Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSuperman battles Iron Man to rule Chinese electric vehicle sales

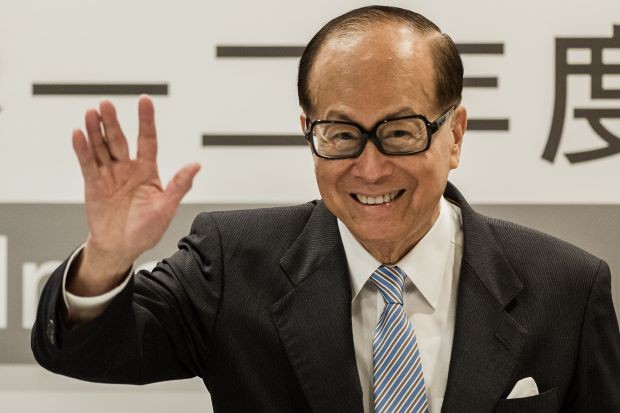

Hong Kong businessman Li Ka-shing invested in We Solutions Ltd., a company that last year acquired the Japanese electric sports car maker GLM Co.

Change text size

Gift Premium Articles

to Anyone

He’s a billionaire. He’s been compared to a superhero. And he’s invested in electric cars.

And no, he’s not “Iron Man” Elon Musk.

If you’re looking for more reinforcement that electric cars are here to stay, look no further than Asia’s fifth-richest man, Li Ka-shing, the Hong Kong businessman affectionately referred to as “Superman” by local media, is invested in two electric vehicle makers.

The investments pit Superman vs. Iron Man for supremacy in the growing Chinese EV market. While Musk’s Tesla Inc. may dominate the higher end of that market, Li has opted for a varied approach. He’s invested in We Solutions Ltd., formerly known as O Luxe Holdings Ltd., a company that last year acquired the Japanese electric sports car maker GLM Co. He also owns shares of FDG Electric Vehicles Ltd., a Chinese maker of electric vans and buses.

The 89-year-old billionaire is invested in We Solutions through Ocean Dynasty Investments Ltd., while he holds about $35 million in FDG shares.

The two investments give Li exposure to the fun and utilitarian sides of a market that’s primed for growth — the Chinese government has vowed to end the production and sales of fossil fuel-powered vehicles in the country (no date given).

Ocean Dynasty’s investment in We Solutions has recently fared better than Li’s own investment in FDG. We Solutions is down 1.26 percent this year to April 25, while FDG has lost more than 24 percent in the same period.