Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSharia banks struggling to grow

Change text size

Gift Premium Articles

to Anyone

W

hen it comes to financial management, religious views no longer seem to matter for most Indonesians, who choose lenders that can accommodate their daily needs and provide the highest investment returns.

Despite its status as the world’s largest Muslim-majority country, Indonesians still favor conventional banks over those that adhere to Islamic principles.

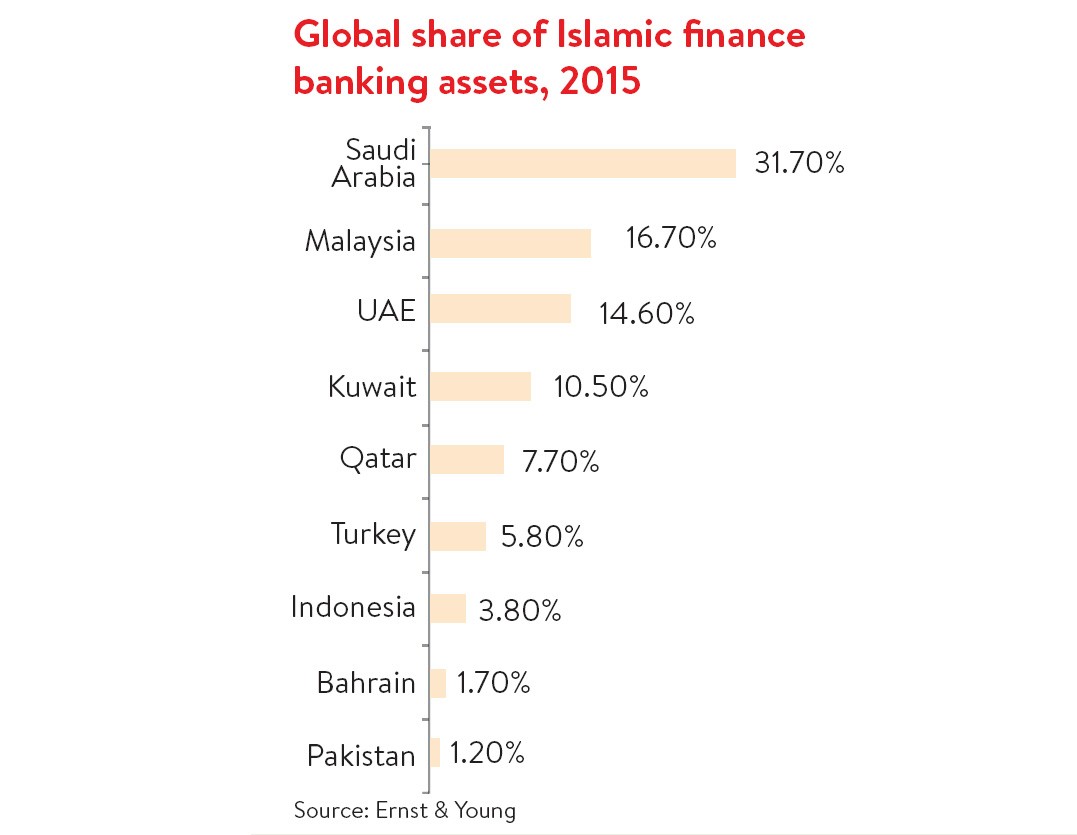

The market share of Islamic banks in the country has remained below 5 percent over recent years despite the existence of sharia banking in the country since the early 1990s.

Perhaps the main reason lies in human nature, as consumers are attracted to products that offer good benefits and reliable services.

Private employee Hanie Dewita, 27, who is Muslim, recently decided to close her account with the sharia unit of a conventional bank as it did not have a branch near her South Jakarta office.

The sharia unit she previously used also did not have a direct link to its parent bank, causing her frequent difficulties when making transactions and interbank transfers.

“For transactional purposes, it is more enjoyable to use banks that have a lot of ATMs and branches located near my office,” she told The Jakarta Post on Thursday.

Another private employee, Gita Rossiana, 30, closed her time deposit account at a sharia bank after calculating that the nisbah (interest rate) was far lower than the percentage offered by conventional banks.

“The return was just too small for me,” she said.

For instance, the average return for a three-month time deposit at a sharia bank stood at 7.08 percent in April, according to data from the Financial Services Authority (OJK). On the other hand, three-month time deposits at conventional banks offered an average interest rate of 7.27 percent in the same month.

Such testimonies reflect a herculean task for domestic sharia banks to offer products and services on par with their conventional counterparts if they want to grow significantly in the future.

Data from the OJK showed that Islamic banks’ market share stood at 4.87 percent in 2015, slightly higher than 4.62 percent a year earlier.

The banking authority was previously optimistic that the market share could hit its 5 percent target this year. Sharia banks, however, are now struggling with rising bad loans and shrinking assets as a result of the global economic slowdown.

In order to grow, Islamic banks must work harder to attract customers with innovations in all types of products and services, according to experts.

“So far, the products and services offered by sharia banks are still very traditional and limited. They’re still unable to respond to business needs, which are always developing,” said Agustianto Mingka, chairman of the Islamic Economic Experts Association’s (IAEI) central advisory board.

To develop more sophisticated sharia banking services, industry players will need to make hefty investments, an effort that should not be too daunting for big sharia lenders owned by giant parents, such as state-owned Bank Mandiri and Bank Negara Indonesia (BNI).

Top executives of large parent banks have acknowledged such matters and have planned several sets of capital injections for their sharia subsidiaries in the long term. Mandiri, for instance, has allocated Rp 1 trillion (US$76 million) for its sharia subsidiary, Bank Syariah Mandiri (BSM).

However, Mandiri president director Kartika “Tiko” Wirjoatmodjo said recently that the bank was looking for a strategic partner from abroad to develop BSM as it would not be able to provide support every year for an unlimited time.

“We are in the process of seeking investors from the Middle East, because they have knowledge in sharia. Mandiri will remain a majority shareholder,” Tiko said.

Agustianto said such efforts would be ineffective without a strong commitment from the government to help grow domestic sharia banks with supportive policies, as seen in Malaysia.

“The government, for example, should place a major amount of its funds in sharia banks and channel the money to infrastructure projects,” he said.

Attractive marketing strategies could also help the appeal of interest rates among potential customers, including non-Muslims, as sharia prohibits the acceptance of specific interest or fees for loans, which it refers to as riba (usury).

Christine Nababan, 32, a Christian, is a loyal customer of sharia banks and plans to open a new locked savings account with another sharia bank.

“I’m interested in opening a new account as the bank offers many prizes, including an iPhone 6,” she said.

__________________________

To receive comprehensive and earlier access to The Jakarta Post print edition, please subscribe to our epaper through iOS' iTunes, Android's Google Play, Blackberry World or Microsoft's Windows Store. Subscription includes free daily editions of The Nation, The Star Malaysia, the Philippine Daily Inquirer and Asia News.

For print subscription, please contact our call center at (+6221) 5360014 or subscription@thejakartapost.com