Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsNeed for insurance rises as pandemic poses risks

The Indonesian people’s interest to be insured has risen amid the uncertainties on health and personal finance brought by the pandemic, yet insurance penetration is still low in the Southeast Asian biggest economy, financial planner and insurers have said.

Change text size

Gift Premium Articles

to Anyone

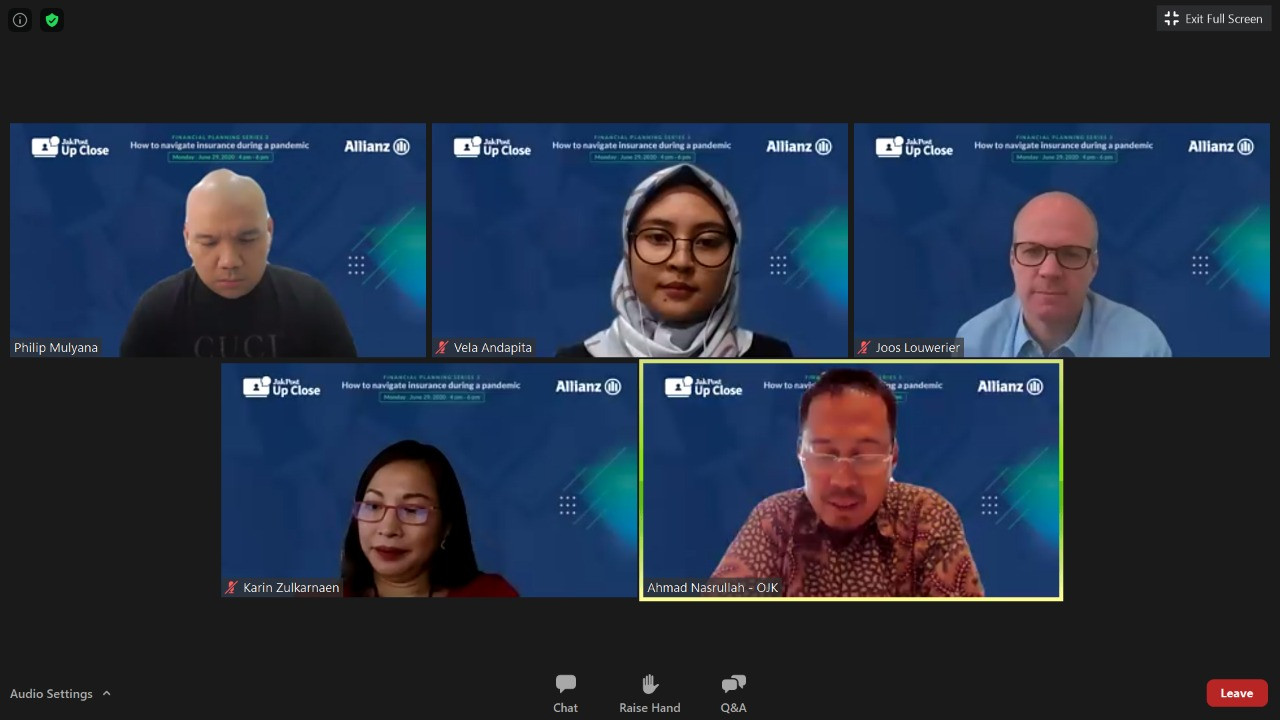

(Clockwise, from upper left) Financial coach Philip Mulyana, The Jakarta Post journalist Vela Andapita, Allianz Life Indonesia country manager and CEO Joos Louwerier, Financial Services Authority (OJK) head of non-bank financial institution supervision department Ahmad Nasrullah and Allianz Life Indonesia chief marketing officer Karin Zulkarnaen during The Jakarta Post webinar Jakpost Up Close titled “How to navigate insurance during a pandemic” in Jakarta on June 29,2020. (JP/est)

(Clockwise, from upper left) Financial coach Philip Mulyana, The Jakarta Post journalist Vela Andapita, Allianz Life Indonesia country manager and CEO Joos Louwerier, Financial Services Authority (OJK) head of non-bank financial institution supervision department Ahmad Nasrullah and Allianz Life Indonesia chief marketing officer Karin Zulkarnaen during The Jakarta Post webinar Jakpost Up Close titled “How to navigate insurance during a pandemic” in Jakarta on June 29,2020. (JP/est)

I

ndonesians have become more interested in insurance to mitigate uncertainty regarding their health and personal finances brought about by the pandemic, yet insurance penetration is still low in Southeast Asia’s biggest economy, financial planners and insurers have said.

