Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOJK sees insurance industry growing amid pandemic

Health insurance sales have increased because of rising awareness, which is reflected in the 17 percent year-on-year (yoy) growth in the first quarter of this year.

Change text size

Gift Premium Articles

to Anyone

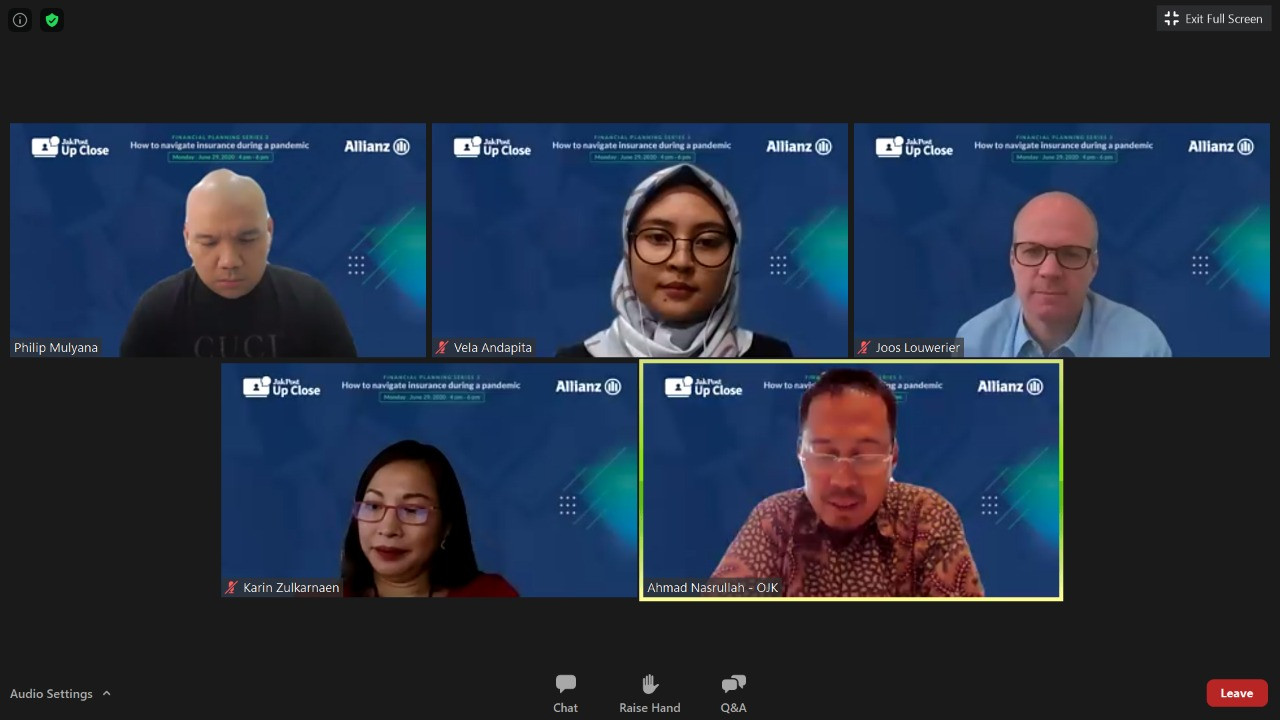

Speakers at the Jakpost Up Close seminar titled “How to navigate insurance during a pandemic” on Monday include (clockwise from top left) Financial coach Philip Mulyana, "The Jakarta Post" journalist Vela Andapita, Allianz Life Indonesia country manager and CEO Joos Louwerier, Financial Services Authority (OJK) head of nonbank financial institution supervision Ahmad Nasrullah and Allianz Life Indonesia chief marketing officer Karin Zulkarnaen. (JP/est)

Speakers at the Jakpost Up Close seminar titled “How to navigate insurance during a pandemic” on Monday include (clockwise from top left) Financial coach Philip Mulyana, "The Jakarta Post" journalist Vela Andapita, Allianz Life Indonesia country manager and CEO Joos Louwerier, Financial Services Authority (OJK) head of nonbank financial institution supervision Ahmad Nasrullah and Allianz Life Indonesia chief marketing officer Karin Zulkarnaen. (JP/est)

T

he Financial Services Authority (OJK) has seen a growing awareness of the need for insurance products among the public because of the COVID-19 pandemic.

According to Ahmad Nasrullah, OJK’s head of nonbank financial institution supervision, insurance will become the preferred financial platform after the novel coronavirus outbreak because of changing perceptions about financial security and health awareness.

“The pandemic and economic turmoil have changed the perspectives of financial planning. It should be a basic life skill,” Ahmad said during The Jakarta Post’s webinar Jakpost Up Close, titled “How to navigate insurance during a pandemic”, on Monday.

Government estimates show some 5.5 million people will be unemployed this year, a rate of 8.1 to 9.2 percent, up from an unemployment rate of 5.28 percent last year. Economic growth reached 2.97 percent in the first quarter, the slowest pace in 19 years.

Read also: Need for insurance rises as pandemic poses risks

Citing a McKinsey study on China’s consumer spending habits, Ahmad noted how health insurance sales had increased because of rising awareness, which was reflected in the 17 percent year-on-year (yoy) growth in the first quarter of this year.

“People started to buy insurance products as part of risk mitigation for their future,” Ahmad said.

This increase came against the backdrop of a badly-hit financial sector and declining purchasing power, which has made it difficult for people to afford financial products, Ahmad said.

Spending on insurance remains low in Indonesia. At 1.79 percent of the country’s gross domestic product (GDP), Indonesia’s insurance spending is much lower than Organization for Economic Cooperation and Development (OECD) members’ average, according to OECD data.

With social distancing measures in place to limit the spread of COVID-19, the OJK issued a regulation that allows insurance companies to sell their products digitally. Sixty-one life insurance companies are currently registered with the OJK.