Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsInvesting through clicks: Digital platforms offer alternative way to invest

Change text size

Gift Premium Articles

to Anyone

In a time when you can easily access the world at your fingertips, investing is as easy and convenient as picking up your phone.

Just ask Cynthia, a 45-year-old stay-at-home mom who recently picked up stock trading during the pandemic. Speaking to The Jakarta Post, she said her newfound hobby was a way to stave off boredom at first, but she came to realize its importance in the long run.

“I actually started buying stocks because a friend of mine was really interested in trading, so I decided to try it for myself. At first it was all for fun because I figured I could get more disposable income this way, but I think I will build my savings this way,” she said.

Cynthia eventually convinced her husband to start investing for their retirement. However, he did not have the time to do the trading himself, and instead decided to put his money in a mutual fund.

“Looking back, I would’ve done this a lot sooner, but better late than never, right? Investing is definitely a great way to build up your savings, or even just a way to get some more spending money to buy that thing you really want,” she said.

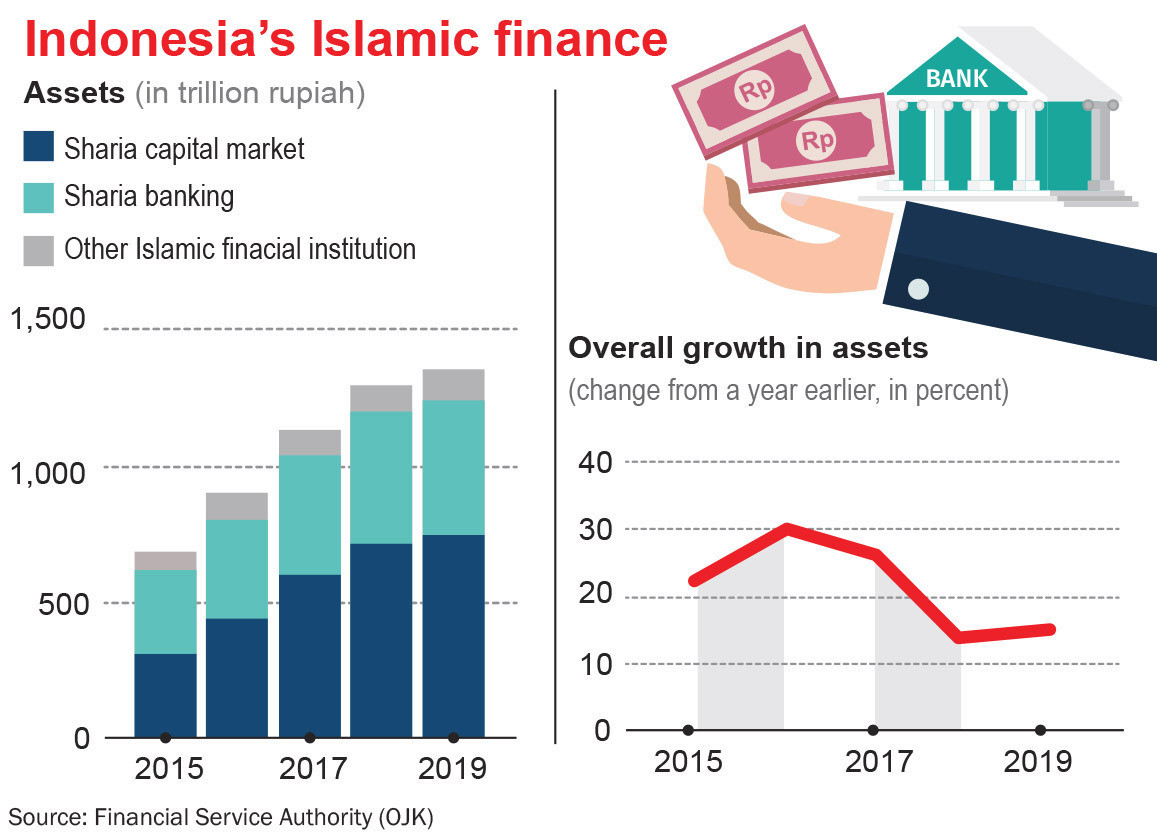

Being the most populous Muslim-majority country, it is no surprise that alongside conventional investing, Indonesia is home to a burgeoning sharia-based investing scene.

In general, sharia-based investing is similar to conventional investing, the only difference being that the companies involved are sharia-compliant.

Sharia stocks are like conventional stocks, but the issuer declares that its business activities are conducted with sharia principles. Meanwhile, sharia time deposits are similar to conventional time deposits, but instead of interest, the investor receives a previously agreed-upon return.

Another product is sukuk, which works the same way as conventional obligations. However, sukuk is based on mutual ownership of a project or asset rather than a loan between investor and issuer, and is only for businesses that do not conflict with sharia principles.

While stock trading is one of the most popular methods of investing, mutual funds are a great alternative for those who are unable or unwilling to build their own portfolio. Essentially, mutual fund investors have their investments professionally managed for optimum profit, with investment managers finding the right solution for each investor’s needs.

Alongside conventional mutual funds, sharia-based mutual funds offer another alternative for those who wish to avoid riba (usury) in their investing portfolio. What this means is that the funds are invested in companies that avoid riba in their business practices, or do not deal in goods that are considered haram such as alcoholic drinks.

Sharia-based mutual funds are becoming increasingly popular in Muslim-majority countries such as Indonesia, and even digital platforms like Tokopedia are offering financial services easily purchasable with a few clicks.

Tokopedia vice president of financial technology Vira Widiyasari said the platform’s Tokopedia Keuangan service, which was launched in late 2016, was designed to increase access to investing, as many held the belief that investing needs a large amount of capital.

“Truthfully, literacy and awareness on investing and financial services in Indonesia is relatively low. Tokopedia will continue to take part in sharing and advocating the importance of investing as soon as possible through a digital platform to our consumers,” she said.

Currently, Tokopedia Keuangan offers two mutual funds in collaboration with Bareksa: the sharia-based Mandiri Pasar Uang Syariah Ekstra (MPUSE) and Syailendra Dana Kas (SDK). Investing starts as low as Rp 10,000, cheaper than an iced coffee.

Prospective investors can also invest in gold through Tokopedia, which can be done through every Tokopedia transaction by rounding up their amount by a minimum of Rp 2,000.

“We want to call on every Tokopedia user to start making saving a habit and dispel the notion that a large amount of money is required to start investing. Now, everyone can start investing, and they can start small,” Vira said.

Tokopedia also offers a wide range of payment methods, ranging from bank transfer, digital wallet, virtual account, to paying at a minimarket. Vira also boasted of the fast transactions, which is processed in mere seconds.

“As soon as the customer purchases the product, it will be recorded without any delay, even if it’s on a weekend or national holiday. Selling is also in real time, and the proceeds will be funneled into the customer’s account.”