Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSupporting ASEAN Businesses in Navigating Complexity and Driving Growth

Change text size

Gift Premium Articles

to Anyone

A

mid ongoing geopolitical turbulence and rising uncertainty in the global economy, the Association of Southeast Asian Nations (ASEAN) continues to demonstrate remarkable resilience and sustained growth.

Over the past two decades, the global macroeconomic environment has faced significant challenges. Trade volatility, driven in part by U.S.– China tensions and broader geopolitical instability, has become a persistent concern. Recent developments, including the Russia–Ukraine conflict and tensions in the Middle East, have further disrupted global trade flows. The introduction of aggressive tariff policies during the Trump administration also added to the strain.

As of August 1, new U.S. import tariffs have taken effect, affecting ASEAN countries to varying degrees. Singapore faces a 10 percent rate, while Indonesia, Malaysia, the Philippines, Thailand, and Cambodia are subject to a 19 percent rate. Vietnam, Brunei Darussalam, and Myanmar are facing rates of 20 percent, 25 percent, and 40 percent, respectively. Despite these discrepancies, ASEAN exporters to the U.S., the world’s largest consumer market, face higher operational costs across the board.

In response to these global headwinds, ASEAN has continued to invest in long-term resilience. At the recent 46th ASEAN Summit, regional leaders reaffirmed their commitment to economic stability and sustainable growth. Key priorities include strengthening supply chains, maintaining open trade flows, and fostering development through regional and international partnerships.

Still, as part of the global economy, ASEAN cannot avoid the effects of trade volatility and supply chain disruptions, particularly in manufacturing and export-intensive industries. This raises critical questions: How significant are these impacts? And how are businesses adapting?

According to HSBC’s Global Trade Pulse Survey, which gathered responses from 5,750 international companies across 13 markets between April 30 and May 12, 2025, 66 percent of global businesses reported cost increases due to tariffs and trade uncertainty. Furthermore, 72 percent anticipate long-term cost pressures, while supply chain disruptions are expected to lead to an average 18 percent decline in revenue.

The survey found that 78 percent of companies are re-evaluating their long-term business models in light of trade uncertainty. About 43 percent are evaluating changes to their international expansion strategies, and 39 percent are shifting their focus toward domestic or regional markets to mitigate the effects of ongoing tariff instability.

Supply chain strategies are also evolving, with 83 percent of companies adopting or planning to implement nearshoring, and 77 percent reshoring operations. Despite these pressures, businesses are responding with resilience and innovation.

In fact, 77 percent of respondents say that trade pressures have become a driving force for innovation. Many businesses are responding by embracing change in meaningful ways: 58 percent have adopted new platforms and technologies, 56 percent have improved their internal processes, and 51 percent have introduced new products or services to the market.

Adaptive Mindset

These responses highlight a forward-thinking and adaptive mindset in the face of an evolving global trade environment.

Encouragingly, despite the challenges, nearly 90 percent of businesses globally remain confident in their ability to grow internationally over the next two years. However, they also acknowledge the increasing complexity of forecasting and strategic planning amid trade uncertainty.

For companies eyeing growth in major consumer markets, ASEAN remains a key region of opportunity. According to a 2024 report by Boston Consulting Group (BCG), Southeast Asia is home to approximately 245 million middle-income consumers, alongside 85 million upper-middle-income shoppers. By 2030, these numbers are projected to exceed 415 million, more than the entire population of the United States.

The report further noted that across the 10 ASEAN member nations, consumption is already a significant driver of economic activity. Final consumption expenditure accounts for over 90 percent of GDP in the Philippines, over 70 percent in Indonesia, Malaysia and Thailand, and over 60 percent of GDP in Vietnam.

To succeed in ASEAN, however, businesses must understand local market dynamics, including regulations, foreign exchange rules, taxation, licensing, industry trends, and business culture.

