Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsLong bond yields rise, gold hits record on fiscal concerns

Change text size

Gift Premium Articles

to Anyone

A

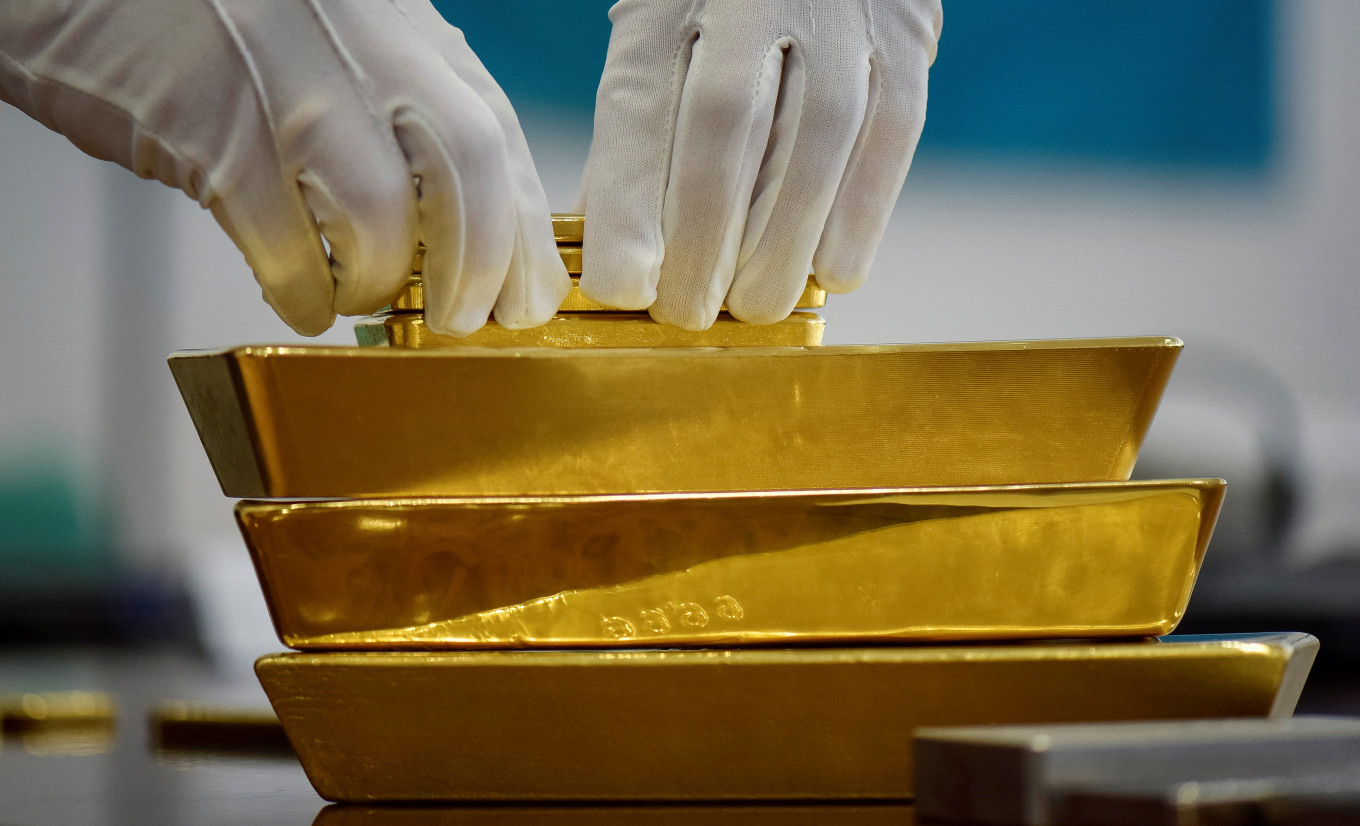

global slide in long-dated bonds extended into Asia on Wednesday, while gold climbed to a new peak as concerns mounted over government debt and economic growth.

The 30-year Japanese government bond (JGB) yield hit an unprecedented 3.255 percent, following a run-up in similarly dated gilts and Treasuries overnight. Japan's Nikkei gauge of shares opened lower, following declines on Wall Street after data showed a continued contraction in US manufacturing.

Attention turns to services data in Europe for indications of how countries are weathering the unpredictable tariff regime from US President Donald Trump and to key US labor data on Friday for signals on rate cuts by the Federal Reserve.

"This rise in bond yields is sort of weighing on your tech sector in the US," Skye Masters, head of markets research at National Australia Bank, said in a podcast. "It is all about concerns about government budget deficit positions and the implications for bond issuance."

Trump on Tuesday said his administration will ask the Supreme Court for an expedited ruling on tariffs that an appeals court found illegal last week. The court allowed for the tariffs to stay in place until Oct. 14.

US manufacturing contracted for a sixth straight month in August as factories grappled with the impact of import tariffs, data showed on Tuesday. Purchasing managers indexes for the euro zone and Britain are due for release on Wednesday.

US nonfarm payrolls on Friday will be preceded by data on job openings and private payrolls, giving clarity on the labor market that has become the focus of policy debate at the Fed.

Markets widely expect the Fed to lower interest rates later this month, pricing in an 89 percent chance of a 25-basis-point cut.

Bond yields move inversely to prices, and yields especially on super-long-dated 30-year bonds have been soaring around the world, with investors concerned about the scale of debt in countries from Japan to the United States.

The 30-year JGB yield jumped 8 basis points (bps) to a record high of 3.28 percent as markets brace for a sale of the debt on Thursday.

The yield on the benchmark US 10-year Treasury note rose 0.4 basis points to 4.281 percent. The yield on the 30-year Treasury rose 0.7 basis points to 4.978 percent, nearing the highest since mid-July.

MSCI's broadest index of Asia-Pacific shares outside Japan was up 0.1 percent, while Japan's Nikkei slid 0.5 percent.

Australia's S&P/ASX 200 index sank 0.9 percent after second-quarter gross domestic product data.

The dollar continued its winning ways, rising 0.3 percent to 148.79 yen. The dollar index, which tracks the greenback against a basket of currencies, was flat at 98.431 after a 0.7 percent surge on Tuesday.

Sterling traded at $1.33716, down 0.2 percent so far on the day. The pound slumped 1.1 percent in the previous session and 30-year gilt yields hit their highest since 1998 after the British government sold 10-year debt at the highest yield in 17 years.

In Europe, French Prime Minister Francois Bayrou looks set to lose a confidence vote as opposition parties balk at his cuts to government spending, while British finance minister Rachel Reeves is expected to raise taxes in her autumn budget to remain in line with her fiscal targets.

US crude ticked up 0.2 percent to $65.69 a barrel. Spot gold reached $3,546.99, a new all-time high.

Futures pointed to strong opens in Europe, with the pan-region Euro Stoxx 50 futures up 0.6 percent, German DAX futures rising 0.5 percent and FTSE futures gaining 0.3 percent.

US stock futures, the S&P 500 e-minis, were up 0.1 percent at 6,430.5.