Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBanks should have more informative, interactive websites: Google

Change text size

Gift Premium Articles

to Anyone

U

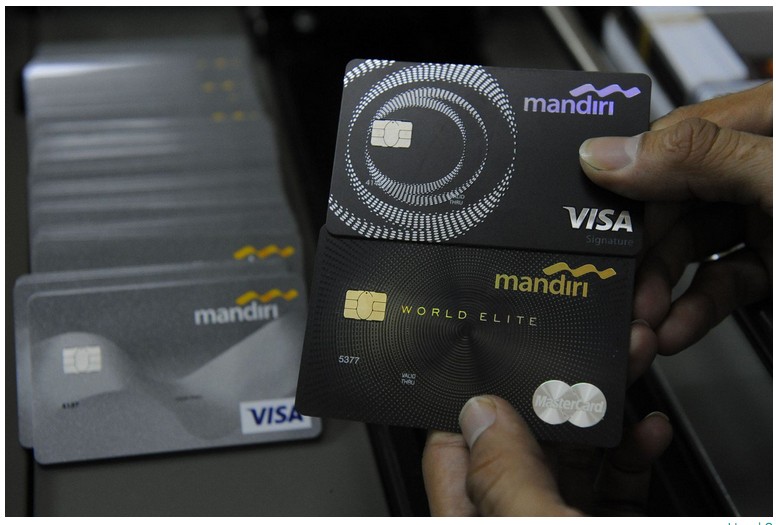

nited States tech giant Google has suggested that local banks have clear product offerings and promotions, online application services and product comparison features to attract customers to apply for personal loans or credit cards.

The recommendation is based on its recently released findings that show that 83 percent of the 501 Indonesians surveyed have little or no information about loan application processes.

When consumers search for information on the internet, Google found out that only 6 percent of credit card and loan applicants considered a bank’s website as the most useful source of information.

“Unfortunately, bank websites are considered less useful to help consumers find information […] The people’s experiences with the bank websites are different from what the banks offer offline,” Google Indonesia’s industry analyst Yudistira Adi Nugroho said on Wednesday, referring to the reason why Indonesians still prefer visiting a branch office of a bank when seeking information.

Read also: OCBC NISP launches credit card for affluent customersThe survey, which involved respondents between 18 and 60 years old and was carried out in big cities from February to April, also reveals that people spend an average of 26 days to research how to get loans.

According to the survey, the three primary reasons consumers apply for loans or credit cards are: emergency reasons (37 percent), promotional offers (27 percent) and major life events (26 percent). (lnd)