

As Indonesia's coal royalties, the main source of mining sector PNBP, are calculated based on coal prices, the price decline directly reduced government revenue. Even with higher export volumes, the lower per-tonne value significantly decreased PNBP contributions, highlighting the sector's vulnerability to price volatility.

In 2024, the average Newcastle coal price fell by 21.9 percent, while the mining sector PNBP declined by 20.7 percent.

Despite increased coal production and exports in 2024, the surge in quantity proved insufficient to compensate for falling prices. The graph illustrates that while coal production rose, the sharp decline in revenue per tonne resulted in an overall PNBP decrease. This confirms price as the dominant factor in the revenue slump.

For instance, while 2024 saw 7 percent growth in both coal production and exports, the 21 percent price drop led to a net PNBP decline, demonstrating the limitations of volume-based growth in stabilizing revenue.

Meanwhile, recent changes to Indonesia's coal royalty system under PP No. 18/2025 have not significantly increased PNBP revenues. The policy raises royalty rates from 10.5 to 11.5 percent for lower-quality coal (under 5,200 kcal/kg) when prices exceed US$90/tonne.

However, this has had minimal impact for two main reasons: 60 percent of Indonesia's coal reserves are medium-grade (5,100-6,100 kcal/kg) and therefore do not qualify; current prices for qualifying coal remain below the $90 threshold, averaging just $86.60/tonne in 2024.

As a result, most production remains unaffected by the new rates, as do PNBP revenues. The reform's limited scope suggests it cannot stabilize the PNBP without either significantly higher coal prices or broader changes to the royalty system.

Therefore, we propose the following policy measures to strengthen and stabilize the mining sector PNBP.

First, a more robust and multi-layered coal royalty system. To strengthen fiscal resilience against price volatility, the government should adopt a royalty mechanism that includes two key enhancements: a tiered structure based on coal calorific value and broader pricing framework.

Royalty rates should be differentiated across all coal grades, not just low-calorific types, so that medium- and high-grade coal contribute proportionately to the PNBP. In addition, the pricing structure should introduce a wider range of brackets that account for both low and high market prices. Importantly, this approach must maintain Indonesia's coal sector competitiveness.

Second, the establishment of a natural resource sovereign wealth fund to better manage commodity price cycles through three key instruments: preserving windfall revenues during price peaks, for instance, by setting aside coal royalties when prices rise significantly to create a buffer when prices drop; investing in economic diversification, such as funding nickel processing facilities in Sulawesi to reduce dependence on coal and raw mineral exports; and providing stabilization support to resource-dependent regions through temporary subsidies for essential services in Kalimantan or worker retraining programs when mining revenues decline.

This three-pronged approach would transform volatile resource income into sustainable long-term value while protecting Indonesia's fiscal stability.

Third, diversify PNBP sources beyond coal. To lessen the over-reliance on coal, Indonesia should implement a comprehensive diversification strategy for its mining sector PNBP. This would involve expanding royalty systems to cover other strategic minerals like nickel, particularly for processed exports that generate higher value.

Such diversification would make government revenues more resilient to coal market fluctuations while supporting Indonesia's economic transition.

Indonesia's PNBP decline last year reveals structural fiscal vulnerability caused by over-reliance on coal revenues, which remain highly sensitive to global price fluctuations. Despite increased production and regulatory adjustments, falling coal prices and limited policy coverage reduced PNBP collection.

Addressing this challenge requires several approaches, such as implementing a more adaptive royalty system, establishing a sovereign wealth fund to mitigate volatility and diversifying revenue sources beyond coal. These measures would strengthen fiscal resilience and ensure long-term sustainability.

It is important to note that exploiting natural resources, including coal, requires consideration of intertemporal choice optimization. Specifically, we should not only exploit natural resources for the current period but also preserve them for future generations.

*****

The writer is an industry and regional analyst at Bank Mandiri