For 25-year-old marketing officer Mika (not their true name), allocating part of the monthly income for insurance premiums was a problem. Mika spent most of their monthly income of Rp 6.5 million (US$455) on food, Mika said to The Jakarta Post.

“This is [the same for] everyone, basically,” Philip Mulyana, an independent financial advisor, said during the Post’s Jakpost Up Close webinar series titled “How to navigate insurance during a pandemic” on Monday.

“With the current COVID-19 situation, we can all agree that everything can change in the blink of an eye. If you want to do something for your family or your loved ones, insurance is one of the options,” he added.

With more than 3 million people laid off during the pandemic as of June 2, according to the government’s data, as well as more than 55,000 recorded COVID-19 cases as of Monday, the pandemic has brought uncertainty to people’s lives, while insurance penetration in the country remained stagnant at 3 percent.

Since the pandemic, a quarter of the Indonesian people feel anxious about their health, while 35 percent want to have health insurance, according to 2020 study by data analytics firms Nielsen, Kantar and consulting firm MarkPlus.

Philip suggested people spend at most 10 percent of their monthly income for insurance, but he acknowledged that the general lack of willingness to spend on insurance was driven by people’s tendency to sacrifice long-term protection for short-term rewards.

Indonesia’s insurance penetration relative to gross domestic product (GDP) remains low. According to the latest data from the Organization for Economic Cooperation and Development (OECD), Indonesia’s insurance spending in 2018 was only 1.79 percent of the country’s GDP, lower than in neighboring Malaysia’s, where it was 4.4 percent, and much lower than the average insurance spending in OECD member countries, where it was 8.92 percent of GDP.

The growth of insurance spending in the country has also been relatively low. Between 2011 and 2018, Indonesian spending on insurance only grew by 0.16 percentage points from 1.63 percent of GDP in 2011. The insurance growth in Singapore, on the other hand, grew by 2.66 percentage points between 2011 and 2017 to 9.02 percent of the country’s GDP.

Karin Zulkarnaen, chief marketing officer of insurance firm Allianz Life Indonesia, stated that another factor hampering insurance growth in the country was the public view of insurance products as intangible items.

“You can’t share insurance products on social media,” Karin said, unlike other experiential-based spending, such as lifestyle, traveling, even expensive designer bags that many young people were gravitating to, Karin observed.

Understanding the need for protection amid the pandemic, Karin suggested for people to decide how much they could spend on insurance and find the maximum protection with what they could afford, adding that there were many insurance products customers could choose from.

Allianz has updated its policy to include a “no-waiting period” for new customers looking for COVID-19 treatments. It has also included an additional 50 percent of the basic sum insured or a maximum Rp 250 million for death benefit due to the coronavirus, Allianz Life Indonesia country manager and president director Joos Louwerier explained during the webinar.

After the pandemic, insurance penetration is projected to continue to grow. The health and medical insurance market in Indonesia is expected to grow at a compound annual growth rate (CAGR) of 7.7 percent between 2019 and 2024, comprising social security schemes and private insurance providers in ratio of 2:3, Market Insights Report says.

“Insurance will rise as a favorite financial platform, especially after the COVID-19 outbreak,” Ahmad Nasrullah, the Financial Services Authority’s (OJK) head of nonbank financial institutions supervision, said during the webinar.

He cited consultancy McKinsey and Company data on China’s consumer spending, which saw a growth in health insurance sales by 17 percent in the first quarter of 2020 from the same period last year.

“People started to buy insurance products as part of risk mitigation for the future,” Ahmad noted.