Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsRI to have draconian tax superbody

Change text size

Gift Premium Articles

to Anyone

T

he government has long dreamed of having a powerful tax agency, as powerful as the US’ Internal Revenue Service (IRS), to improve the country’s taxation landscape. The wish may just come true beginning in 2018 with the establishment of a state revenue agency (BPN).

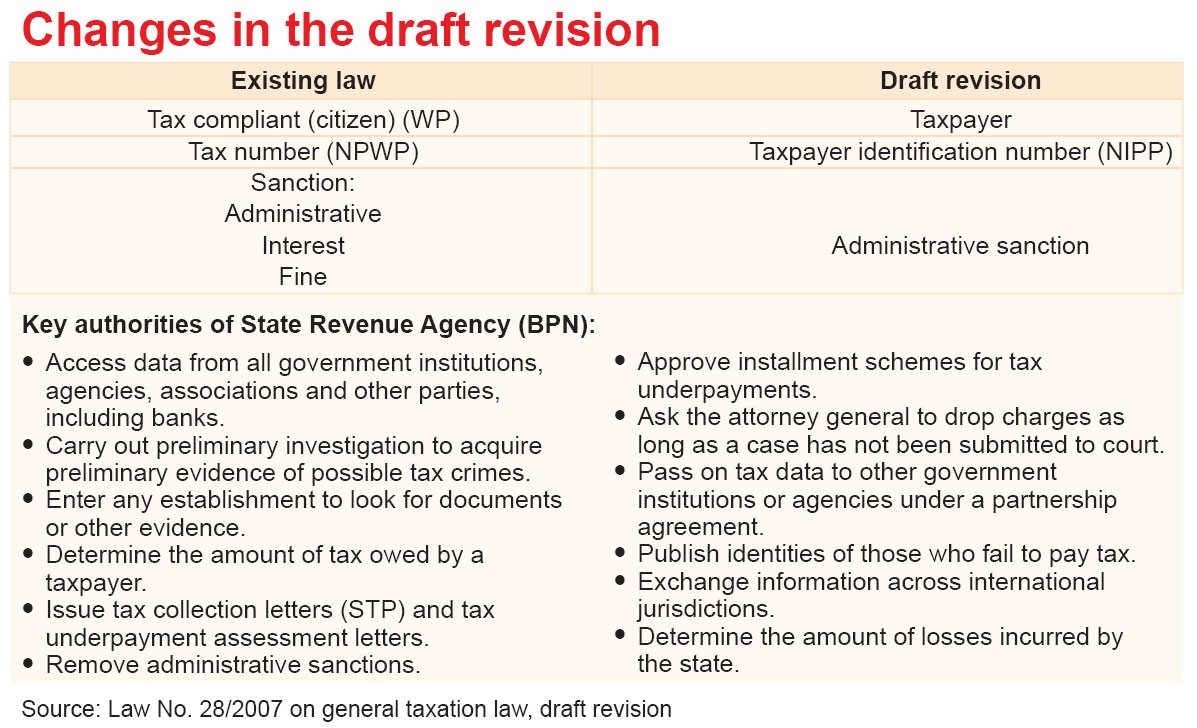

A draft revision of the General Taxation System (KUP) Law shows that the agency will take over the responsibilities of the directorate general of taxation and then some.

The draft is currently being discussed by the government and lawmakers at the House of Representatives. It is a government-proposed bill and is one of the House’s priority bills for 2016.

It would replace the original KUP Law, which was created in 1983 and revised several times, with the last revision occurring in 2009.

According to the draft, the future revenue agency would be able to penetrate deeper into financial activities as it would have the authority to access data from government institutions and other parties, including banks, without having to be pursuing an active tax crime case.

The upcoming revised law would nullify banking confidentiality, which often stonewalls a tax probe.

In addition to accessing data, the agency would be able to legally enter any establishment to look for documents or other evidence, all in the name of a tax investigation that is expected to improve both compliance and collection.

Unlike other directorates general, the BPN would stand on its own feet and not be part of the Finance Ministry.

“It would be under the finance minister, but not be part of the Finance Ministry. It would have a different system, probably similar to the BPPT [the Agency for the Assessment and Application of Technology] or the BPS [Central Statistics Agency],” Finance Minister Bambang Brodjonegoro told The Jakarta Post in a text message on Thursday.

It would still directly report to the finance minister because, as Bambang claimed, tax policy would remain under his authority.

The government’s seriousness about having a superbody is also reflected by a partnership with the IRS, which was conceived last year and is now ongoing.

President Joko “Jokowi” Widodo has frequently stated that he wants to see tax reforms. In a country of more than 250 million people, there are currently only 27 million taxpayers. The tax ratio is similarly low at 12 percent of gross domestic product (GDP) and Jokowi said he wanted the figure to climb to at least 14 percent in coming years.

Last year, the government only collected Rp 1.06 quadrillion (US$79.5 billion) in tax revenues, 82.2 percent of its full-year target.

It aims to collect Rp 1.36 quadrillion in tax revenues in 2016, a 35 percent jump from last year’s achievement. Economists and businesspeople deem the target too ambitious amid the sluggish domestic and global economies and also considering the limited capacity of the tax office.

Taxation director general Ken Dwijugiasteadi expressed hope that the new institution would be better at collecting tax revenues in the long term. “It would be able to manage its own human resources and budget.”

Center for Indonesia Taxation Analysis (CITA) executive director Yustinus Prastowo said the new body’s duty would emphasize its role as a tax administrator, rather than a policymaker. He agreed that such a semi-autonomous body was essential to achieve tax revenue targets.

CITA considers the BPN to be a more credible and accountable institution, thanks to its wider authority that will provide stronger leverage to coordinate with other government institutions, such as the National Police, the Attorney General’s Office and the Financial Services Authority (OJK), most of which work at the ministerial level.

OJK commissioner for banking supervision Nelson Tampubolon said that his organization — which oversees the banking industry —would work with the BPN to provide banking data if the law required it to do so.

Meanwhile, for businesspeople, it is the effectiveness of the BPN that would matter most. Indonesian Chamber of Commerce and Industry (Kadin) monetary, fiscal and public policy deputy chairman Raden Pardede said Kadin also demanded improvements in the professionalism and services of tax officials.