“With 160 years of international presence, HSBC has built a global network that is second to none. Our deep-rooted expertise allows us to support clients as they navigate the complexities of cross-border growth, whether they’re entering new markets, adapting to regulatory shifts, or managing evolving risks. We’re proud to help businesses turn uncertainty into opportunity with solutions that are seamless, agile, and built around their ambitions,” said Charles Kho, HSBC Country Head of Global Network Banking

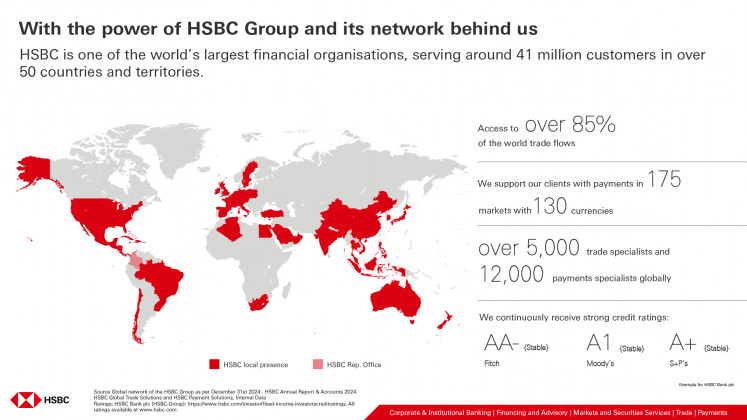

HSBC’s Corporate and Institutional Banking (CIB) division plays a vital role in supporting international clients across ASEAN. With $3 trillion in assets, CIB is a global financing powerhouse that helps multinational businesses expand through HSBC’s extensive international network.

In 2024 alone, HSBC facilitated over $850 billion in global trade volume, processing approximately 5.7 billion transactions through its 5,000+ trade specialists and 12,000+ payments experts. The bank consistently ranks among the world’s top three institutions in trade, payments, and foreign exchange.

HSBC maintains a strong presence across six countries in the Americas, 18 in Europe, 19 in Asia, and 8 in the Middle East. Its cross-border banking capabilities are backed by deep local expertise, ensuring clients receive tailored support in navigating complex environments.

Recognizing that each client is unique, HSBC offers customized financial solutions, from structured lending and access to capital markets, to treasury services, trade finance, and advisory support.

In today's rapidly evolving financial landscape, sustainability is no longer optional, it’s essential. HSBC plays a vital role in helping clients meet their environmental, social, and governance (ESG) objectives.

Technology and innovation are also at the core of HSBC’s strategy. By embracing digital transformation, the bank continuously enhances its clients’ experiences and operational efficiency. It provides robust digital platforms that streamline trade, payments, and treasury management, empowering businesses to operate more effectively in a digital-first world.

A Spotlight on Indonesia

(Courtesy of HSBC)HSBC Business Update 2025, themed “What’s Next: Trump, Trade, and the Future of Indonesia,” Dr. Aviliani of the Institute for Development of Economics and Finance (INDEF) noted that a series of crises has driven Indonesia to become more creative and innovative, enhancing its ability to adapt to challenges that have emerged over the past two decades.

Indonesia, ASEAN’s largest economy and the world’s fourth most populous country, represents a standout opportunity. Rich in natural resources, such as coal, tin, copper, nickel, oil, and gas, Indonesia also benefits from fertile agricultural land that produces palm oil, rubber, cocoa, and rice.

With a population of over 280 million, the majority under age 30, Indonesia is poised for sustained growth in consumer spending, digital transformation, and labor force expansion. These demographic and economic fundamentals make it a strategic priority for HSBC.

HSBC views Indonesia as central to its long-term strategy in Asia, given its dynamic demographics, expanding consumer base, and increasing role in regional and global trade.

Beyond financing, HSBC’s CIB offers strategic advisory services to guide clients through evolving financial and regulatory environments. Its long-standing presence in ASEAN positions the bank as a trusted partner in supporting sustainable, region-wide growth.

As global dynamics continue to shift, ASEAN stands out as a resilient, opportunity-rich region. With strong demographics, forward-looking policies, and regional cooperation, it offers a solid foundation for long-term growth. Through strategic guidance, international reach, and deep local expertise, HSBC is committed to helping businesses grow, adapt, and thrive in this complex global landscape.